PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913283

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913283

Piezoelectric Micro Pump Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

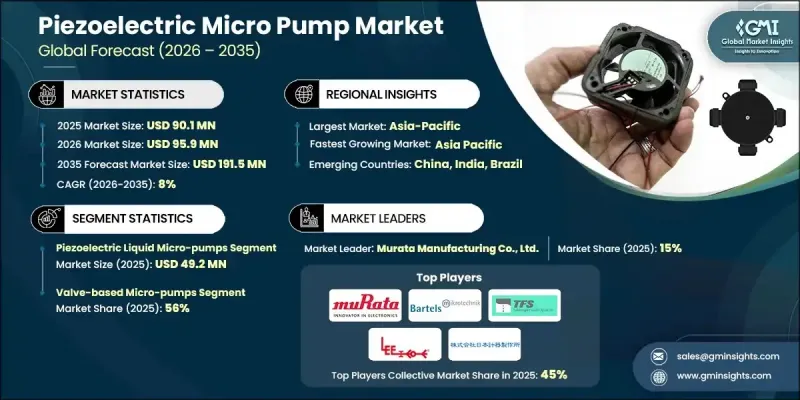

The Global Piezoelectric Micro Pump Market was valued at USD 90.1 million in 2025 and is estimated to grow at a CAGR of 8% to reach USD 191.5 million by 2035.

The market is steadily gaining momentum as industries increasingly seek compact, highly accurate, and energy-efficient solutions for fluid and gas handling. Piezoelectric micro pumps, which operate using piezoelectric actuators, are reshaping fluid control in applications where precision, space efficiency, and low power usage are critical. Their quiet performance, minimal heat generation, and ability to deliver stable flow rates without complex mechanical assemblies make them particularly attractive across a wide range of sectors. Demand is rising as manufacturers focus on smaller, smarter system designs that require reliable microfluidic components capable of consistent operation over long lifecycles. As innovation accelerates, these pumps are becoming integral to advanced system architectures that emphasize portability, accuracy, and operational efficiency. Continuous advancements in actuator materials and pump structures are further enhancing performance, durability, and integration flexibility, supporting sustained market growth.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $90.1 Million |

| Forecast Value | $191.5 Million |

| CAGR | 8% |

The use of piezoelectric micro pump technology is expanding beyond traditional applications into areas that require extremely controlled dosing and fluid transfer. Growing emphasis on compact analytical systems, thermal management solutions for electronics, and next-generation wearable platforms is contributing to broader adoption. Industries that rely on repeatable and contamination-free fluid handling are increasingly integrating these pumps into their designs, supported by ongoing improvements in manufacturing precision and system compatibility.

In 2025, the piezoelectric liquid micro pumps segment generated USD 49.2 million. These pumps are widely adopted due to their ability to deliver accurate liquid volumes while maintaining a compact footprint. Their actuator-driven design minimizes moving components, which enhances reliability and supports use in highly sensitive systems that require precise and consistent fluid delivery.

The valve-based micro pumps represented 56.4% share in 2025. Their strong adoption is linked to their enhanced flow regulation capabilities, as integrated valve mechanisms allow controlled directionality and reduce the risk of reverse flow. This design advantage makes them suitable for applications that demand higher levels of operational control and repeatability.

U.S Piezoelectric Micro Pump Market held 75% share, generating USD 20.3 million in 2025. The region benefits from early adoption of microfluidic technologies, strong investment in research and development, and established commercialization pathways, particularly across technologically advanced industries.

Key companies operating in the Global Piezoelectric Micro Pump Market include Murata Manufacturing Co., Ltd., Bartels Mikrotechnik GmbH, Dolomite Microfluidics, Takasago Electric, Inc., The Lee Company, NITTO KOHKI CO., LTD., Nippon Keiki Works, Ltd., Audiowell Electronics (Guangdong) Co., Ltd., MicroJet Technology Co., Ltd., HOERBIGER Motion Control GmbH, Debiotech SA, Koge Micro Tech Co., Ltd., Maxclever Electric Co., Ltd., HeYi Precision Pump, and PiezoData Inc. Companies in the Global Piezoelectric Micro Pump Market are strengthening their competitive position by prioritizing product miniaturization, performance optimization, and long-term reliability. Many players are investing in advanced piezoelectric materials and refined actuator designs to improve flow accuracy and energy efficiency. Strategic collaborations with system integrators and OEMs help accelerate adoption across specialized applications.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 By regional

- 2.2.2 By machine type

- 2.2.3 By design type

- 2.2.4 By end use industry

- 2.2.5 By distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising Demand for Miniaturized Medical Devices

- 3.2.1.2 Advancements in Microfluidics and Lab Automation

- 3.2.1.3 Integration in Consumer Electronics and Cooling Systems

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High Manufacturing Complexity and Cost

- 3.2.2.2 Reliability Issues in Harsh Environments

- 3.2.3 Opportunities

- 3.2.3.1 Expansion in Point-of-Care Diagnostics

- 3.2.3.2 Adoption in Wearable and IoT Devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Major market trends and disruptions

- 3.5 Future market trends

- 3.6 Risk and mitigation Analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By Machine type

- 3.9 Regulatory landscape

- 3.9.1 North America

- 3.9.2 Europe

- 3.9.3 Asia-Pacific

- 3.9.4 Middle East and Africa

- 3.9.5 Latin America

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Machine Type, 2022-2035 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Piezoelectric liquid micro-pumps

- 5.3 Piezoelectric air/gas micro-pumps

Chapter 6 Market Estimates & Forecast, By Design Type, 2022-2035 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Valveless micro-pumps

- 6.3 Valve-based micro-pumps

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2022-2035 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Medical & life sciences

- 7.3 Consumer electronics

- 7.4 Industrial applications

- 7.5 Automotive & transportation

- 7.6 Household appliances

- 7.7 Others (aerospace & defense, agriculture)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2022-2035 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Turkey

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Murata Manufacturing Co., Ltd.

- 10.2 Bartels Mikrotechnik GmbH

- 10.3 Takasago Electric, Inc

- 10.4 The Lee Company

- 10.5 Nippon Keiki Works, Ltd.

- 10.6 NITTO KOHKI CO., LTD.

- 10.7 MicroJet Technology Co., Ltd.

- 10.8 Audiowell Electronics (Guangdong) Co., Ltd.

- 10.9 HeYi Precision Pump

- 10.10 Maxclever Electric Co., Ltd.

- 10.11 Dolomite Microfluidics

- 10.12 Koge Micro Tech Co., Ltd.

- 10.13 Debiotech SA

- 10.14 PiezoData Inc.

- 10.15 HOERBIGER Motion Control GmbH