PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913297

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913297

Rubber Processing Chemicals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

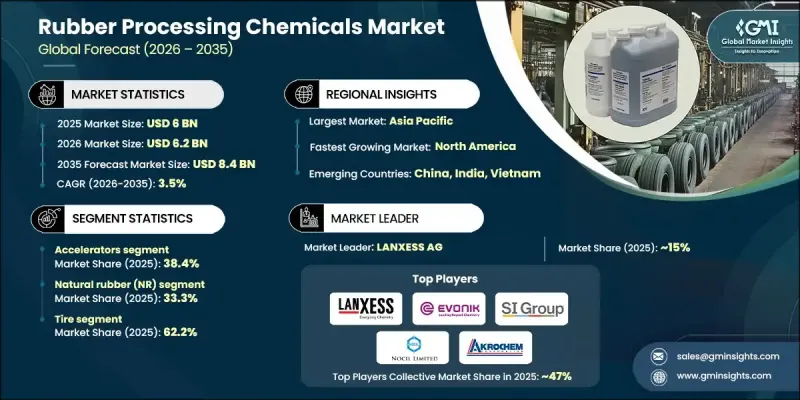

The Global Rubber Processing Chemicals Market was valued at USD 6 billion in 2025 and is estimated to grow at a CAGR of 3.5% to reach USD 8.4 billion by 2035.

Rubber processing chemicals play a foundational role in rubber manufacturing by enhancing durability, processing efficiency, and functional performance of both natural and synthetic rubber. These formulations support critical stages of rubber production by improving curing efficiency, resistance to degradation, adhesion properties, flame resistance, and overall material stability. Market growth is shaped by ongoing changes in transportation, industrial manufacturing, infrastructure development, and sustainability-driven production practices. Manufacturers are increasingly prioritizing environmentally responsible chemical solutions to align with evolving regulatory frameworks and corporate sustainability goals. As a result, the market is steadily transitioning toward advanced and cleaner chemistries that maintain performance while reducing environmental impact. The growing need for high-quality rubber products across diverse industrial applications, combined with advancements in rubber formulation technologies, continues to reinforce long-term demand. Expansion of modern manufacturing systems and rising expectations for performance consistency across global markets further support the steady evolution of rubber processing chemicals.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $6 Billion |

| Forecast Value | $8.4 Billion |

| CAGR | 3.5% |

The accelerators segment held a 38.4% share in 2025 and is expected to grow at a CAGR of 3.7% through 2035. This dominance is attributed to their indispensable function in controlling curing behavior and enabling the transformation of raw rubber into durable, elastic materials. Accelerators remain essential across all rubber processing activities due to their role in achieving optimal strength, flexibility, and thermal resistance.

The natural rubber segment accounted for 33.3% share in 2025 and is forecast to grow at a CAGR of 3.8% by 2035. Its leadership stems from inherent mechanical advantages that support demanding performance requirements. The unique molecular structure of natural rubber continues to sustain its relevance despite market fluctuations, ensuring consistent demand across performance-focused rubber applications.

U.S. Rubber Processing Chemicals Market generated USD 1 billion in 2025. Growth in the country is supported by a mature manufacturing base and strong demand from automotive and industrial rubber production. A well-established supply ecosystem and continued investment in advanced rubber formulations contribute to stable market momentum across North America.

Key companies active in the Rubber Processing Chemicals Market include Evonik Industries, LANXESS AG, Eastman Chemical, Arkema S.A., SI Group, China Sunsine, Nocil Limited, KUMHO PETROCHEMICAL, Robinson Brothers, R.T. Vanderbilt, Akrochem Corporation, Duslo a.s., Sennics Co., Ltd., Sinopec Corp., and Struktol Company. Companies operating in the Global Rubber Processing Chemicals Market are reinforcing their market position through innovation-led product development and sustainability-focused strategies. Many players are investing in research to create high-performance formulations that comply with stricter environmental standards while maintaining efficiency and durability. Capacity expansion in emerging manufacturing regions and strengthening distribution networks remain key priorities. Strategic collaborations with rubber producers help companies deliver customized solutions and improve long-term customer engagement.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product Type

- 2.2.2 Rubber Type

- 2.2.3 Application

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product type

- 3.9 Future market trends

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Accelerators

- 5.2.1 Thiazoles

- 5.2.2 Sulfenamides

- 5.2.3 Thiurams

- 5.2.4 Guanidines

- 5.2.5 Dithiocarbamates

- 5.2.6 Thiophosphates

- 5.2.7 Thioureas

- 5.2.8 Aldehyde amines

- 5.3 Antidegradants

- 5.3.1 Antioxidants

- 5.3.2 Antiozonants

- 5.3.3 Waxes

- 5.3.4 Silane coupling agents

- 5.4 Ethoxy silanes

- 5.4.1 Methoxy silanes

- 5.4.2 Mercaptosilanes

- 5.4.3 Novel coupling systems

- 5.4.4 Silane alternatives

- 5.5 Processing aids & plasticizers

- 5.5.1 Plasticizers

- 5.5.2 Peptizers

- 5.5.3 Dispersing agents

- 5.5.4 Processing promoters

- 5.5.5 Mold release agents

- 5.5.6 Lubricants

- 5.5.7 Bio-based processing aids

- 5.6 Flame retardants

- 5.6.1 Halogenated flame retardants

- 5.6.2 Phosphorus-based flame retardants

- 5.6.3 Mineral fillers

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Rubber Type, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Natural rubber (NR)

- 6.3 SBR (solution & emulsion)

- 6.4 Nitrile rubber (NBR)

- 6.5 EPDM

- 6.6 Butyl & halobutyl rubber

- 6.7 Specialty rubbers

Chapter 7 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Tire

- 7.3 Automotive (non-tire)

- 7.4 Industrial goods

- 7.5 Construction

- 7.6 Wire & cable

- 7.7 Medical & healthcare

- 7.8 Consumer goods

- 7.9 Aerospace

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 LANXESS AG

- 9.2 Evonik Industries

- 9.3 SI Group

- 9.4 Nocil Limited

- 9.5 Akrochem Corporation

- 9.6 Sennics Co., Ltd.

- 9.7 R.T. Vanderbilt

- 9.8 KUMHO PETROCHEMICAL

- 9.9 Duslo a.s.

- 9.10 Struktol Company

- 9.11 Robinson Brothers

- 9.12 Sinopec Corp.

- 9.13 China Sunsine

- 9.14 Eastman Chemical

- 9.15 Arkema S.A.