PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913276

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913276

Programmable Matter for Consumer Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

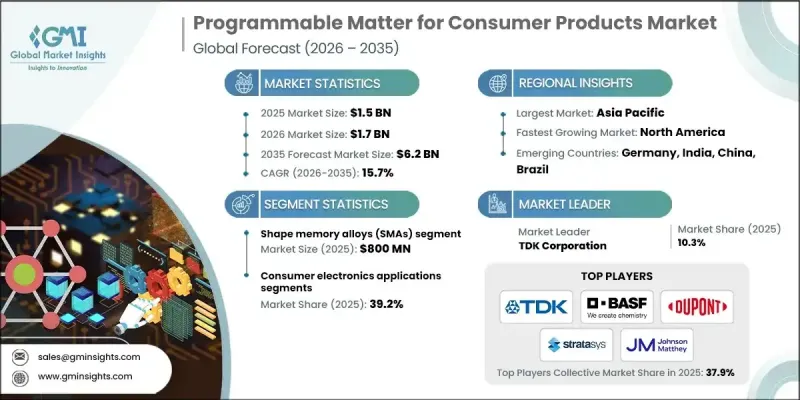

The Global Programmable Matter for Consumer Products Market was valued at USD 1.5 billion in 2025 and is estimated to grow at a CAGR of 15.7% to reach USD 6.2 billion by 2035.

Rapid progress in material science and responsive technologies reshapes how consumer products are designed, manufactured, and experienced. Significant funding from defense, aerospace, and public research institutions accelerates innovation and gradually shifts these technologies toward consumer-ready applications. Research initiatives focus on materials capable of responding to external stimuli, enabling properties such as self-adjustment, adaptability, and functional transformation. As advanced manufacturing capabilities continue to mature, commercialization barriers decline, and scalable production becomes increasingly viable. Consumer interest in intelligent, adaptive, and personalized products supports adoption across multiple end-use categories. Companies leverage cross-disciplinary collaboration between material science, electronics, and digital systems to unlock new use cases. Technology transfer frameworks play a critical role in moving innovations from controlled research environments into consumer markets. This convergence of funding, infrastructure, and consumer demand positions programmable matter as a transformative force within next-generation consumer products.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.5 Billion |

| Forecast Value | $6.2 Billion |

| CAGR | 15.7% |

The shape memory alloys segment generated USD 800 million in 2025. Long-term public investment in smart materials research supports advancements in manufacturing techniques and accelerates readiness for large-scale commercial deployment. Government-backed research institutions continue to expand applications for alloys that respond to thermal and mechanical stimuli, while energy-focused agencies recognize their potential to support environmentally efficient technologies.

The consumer electronics segment held 39.2% share in 2025. Ongoing academic and industrial research drives innovation in reprogrammable materials that enable adaptive functionality within electronic consumer goods. Smart textiles and wearable solutions increasingly integrate programmable matter to enhance performance, comfort, and user interaction.

U.S. Programmable Matter for Consumer Products Market held a 74.9% share in 2025. Strong research ecosystems, early technology adoption, and sustained investment in advanced manufacturing reinforce this leadership position. Robust development activity across materials science, artificial intelligence, and connected technologies continues to fuel market expansion.

Key companies operating in the Global Programmable Matter for Consumer Products Market include BASF, Stratasys, DuPont, TDK, Johnson Matthey, Parker Hannifin, Gentherm, ATI, Fort Wayne Metals, Cambridge Mechatronics, Sensoria, AiQ Smart Clothing, Ohmatex, Interactive Wear, and Schoeller Textil. Companies strengthen their position by prioritizing research-driven innovation, strategic partnerships, and scalable manufacturing capabilities. Many firms invest heavily in proprietary materials and process optimization to accelerate commercialization timelines. Collaboration with research institutions and technology developers supports access to emerging breakthroughs while reducing development risk. Businesses also focus on integrating programmable matter with digital platforms to enable smarter, connected consumer products. Expanding production capacity and improving material reliability help address cost and performance expectations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Application

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Demand for customization and personalization

- 3.2.1.2 Advances in material science and nanotechnology

- 3.2.1.3 Integration with IoT and AI

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost and manufacturing complexity

- 3.2.2.2 Energy consumption and control systems

- 3.2.3 Opportunities

- 3.2.3.1 Next-gen consumer interfaces

- 3.2.3.2 Circular economy and product longevity

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Regulatory landscape

- 3.6.1 Standards and compliance requirements

- 3.6.2 Regional regulatory frameworks

- 3.6.3 Certification standards

- 3.7 Gap analysis

- 3.8 Risk assessment and mitigation

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behaviour analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behaviour

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Technology Type, 2022-2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Shape memory alloys (SMAs)

- 5.3 4d printing technologies

- 5.4 Smart and adaptive textiles

- 5.5 Electroactive polymers and materials

- 5.6 Hydrogels and bio-responsive materials

- 5.7 Phase change materials (PCMS)

Chapter 6 Market Estimates & Forecast, By Application Type, 2022-2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Consumer Electronics Applications

- 6.2.1 Integration in smartphones and mobile devices integration

- 6.2.2 Wearable technology & accessories

- 6.2.3 Adaptive display technologies

- 6.2.4 Haptic interface systems

- 6.3 Smart textiles & apparel

- 6.3.1 Adaptive clothing & fashion applications

- 6.3.2 Sports & performance monitoring gear

- 6.3.3 Health monitoring garments

- 6.3.4 Interactive & entertainment textiles

- 6.4 Home automation & furniture

- 6.4.1 Reconfigurable furniture systems

- 6.4.2 Adaptive home appliances

- 6.4.3 Smart surface technologies

- 6.4.4 Interactive interface integration

- 6.5 Automotive consumer features

- 6.5.1 Adaptive interior systems

- 6.5.2 Comfort & climate control applications

- 6.6 Healthcare & wellness products

- 6.6.1 Wearable health monitoring devices

- 6.6.2 Adaptive medical equipment

- 6.6.3 Therapeutic & rehabilitation systems

- 6.6.4 Products for elderly & disability assistance

- 6.7 Food & packaging applications

- 6.7.1 4D printed food products

- 6.7.2 Smart packaging technologies

- 6.7.3 Temperature & freshness indicators

Chapter 7 Market Estimates & Forecast, By Region, 2022-2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 UK

- 7.3.4 Italy

- 7.3.5 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 AiQ Smart Clothing

- 8.2 ATI

- 8.3 BASF

- 8.4 Cambridge Mechatronics

- 8.5 DuPont

- 8.6 Fort Wayne Metals

- 8.7 Gentherm

- 8.8 Interactive Wear

- 8.9 Johnson Matthey

- 8.10 Ohmatex

- 8.11 Parker Hannifin

- 8.12 Schoeller Textil

- 8.13 Sensoria

- 8.14 Stratasys

- 8.15 TDK