PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913319

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913319

Europe Air to Water Heat Pump Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

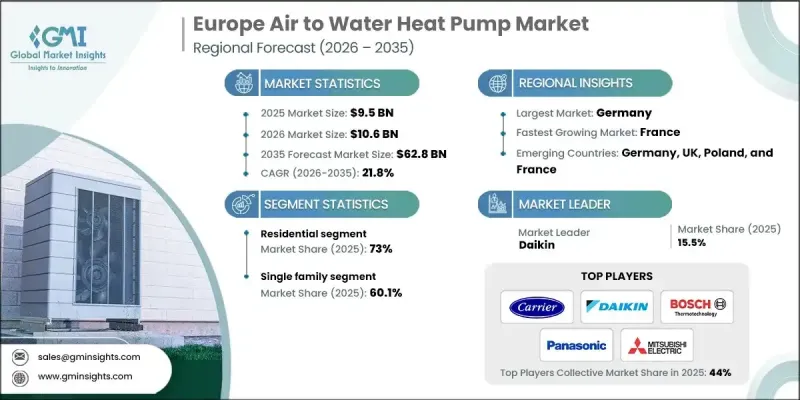

Europe Air to Water Heat Pump Market was valued at USD 9.5 billion in 2025 and is estimated to grow at a CAGR of 21.8% to reach USD 62.8 billion by 2035.

Market growth is fueled by the accelerating shift toward high-efficiency heating technologies as European countries tighten climate policies and promote low-carbon energy systems. Increasing pressure to reduce greenhouse gas emissions, combined with strong financial incentives and subsidy programs, is encouraging widespread adoption of renewable-based heating solutions. Continuous innovation in heat pump design, performance optimization, and system integration is improving seasonal efficiency while lowering operating expenses, making these systems increasingly attractive across residential and commercial buildings. Manufacturers are focusing on compact, versatile systems capable of delivering both heating and cooling, supporting year-round comfort in diverse climate conditions. Regional initiatives aimed at increasing the share of renewable energy in heating and cooling applications are reshaping purchasing decisions, while stricter building energy standards are reinforcing demand. Expanding construction activity across housing and commercial infrastructure, combined with heightened awareness of environmental responsibility, continues to support the rapid penetration of air-to-water heat pump systems across Europe.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $9.5 Billion |

| Forecast Value | $62.8 Billion |

| CAGR | 21.8% |

The commercial application segment is expected to reach USD 16 billion by 2035. Growing demand for space heating and hot water in facilities such as hospitals, academic institutions, offices, and retail environments, along with stricter building performance regulations, is strengthening adoption. Ongoing development of commercial properties and policy support for low-emission HVAC technologies are further enhancing growth prospects.

Within the residential sector, single-family homes are gaining strong momentum due to population growth, rising housing development, and increasing demand for dependable heating, cooling, and hot water systems. Climatic diversity across Europe and the need for advanced, energy-efficient solutions are accelerating product uptake.

Germany Air to Water Heat Pump Market held 17% share in 2025, generating USD 1.6 billion. Demand is supported by the country's varied climate, strong preference for cost-efficient heating systems, and broad acceptance of energy-saving technologies. Rising sustainability awareness and long-term efficiency goals are steadily shifting consumers toward low-emission heating alternatives.

Key participants operating in the Europe Air to Water Heat Pump Market include Daikin, Bosch Thermotechnology Ltd., Vaillant, Mitsubishi Electric Europe B.V., Panasonic Corporation, NIBE Industrier AB, LG Electronics, Carrier, STIEBEL ELTRON GmbH & Co. KG, SAMSUNG, Trane Technologies International Limited, Glen Dimplex, Aermec S.p.A, Systemair AB, WOLF, Fujitsu General, Intuis Group, OCHSNER, and Master Therm tepelna cerpadla s. r. o., Clade Engineering Systems Ltd., and Baxi, part of BDR Thermea Group BV. Companies in the Europe Air to Water Heat Pump Market are strengthening their market position through continuous product innovation, efficiency enhancements, and alignment with evolving regulatory frameworks. Manufacturers are investing heavily in research to improve performance in cold climates, reduce noise levels, and enhance smart connectivity. Strategic partnerships with installers, developers, and energy service providers are helping expand distribution networks and accelerate adoption. Firms are also localizing production and service capabilities to meet regional standards and shorten delivery timelines. Digital controls, remote monitoring, and integrated energy management features are being introduced to improve user experience and lifecycle value.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.3 Forecast model

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.1.1 Sources, by country

- 1.5.1 Paid Sources

- 1.6 Research Trail & confidence scoring

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.2 Application trends

- 2.3 Country trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Key factors affecting the value chain

- 3.1.3 Disruptions

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of air to water heat pump

- 3.8 Emerging opportunities & trends

- 3.8.1 Digital transformation with IoT technologies

- 3.8.2 Emerging market penetration

- 3.9 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by country, 2024

- 4.2.1 Austria

- 4.2.2 Norway

- 4.2.3 Denmark

- 4.2.4 Finland

- 4.2.5 France

- 4.2.6 Germany

- 4.2.7 Italy

- 4.2.8 Switzerland

- 4.2.9 Spain

- 4.2.10 Sweden

- 4.2.11 UK

- 4.2.12 Netherlands

- 4.2.13 Poland

- 4.2.14 Belgium

- 4.2.15 Slovakia

- 4.2.16 Ireland

- 4.2.17 Czech Republic

- 4.3 Strategic initiatives

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Product innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Application, 2022 - 2035 (‘000 Units & USD Million)

- 5.1 Key trends

- 5.2 Residential

- 5.2.1 Single Family

- 5.2.2 Multi Family

- 5.2.3 By Product

- 5.2.3.1 Domestic Hot Water Heat Pump

- 5.2.3.2 Room Heat Pump

- 5.3 Commercial

- 5.3.1 Education

- 5.3.2 Healthcare

- 5.3.3 Retail

- 5.3.4 Logistics & transportation

- 5.3.5 Offices

- 5.3.6 Hospitality

- 5.3.7 Others

Chapter 6 Market Size and Forecast, By Country, 2022 - 2035 (‘000 Units & USD Million)

- 6.1 Key trends

- 6.2 Austria

- 6.3 Norway

- 6.4 Denmark

- 6.5 Finland

- 6.6 France

- 6.7 Germany

- 6.8 Italy

- 6.9 Switzerland

- 6.10 Spain

- 6.11 Sweden

- 6.12 UK

- 6.13 Netherlands

- 6.14 Poland

- 6.15 Belgium

- 6.16 Slovakia

- 6.17 Ireland

- 6.18 Czech Republic

Chapter 7 Company Profiles

- 7.1 Aermec S.p.A

- 7.2 Baxi - part of BDR Thermea Group BV

- 7.3 Bosch Thermotechnology Ltd.

- 7.4 Carrier

- 7.5 Clade Engineering Systems Ltd

- 7.6 Daikin

- 7.7 FUJITSU GENERAL

- 7.8 Glen Dimplex

- 7.9 Intuis Group

- 7.10 LG Electronics

- 7.11 Master Therm tepelna cerpadla s. r. o.

- 7.12 Mitsubishi Electric Europe B.V.

- 7.13 NIBE Industrier AB

- 7.14 OCHSNER

- 7.15 Panasonic Corporation

- 7.16 SAMSUNG

- 7.17 STIEBEL ELTRON GmbH & Co. KG

- 7.18 Systemair AB

- 7.19 Trane Technologies International Limited

- 7.20 Vaillant Group

- 7.21 WOLF