PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913280

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913280

Automatic Ice Maker Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

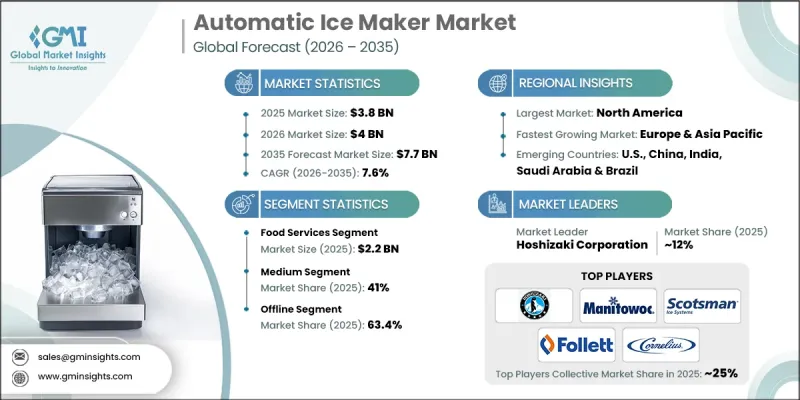

The Global Automatic Ice Maker Market was valued at USD 3.8 billion in 2025 and is estimated to grow at a CAGR of 7.6% to reach USD 7.7 billion by 2035.

Demand accelerated as both commercial and household users increasingly prioritized efficiency, speed, and reliability in daily operations. Rising urban development and faster-paced lifestyles pushed consumers toward appliances that reduce manual effort and save time. Automatic ice makers addressed this shift by offering fast, consistent ice production without the delays of traditional methods. Advancements in compact engineering, smart-enabled features, and improved energy performance further enhanced product appeal. Growth in travel activity and premium hospitality environments also supported higher adoption, particularly for machines capable of producing uniform, high-quality ice suitable for advanced beverage presentation. Together, convenience-driven consumption patterns and technological innovation positioned automatic ice makers as an essential modern appliance across multiple end-use environments.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $3.8 Billion |

| Forecast Value | $7.7 Billion |

| CAGR | 7.6% |

The food service applications segment generated USD 2.2 billion in 2025 and is expected to grow at a CAGR of 7.1% from 2026 to 2035. Continuous global expansion of dining and accommodation infrastructure increased the need for dependable, high-output ice production. Consumer demand for chilled beverages and elevated dining standards reinforced ice as a critical operational input. The rise of fast-paced food formats further strengthened demand for machines that support speed, consistency, and service quality.

The medium-priced segment captured 41% share in 2025 and is forecast to grow at a CAGR of 7.3% through 2035. This segment gained traction by balancing cost, durability, and essential performance features. Buyers favored these units for offering dependable capacity and efficiency without premium pricing. Energy-saving functions and space-efficient designs added further appeal for budget-aware purchasers seeking modern functionality.

United States Automatic Ice Maker Market reached USD 800 million in 2025 and is projected to grow at a CAGR of 7.5% from 2026 to 2035. Adoption increased across both household and professional settings as users emphasized convenience and productivity. Ongoing growth in hospitality infrastructure and rising interest in at-home social experiences supported sustained demand for automatic ice makers nationwide.

Key companies active in the Global Automatic Ice Maker Market include Hoshizaki Corporation, Manitowoc Ice, Scotsman Ice Systems, Ice-O-Matic, Follett Ice, Cornelius, Inc., Brema Ice Makers, KOLD-DRAFT, U-Line Corporation, Marvel Refrigeration, Icematic, Howe Corporation, Newair, Marx Ice, and Polar Ice. Companies in the Global Automatic Ice Maker Market strengthen their competitive position through product innovation, portfolio diversification, and operational efficiency. Manufacturers focus on developing energy-efficient models with smart controls and compact footprints to align with evolving consumer expectations. Strategic pricing across entry-level and mid-range offerings helps brands capture a wider customer base. Many players invest in improving manufacturing processes and supply chain resilience to ensure consistent product availability. Geographic expansion through distribution partnerships allows companies to reach emerging demand centers. Brand differentiation is reinforced through reliability, performance consistency, and after-sales support.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Capacity

- 2.2.4 Price

- 2.2.5 Application

- 2.2.6 End-use

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of hospitality and foodservice industry

- 3.2.1.2 Rising consumer preference for convenience

- 3.2.1.3 Growth of quick-service restaurants and home entertainment trends

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High energy consumption

- 3.2.2.2 Supply chain interruptions and supplier product shortages

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2022 - 2035, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Ice cubes

- 5.3 Ice flakes

- 5.4 Ice nuggets

- 5.5 Ice ball/sphere

Chapter 6 Market Estimates & Forecast, By Capacity, 2022 - 2035, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 <20 lbs/day

- 6.3 20-50 lbs/day

- 6.4 50 lbs/day

Chapter 7 Market Estimates & Forecast, By Price, 2022 - 2035, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Application, 2022 - 2035, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.3.1 Restaurants

- 8.3.2 Craft cocktail bars/speakeasies

- 8.3.3 Luxury hotels/resorts

- 8.3.4 Whisky bars/lounges

Chapter 9 Market Estimates & Forecast, By End Use, 2022 - 2035, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Healthcare industry

- 9.3 Food services

- 9.4 Retail

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce website

- 10.2.2 Company website

- 10.3 Offline

- 10.3.1 Specialty retail

- 10.3.2 Department stores

- 10.3.3 Appliance retailers

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.4.6 Indonesia

- 11.4.7 Malaysia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Brema Ice Makers

- 12.2 Cornelius, Inc.

- 12.3 Follett Ice

- 12.4 Hoshizaki Corporation

- 12.5 Howe Corporation

- 12.6 Icematic

- 12.7 Ice-o-Matic

- 12.8 KOLD-DRAFT

- 12.9 Manitowoc Ice

- 12.10 Marvel Refrigeration

- 12.11 Marx Ice

- 12.12 Newair

- 12.13 Polar Ice

- 12.14 Scotsman Ice Systems

- 12.15 U-Line Corporation