PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913289

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913289

Asia Automatic Fish Feeder for Marine Cage Farming Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

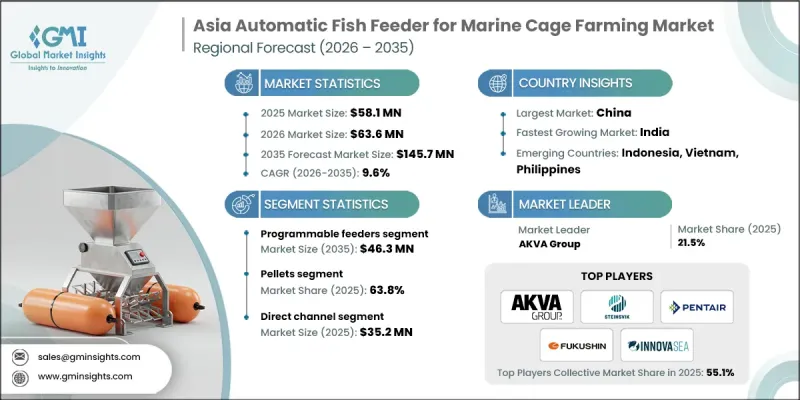

Asia Automatic Fish Feeder for Marine Cage Farming Market was valued at USD 58.1 million in 2025 and is estimated to grow at a CAGR of 9.6% to reach USD 145.7 million by 2035.

This market is expanding owing to Asia's strong position in global aquaculture output and the increasing need for efficiency across offshore and nearshore cage farming operations. Automatic feeding systems are now viewed as a core operational tool by marine cage farmers, as they support accurate feeding schedules, help align feed delivery with fish consumption patterns, reduce losses caused by excess feed or stress-related fish damage, and support healthier stock conditions. The growing adoption of connected systems, including IoT-enabled platforms, artificial intelligence, and cloud-based monitoring tools, is transforming feeding operations by improving precision and reducing labor dependence. Public sector support for aquaculture modernization across Asia continues to encourage technology uptake, creating a supportive environment for equipment suppliers. The continued advancement of AI and data-driven feeding logic is also reinforcing demand, as farmers increasingly prioritize productivity, sustainability, and cost control across large-scale marine cage installations.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $58.1 Million |

| Forecast Value | $145.7 Million |

| CAGR | 9.6% |

The programmable feeders segment generated USD 17.4 million in 2025 and is forecast to reach USD 46.3 million by 2035. Within the Asia marine cage farming automatic feeder landscape, this product category holds a leading position. Programmable systems allow farmers to manage feed quantities and schedules with high accuracy, which supports consistent fish growth while limiting unnecessary feed dispersion. Adoption has accelerated across major aquaculture-producing countries in the region as these feeders align well with the operational needs of both small and industrial-scale cage farms.

The direct sales channel reached USD 35.2 million in 2025. This channel remains dominant because it enables manufacturers to address farm-specific requirements and provide tailored technical support. Across Asia, government-led efforts to strengthen aquaculture output and modernize fisheries have contributed to higher investment in automated feeding solutions, reinforcing demand through direct procurement models that favor reliability and long-term service partnerships.

China Automatic Fish Feeder for Marine Cage Farming Market held a 33.4% share in 2025, making it the leading country in the region. The country's dominance reflects its extensive aquaculture infrastructure and large-scale marine farming operations, which benefit from automated feeding systems that reduce labor pressure and improve feed efficiency. Ongoing efforts to expand offshore and deep-water aquaculture capacity continue to support strong demand for advanced feeding equipment across coastal regions.

Key companies active in the Asia Automatic Fish Feeder for Marine Cage Farming Market include AKVA Group, ABP Aquaculture Equipment Ltd., Aquasyster, Eruvaka Technologies, eFishery, FishFarmFeeder, FUKUSHIN ELECTRIC Co., Ltd., Hung Star Enterprise Corp., IAS Products, Innovasea, Kamber Tech, Pentair AES, Pioneer Group, Steinsvik Group, and Ternakin. Companies operating in the Asia Automatic Fish Feeder for Marine Cage Farming Market are focusing on product innovation, regional expansion, and service differentiation to strengthen their market position. Many manufacturers are investing heavily in smart feeder development that integrates sensors, data analytics, and adaptive feeding algorithms to improve accuracy and farm performance. Strategic partnerships with local distributors and aquaculture operators are being used to enhance market access and after-sales support. Firms are also prioritizing customization to address varying cage sizes, species requirements, and environmental conditions across Asian markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Feed type

- 2.2.4 Marine fish species

- 2.2.5 Delivery mechanism

- 2.2.6 Cage operation scale

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing popularity of aquaculture

- 3.2.1.2 Technological advancements in smart feeders

- 3.2.1.3 Labor cost reduction in marine cage farming

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and intensive maintenance requirement

- 3.2.2.2 Technical issues and maintenance needs

- 3.2.3 Opportunities

- 3.2.3.1 Integration with IoT and sensor-based feeding systems

- 3.2.3.2 Customization for species-specific diets and feeding patterns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By type

- 3.6.2 By country

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code 8479.89.99)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Gap analysis

- 3.10 Risk assessment and mitigation

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By country

- 4.2.1.1 China

- 4.2.1.2 India

- 4.2.1.3 Japan

- 4.2.1.4 Indonesia

- 4.2.1.5 Vietnam

- 4.2.1.6 Philippines

- 4.2.1.7 Rest of Asia

- 4.2.1 By country

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2022-2035 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Programmable feeders

- 5.3 Pneumatic feeders

- 5.4 Drum feeders

- 5.5 Rotary feeders

- 5.6 Gravity feeders

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Feed Type, 2022-2035 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Pellets

- 6.3 Flakes

- 6.4 Granules

- 6.5 Freeze-dried food

- 6.6 Live feed

Chapter 7 Market Estimates & Forecast, By Marine Fish Species, 2022-2035 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Sea bass and sea bream

- 7.3 Grouper species

- 7.4 Salmon and trout species

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Delivery Mechanism, 2022-2035 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Water-assisted feed distribution systems

- 8.3 Hydraulic feeding mechanisms

- 8.4 Underwater feed dispensing technologies

- 8.5 Air-assisted delivery systems

Chapter 9 Market Estimates & Forecast, By Cage Operation Mechanism, 2022-2035 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Small-scale (<100 tons/year)

- 9.3 Medium-scale (100-1000 tons/year)

- 9.4 Large-scale (>1000 tons/year)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2022-2035 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Country, 2022-2035 (USD Million) (Thousand Units)

- 11.1 Key trends

- 11.2 China

- 11.3 India

- 11.4 Japan

- 11.5 Indonesia

- 11.6 Vietnam

- 11.7 Philippines

- 11.8 Rest of Asia

Chapter 12 Company Profiles

- 12.1 ABP Aquaculture Equipment Ltd.

- 12.2 AKVA Group

- 12.3 Aquasyster

- 12.4 eFishery

- 12.5 Eruvaka Technologies

- 12.6 FishFarmFeeder

- 12.7 FUKUSHIN ELECTRIC Co., Ltd.

- 12.8 Hung Star Enterprise Corp.

- 12.9 IAS Products

- 12.10 Innovasea

- 12.11 Kamber Tech

- 12.12 Pentair AES

- 12.13 Pioneer Group

- 12.14 Steinsvik Group

- 12.15 Ternakin