PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913271

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913271

North America Hydraulic Cylinder Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

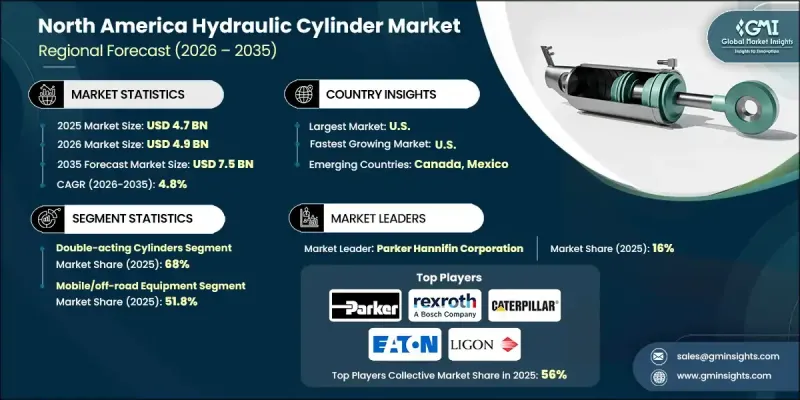

North America Hydraulic Cylinder Market was valued at USD 4.7 billion in 2025 and is estimated to grow at a CAGR of 4.8% to reach USD 7.5 billion by 2035.

The market is undergoing a significant transformation driven by smart technologies, IoT integration, and advanced sealing systems that enable real-time hydraulic analytics and predictive maintenance. Manufacturers and fleet operators are increasingly adopting connected hydraulic systems that allow precise control over actuation processes, achieving efficiency levels up to 96% in heavy-duty applications. The shift from conventional mechanical actuators to electro-hydraulic systems is redefining mobile and industrial machinery operations, offering programmable stroke control, enhanced accuracy, and operational responsiveness that can increase component life by 20% to over 150%, while reducing unscheduled maintenance and leakage issues. The combination of IoT-enabled monitoring, edge computing, and smart analytics is empowering operators to improve fluid life, performance quality, and overall machine efficiency.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $4.7 Billion |

| Forecast Value | $7.5 Billion |

| CAGR | 4.8% |

The double-acting cylinders segment held a 68% share in 2025. These cylinders are preferred due to their capability to apply force in both extension and retraction, supporting complex movements in machinery such as industrial automation systems, forklifts, and excavators.

The mobile/off-road equipment segment held 51.8% share in 2025, driven by earthmoving and construction projects. Massive infrastructure investments in roads, transit networks, and urban development in the U.S. and Canada are fueling demand for robust hydraulic actuators capable of handling heavy-duty operations.

U.S. Hydraulic Cylinder Market is expected to grow at a CAGR of 4.9% from 2026 to 2035. Growth is supported by the country's emphasis on infrastructure expansion, industrial automation, and advanced manufacturing technologies. Increasing adoption of electro-hydraulic systems, smart monitoring, and predictive maintenance is enhancing operational reliability. The demand for mobile hydraulic solutions in construction, mining, and industrial automation is surging, further strengthening the U.S. market.

Key players in the North America Hydraulic Cylinder Market include Eaton, Bosch Rexroth AG, Caterpillar Inc., Danfoss Power Solutions, Enerpac Tool Group, Hengli Hydraulic, HYDAC International, KYB Corporation, Liebherr, Ligon Industries, LLC, Milwaukee Cylinder, Parker Hannifin Corporation, Prince Manufacturing Corporation, Texas Hydraulics, Inc., and Weber-Hydraulik Group. Companies in the North America Hydraulic Cylinder Market are adopting several strategies to strengthen their foothold. They are investing in IoT-enabled and electro-hydraulic technologies to offer smarter, more efficient solutions. Firms are expanding their product portfolios with modular, high-performance, and durable cylinder designs for mobile and industrial applications. Strategic partnerships with construction, mining, and industrial equipment manufacturers are enhancing market reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 North America

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Functional

- 2.2.3 Bore Size

- 2.2.4 Application

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid adoption of smart electro-hydraulic technology

- 3.2.1.2 Integration of IoT & connected hydraulic systems

- 3.2.1.3 Booming infrastructure & energy development in NA

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Dependence on volatile raw material prices (Steel/Aluminum)

- 3.2.2.2 Competition from electric actuator alternatives

- 3.2.3 Opportunities

- 3.2.3.1 Focus on safety features and environmental sealing

- 3.2.3.2 Rise of the remanufacturing and service segment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Bore Size

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Country

- 4.2.1.1 U.S.

- 4.2.1.2 Canada

- 4.2.1.3 Mexico

- 4.2.1 By Country

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Function, 2022 - 2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Single acting cylinders

- 5.3 Double-acting cylinders

- 5.4 Telescopic

Chapter 6 Market Estimates and Forecast, By Bore Size, 2022 - 2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 ≤ 50 mm

- 6.3 51 - 100 mm

- 6.4 101-150mm

- 6.5 151-250mm

- 6.6 > 250 mm

Chapter 7 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Mobile/off-road equipment

- 7.2.1 Earthmoving & construction equipment

- 7.2.2 Mining equipment

- 7.2.3 Material handling equipment

- 7.2.3.1 Forklifts & reach stackers

- 7.2.3.2 Telescopic handlers (telehandlers)

- 7.2.3.3 Container handlers

- 7.2.4 Agricultural machinery

- 7.2.5 Forestry equipment

- 7.2.6 Specialty off-road

- 7.3 On-road commercial vehicles

- 7.3.1 Tipper/dump trucks

- 7.3.2 Trailers

- 7.3.3 Refuse & waste collection

- 7.3.4 Truck-mounted equipment

- 7.3.5 Specialty commercial (fire, airport, utility vehicles)

- 7.4 Industrial equipment

- 7.5 Marine & offshore

- 7.6 Energy & power

Chapter 8 Market Estimates and Forecast, By Country, 2022 - 2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

Chapter 9 Company Profiles

- 9.1 Bosch Rexroth AG

- 9.2 Caterpillar Inc.

- 9.3 Danfoss Power Solutions

- 9.4 Eaton

- 9.5 Enerpac Tool Group

- 9.6 Hengli Hydraulic

- 9.7 HYDAC International

- 9.8 KYB Corporation

- 9.9 Liebherr

- 9.10 Ligon Industries, LLC

- 9.11 Milwaukee Cylinder

- 9.12 Parker Hannifin Corporation

- 9.13 Prince Manufacturing Corporation

- 9.14 Texas Hydraulics, Inc.

- 9.15 Weber-Hydraulik Group