PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913298

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913298

Cosmetic Oil Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

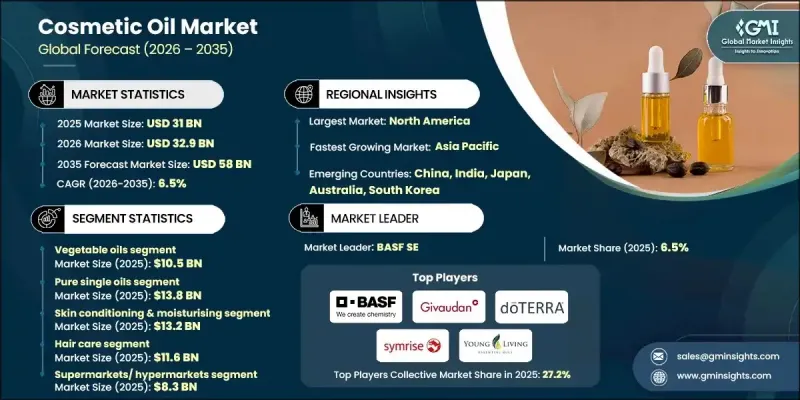

The Global Cosmetic Oil Market was valued at USD 31 billion in 2025 and is estimated to grow at a CAGR of 6.5% to reach USD 58 billion by 2035.

Market growth is linked to growing consumer interest in skincare and haircare products that support nourishment, hydration, and protection. Cosmetic oils are formulated to enhance skin and hair health by delivering fatty acids, antioxidants, vitamins, and functional compounds that improve surface condition and resilience. These oils are carefully refined to ensure safety and performance in topical applications, distinguishing them from industrial or untreated oils. Their ability to support moisture retention, improve texture, reinforce natural barriers, and enhance overall appearance continues to drive widespread use across daily personal care routines. The presence of naturally occurring antioxidants also supports protection against environmental exposure, reinforcing their role in modern cosmetic formulations.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $31 Billion |

| Forecast Value | $58 Billion |

| CAGR | 6.5% |

The pure single oils segment generated USD 13.8 billion in 2025. These oils are derived from a single source and are valued for their straightforward composition and naturally occurring functional benefits. In comparison, blended oils are formulated to improve usability, balance sensory characteristics, or moderate intensity, while infused oils incorporate additional botanical properties through specialized processing techniques.

The skin conditioning and moisturizing applications segment accounted for USD 13.2 billion in 2025. These products are widely used across age groups and represent a core category within personal care. Hair conditioning oils are also recording gradual growth due to their role in nourishment, repair, and scalp maintenance. Both application categories remain essential components of mass-market cosmetic consumption, supporting steady demand.

U.S. Cosmetic Oil Market reached USD 7.7 billion in 2025, driven by strong consumer spending on beauty and personal care. Regional demand is reinforced by growing interest in ingredient transparency and naturally derived formulations, supported by established brands and ongoing product innovation across North America.

Key companies operating in the Global Cosmetic Oil Market include BASF SE, Givaudan SA, Cargill, Incorporated, Symrise AG, Clariant AG, ExxonMobil Corporation, ATDM Co., Ltd., Henry Lamotte Oils, Sophim, Olvea Vegetable Oils, Renkert Oil, Sonneborn LLC, Petro-Canada Lubricants, Maverik Oils, Vigon International, Inc., Gandhar Oil Refinery India Limited, doTERRA International LLC, and Young Living Essential Oils. Companies in the Global Cosmetic Oil Market are strengthening their market position through product innovation, ingredient transparency, and portfolio diversification. Leading players are investing in advanced refining and sourcing techniques to enhance purity, consistency, and functional performance. Strategic partnerships with cosmetic brands are helping suppliers align oils with evolving formulation trends.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Source

- 2.2.2 Formulation

- 2.2.3 Application

- 2.2.4 Function

- 2.2.5 Distribution Channel

- 2.2.6 End User

- 2.2.7 Regional

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for natural and organic products

- 3.2.1.2 Awareness of skin and hair health

- 3.2.1.3 Expansion of the beauty and personal care industry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Allergic reactions or skin sensitivity

- 3.2.2.2 High cost of premium oils

- 3.2.3 Market opportunities

- 3.2.3.1 Sustainable and eco-friendly packaging

- 3.2.3.2 Development of multifunctional oils

- 3.2.3.3 Integration with advanced skincare technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By source

- 3.9 Future market trends

- 3.10 Technology and innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent landscape

- 3.12 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Source, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Mineral oil

- 5.3 Nut oil

- 5.3.1 Macadamia oil

- 5.3.2 Walnut oil

- 5.3.3 Hazelnut oil

- 5.3.4 Pecan oil

- 5.3.5 Kalahari melon oil

- 5.3.6 Brazil nut oil

- 5.3.7 Mongongo oil

- 5.3.8 Others

- 5.4 Plant oil

- 5.4.1 Almond oil

- 5.4.2 Argan oil

- 5.4.3 Coconut oil

- 5.4.4 Olive oil

- 5.4.5 Avocado oil

- 5.4.6 St. John's wort oil

- 5.4.7 Jojoba oil

- 5.4.8 Micro-algae oil

- 5.4.9 Others

- 5.5 Vegetable oils

- 5.5.1 Palm oil

- 5.5.2 Soy oil

- 5.5.3 Hemp oil

- 5.5.4 Sesame oil

- 5.5.5 Rice bran oil

- 5.5.6 Sunflower oil

- 5.5.7 Safflower oil

- 5.5.8 Borage oil

- 5.5.9 Rapeseed oil

- 5.5.10 Others

- 5.6 Synthetic & biotechnology-derived oils

- 5.6.1 Squalane (synthetic)

- 5.6.2 Silicone-based oils

- 5.6.3 Bioengineered oils

Chapter 6 Market Estimates and Forecast, By Formulation, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Pure single oils

- 6.3 Blended/carrier oils

- 6.4 Infused oils

- 6.5 Encapsulated/nano-emulsified oils

Chapter 7 Market Estimates and Forecast, By Function, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Skin conditioning & moisturising

- 7.3 Hair conditioning

- 7.4 Anti-aging & antioxidant

- 7.4.1 Free radical protection

- 7.4.2 Wrinkle reduction

- 7.5 UV protection

- 7.6 Cleansing & makeup removal

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Hair care

- 8.2.1 Hair oil

- 8.2.2 Shampoos

- 8.2.3 Conditioners

- 8.2.4 Hair serums

- 8.2.5 Hair masks

- 8.2.6 Others

- 8.3 Skin care

- 8.3.1 Creams & lotions

- 8.3.2 Oils and Formulations

- 8.3.3 Others

- 8.4 Fragrance & aromatherapy

- 8.5 Bath & shower products

- 8.6 Make-up

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2022-2035 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Supermarkets/ Hypermarkets

- 9.3 Specialty stores

- 9.4 Professional salon

- 9.5 Online/e-commerce

- 9.6 Pharmacy stores

- 9.7 Others

Chapter 10 Market Estimates and Forecast, By End Use, 2022-2035 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 Individual consumers

- 10.3 Professional users (Salons, Spas, Massage Therapists)

- 10.4 Industrial/B2B

Chapter 11 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.2.3 Mexico

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Rest of Latin America

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

- 11.6.4 Rest of Middle East and Africa

Chapter 12 Company Profiles

- 12.1 ATDM Co., Ltd.

- 12.2 BASF SE

- 12.3 Cargill, Incorporated

- 12.4 Clariant AG

- 12.5 doTERRA International LLC

- 12.6 ExxonMobil Corporation

- 12.7 Gandhar Oil Refinery India Limited (India)

- 12.8 Givaudan SA

- 12.9 Henry Lamotte Oils

- 12.10 Maverik Oils

- 12.11 Olvea Vegetable Oils

- 12.12 Petro-Canada Lubricants

- 12.13 Renkert Oil

- 12.14 Sonneborn LLC

- 12.15 Sophim

- 12.16 Symrise AG

- 12.17 Vigon International, Inc.

- 12.18 Young Living Essential Oils