PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913305

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913305

Naphthalene Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

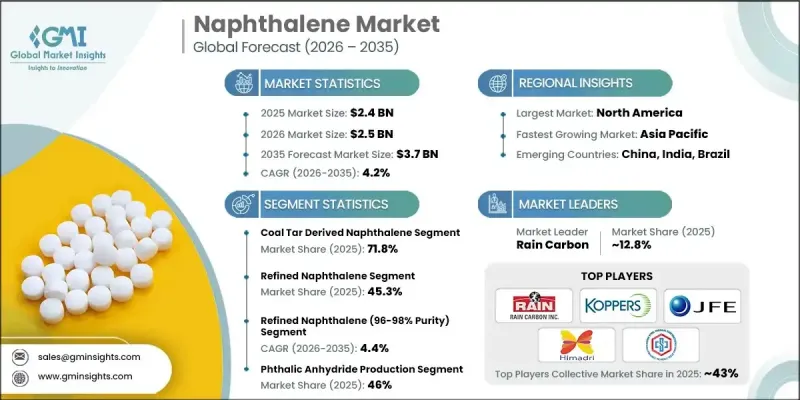

The Global Naphthalene Market was valued at USD 2.4 billion in 2025 and is estimated to grow at a CAGR of 4.2% to reach USD 3.7 billion by 2035.

Naphthalene, chemically identified as C10H8, is a polycyclic aromatic hydrocarbon produced mainly through coal tar processing and petroleum refining. The material is supplied in multiple commercial forms such as refined naphthalene, alkyl naphthalene, and solid variants, with purity levels spanning from crude grades of 90-95% to high-purity grades exceeding 99%. It is widely used as a core feedstock in chemical manufacturing chains, construction-related formulations, and established industrial applications. Rising demand for phthalic anhydride, increasing use of construction chemicals, and the development of specialty chemical applications are collectively shaping market expansion worldwide. Producers are focusing on cleaner production routes, precision purification systems, and differentiated product grades to meet evolving customer specifications. Improvements in processing efficiency and consistency are supporting stable demand across multiple end-use industries and regions. This combination of demand growth, technology advancement, and diversified applications continues to support long-term development of the naphthalene market.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.4 billion |

| Forecast Value | $3.7 billion |

| CAGR | 4.2% |

Technological progress in purification and grade control is reshaping naphthalene manufacturing by enabling purity levels above 99% for high-performance uses, tighter crystallization management, and improved batch consistency from both coal tar and petroleum-based sources. These advancements are designed to meet strict quality benchmarks required for high-value chemical synthesis and intermediate production. Enhanced distillation, crystallization refinement, and hydrogenation-based processes are lowering impurity content while improving functional reliability, allowing manufacturers to deliver naphthalene products with more predictable performance and broader industrial acceptance.

The coal tar-based naphthalene segment held 71.8% share in 2025 and is forecast to grow at a CAGR of 4% from 2026 to 2035. Its dominance is attributed to mature production systems aligned with steel and coke processing operations, favorable yield economics, and stable output quality. This source benefits from extensive global coal tar infrastructure that supports large-scale production while maintaining cost efficiency and dependable supply. Its strong foothold across major consuming regions, combined with long-standing integration into industrial value chains, continues to reinforce its leadership in the global naphthalene landscape.

The refined naphthalene segment accounted for 45.3% share in 2025 and is anticipated to register a CAGR of 3.6% through 2035. This form remains the preferred choice for large-volume chemical processing due to its consistent purity and favorable handling characteristics. Its widespread use within integrated chemical manufacturing facilities supports efficient downstream processing and reliable operational performance. Established production networks and proven economic advantages contribute to its continued dominance across global chemical production hubs.

US Naphthalene Market generated USD 929.9 million in 2025, reflecting strong regional demand driven by steady consumption across industrial and construction-related sectors. The presence of established production facilities, integrated processing infrastructure, and sustained end-use requirements supports market stability within the country. Ongoing investment in processing efficiency and supply chain reliability continues to underpin demand growth across North America.

Key companies active in the Naphthalene Market include Rain Carbon, Himadri Specialty Chemical Ltd., ExxonMobil Chemical, Koppers, PCC Group, China Steel Chemical, JFE Chemical Corporation, and Dong-Suh Chemical Ind. Co., Ltd., Deza, King Industries, Atom Scientific, CDH Fine Chemical, and Tulstar Products. Companies operating in the Naphthalene Market are strengthening their market position through capacity optimization, investment in advanced purification technologies, and expansion of high-purity product portfolios. Many players are focusing on operational integration with upstream raw material sources to improve cost control and supply security. Strategic partnerships and long-term supply agreements are being used to stabilize demand and enhance regional presence. Firms are also prioritizing process efficiency, emission reduction, and sustainable production practices to align with evolving regulatory expectations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Source

- 2.2.2 Form

- 2.2.3 Product Grade

- 2.2.4 Application

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product grade

- 3.9 Future market trends

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Form, 2022-2035 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Refined naphthalene

- 5.3 Alkyl naphthalene

- 5.4 Naphthalene solid

- 5.5 Other

Chapter 6 Market Estimates and Forecast, By Source, 2022-2035 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Coal tar derived naphthalene

- 6.3 Petroleum derived naphthalene

- 6.4 Recycled and secondary sources

Chapter 7 Market Estimates and Forecast, By Product Grade, 2022-2035 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Crude naphthalene (90-95% purity)

- 7.3 Refined naphthalene (96-98% purity)

- 7.4 Pure naphthalene (99%+ purity)

- 7.5 Specialty grades and custom products

Chapter 8 Market Estimates and Forecast, By Application, 2022-2035 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Phthalic anhydride production

- 8.3 Surfactants & dispersants

- 8.4 Water reducing agents (construction chemicals)

- 8.5 Dyes & pigments (chemical intermediates)

- 8.6 Traditional applications (mothballs, tanning agents)

- 8.7 Emerging and other applications

Chapter 9 Market Estimates and Forecast, By Region, 2022-2035 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Atom Scientific

- 10.2 CDH Fine Chemical

- 10.3 China Steel Chemical

- 10.4 Deza

- 10.5 Dong-Suh Chemical Ind. Co., Ltd.

- 10.6 ExxonMobil Chemical

- 10.7 Himadri Specialty Chemical Ltd.

- 10.8 JFE Chemical Corporation

- 10.9 King Industries

- 10.10 Koppers

- 10.11 PCC Group

- 10.12 Rain Carbon

- 10.13 Tulstar Products