PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913311

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913311

Mobile Cardiac Telemetry Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

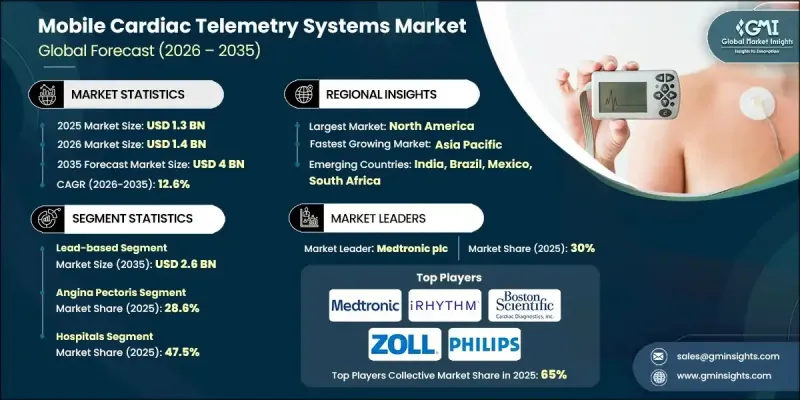

The Global Mobile Cardiac Telemetry Systems Market was valued at USD 1.3 billion in 2025 and is estimated to grow at a CAGR of 12.6% to reach USD 4 billion by 2035.

This expansion reflects the rising prevalence of heart-related conditions, supportive public health initiatives, an expanding elderly population, and continuous innovation in remote cardiac monitoring technologies. Mobile cardiac telemetry systems enable uninterrupted heart activity tracking while individuals continue their normal routines, offering a more flexible alternative to conventional monitoring methods. These systems rely on wearable sensors that continuously capture cardiac signals and automatically transmit clinically relevant data to off-site monitoring facilities through wireless connectivity. The growing global burden of cardiovascular conditions has intensified the demand for early diagnosis and proactive disease management. Continuous remote monitoring supports faster clinical decision-making, enhances care coordination, and helps limit unnecessary hospital visits. As healthcare systems increasingly prioritize preventive care and digital health solutions, mobile cardiac telemetry is becoming an essential component of modern cardiac care delivery, reinforcing its strong growth trajectory across both clinical and outpatient settings.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.3 Billion |

| Forecast Value | $4 Billion |

| CAGR | 12.6% |

The lead-based product category generated USD 821.6 million during 2025 and is expected to reach USD 2.6 billion by 2035, growing at a CAGR of 12.8%. These systems utilize multiple electrodes and external leads to deliver highly reliable cardiac data, supporting consistent clinical interpretation. Their established use in medical environments and integration into routine diagnostic workflows continue to drive widespread adoption across hospitals and specialized care centers.

The angina pectoris application segment held 28.6% share in 2025. This condition is associated with reduced blood supply to cardiac tissue and often occurs unpredictably, requiring continuous observation for effective management. Mobile cardiac telemetry systems facilitate ongoing assessment during daily activities, allowing clinicians to identify concerning cardiac patterns in real-time and intervene promptly.

North America Mobile Cardiac Telemetry Systems Market accounted for 40.4% share in 2025. Strong healthcare infrastructure, early adoption of digital medical technologies, and a rising incidence of cardiovascular conditions have supported market leadership in the region. Established reimbursement frameworks, increased patient awareness, and sustained investment in medical research further encourage adoption across the U.S. and Canada.

Key companies active in the Global Mobile Cardiac Telemetry Systems Market include Medtronic plc, Koninklijke Philips N.V., iRhythm Technologies, Inc., AliveCor, BIOTRICITY INC., Boston Scientific Cardiac Diagnostics Inc., Zoll Medical Corporation, Biotronik, Baxter International Inc., Medicomp Systems, ScottCare Cardiovascular Solutions, Bittium, Telerhythmics LLC, Cardiosense, and ACS Diagnostics. Companies operating in the Global Mobile Cardiac Telemetry Systems Market are strengthening their market position through technology upgrades, strategic partnerships, and geographic expansion. Many firms are investing in advanced analytics, cloud-based platforms, and artificial intelligence to enhance diagnostic accuracy and data transmission efficiency. Product portfolio diversification and the development of user-friendly wearable designs are being prioritized to improve patient adherence. Strategic collaborations with healthcare providers and payers help expand clinical adoption and reimbursement coverage.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Indication trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of cardiac disorders

- 3.2.1.2 Favorable government policies

- 3.2.1.3 Growing aging population

- 3.2.1.4 Technological advancements in cardiac telemetry systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of professional training & education

- 3.2.2.2 Stringent regulatory policies and quality control standards

- 3.2.3 Market opportunities

- 3.2.3.1 Shift toward value-based and preventive care models

- 3.2.3.2 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2024

- 3.9 Future market trends

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Lead-based

- 5.3 Patch-based

Chapter 6 Market Estimates and Forecast, By Indication, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Angina pectoris

- 6.3 Coronary artery disease

- 6.4 Atherosclerosis

- 6.5 Heart failure

- 6.6 Stroke

- 6.7 Other indications

Chapter 7 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Specialty clinics

- 7.4 Diagnostic centres

- 7.5 Homecare settings

- 7.6 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ACS Diagnostics

- 9.2 AliveCor

- 9.3 Baxter International Inc.

- 9.4 BIOTRICITY INC.

- 9.5 Biotronik

- 9.6 Bittium

- 9.7 Boston Scientific Cardiac Diagnostics Inc.

- 9.8 Cardiosense

- 9.9 iRhythm Technologies, Inc.

- 9.10 Koninklijke Philips N.V.

- 9.11 Medicomp Systems

- 9.12 Medtronic plc

- 9.13 ScottCare Cardiovascular Solutions

- 9.14 Telerhythmics LLC

- 9.15 Zoll Medical Corporation