PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913324

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913324

Nonwoven Filter Media Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

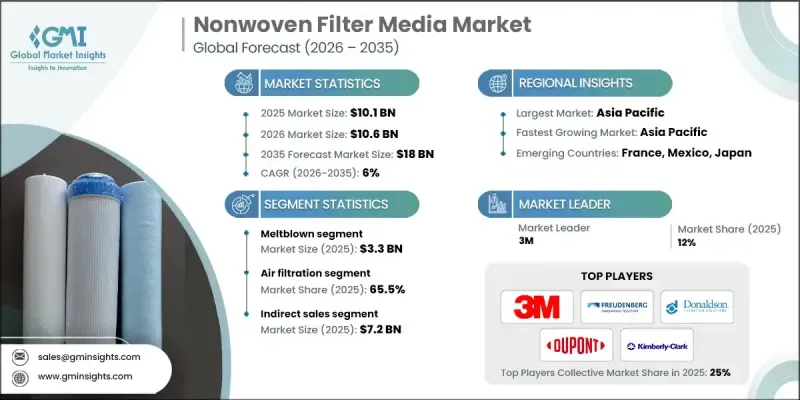

The Global Nonwoven Filter Media Market was valued at USD 10.1 billion in 2025 and is estimated to grow at a CAGR of 6% to reach USD 18 billion by 2035.

Market expansion is driven by accelerating urban development, rising emissions from transportation and industrial activity, and increasing concerns related to air quality across populated regions. Growing awareness of airborne pollutants has encouraged governments, institutions, and private organizations to invest in advanced filtration technologies across built environments and industrial systems. At the same time, heightened consumer focus on indoor environmental conditions is supporting demand for high-performance filtration solutions used in residential and commercial settings. These combined factors are pushing manufacturers to develop nonwoven filter media that deliver higher efficiency, longer service life, and application-specific performance. Regulatory pressure surrounding environmental protection and occupational safety is further reinforcing adoption. Industries are increasingly prioritizing contamination control and compliance, which is driving steady demand for reliable and scalable filtration media. Continuous improvements in material science and fiber engineering are enabling broader deployment of nonwoven filter media across air and liquid filtration systems, supporting sustained market growth over the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $10.1 Billion |

| Forecast Value | $18 Billion |

| CAGR | 6% |

Industries with strict quality and safety standards are increasingly relying on advanced filtration structures to meet regulatory requirements and ensure product integrity. Multi-layer filtration architectures are being adopted to address complex filtration needs related to particulates, sediments, and microbial control, supporting stable demand across municipal and industrial treatment systems.

The meltblown segment generated USD 3.3 billion in 2025. This segment is described as a critical category within the nonwoven filter media market due to its ability to deliver ultra-fine fiber structures with high surface area. These characteristics enable high filtration efficiency and consistent performance in applications that require precise particle retention and airflow balance.

The air filtration segment accounted for 65.5% share in 2025. Nonwoven filter media play a central role in maintaining indoor air quality across residential, commercial, and industrial environments. Their low airflow resistance and high particle capture efficiency support energy efficiency goals while aligning with evolving environmental and safety regulations.

United States Nonwoven Filter Media Market held 72.3% share and generated USD 2.2 billion in 2025. Market strength in the country is supported by strong regulatory frameworks, ongoing infrastructure upgrades, and sustained demand across healthcare, industrial, and environmental applications. Continued investment in advanced fiber technologies and sustainable materials is reinforcing long-term growth.

Key companies operating in the Global Nonwoven Filter Media Market include DuPont, 3M, Freudenberg Group, Mann+Hummel, Ahlstrom, Donaldson, Kimberly-Clark, Johns Manville, Camfil Group, Glatfelter, Sandler Group, Gessner, Avintiv, Americo, and Mogul. Companies in the Global Nonwoven Filter Media Market are strengthening their competitive position by investing in advanced material development and high-efficiency fiber technologies. Many manufacturers are focusing on lightweight, durable, and sustainable nonwoven structures to meet evolving regulatory and performance standards. Strategic expansion of production capacity and regional manufacturing footprints is helping firms improve supply reliability and reduce lead times. Partnerships with system integrators and end-use industries are supporting customized product development. Continuous research into environmentally responsible materials and recyclable solutions is gaining priority. Companies are also enhancing quality control and certification capabilities to meet strict compliance requirements.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Filtration media

- 2.2.4 End use

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for air and water filtration

- 3.2.1.2 Increase in filtration applications in consumer goods

- 3.2.1.3 Water scarcity & need for better water treatment

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Volatility in raw material costs

- 3.2.2.2 Performance limitations under extreme conditions

- 3.2.3 Opportunities

- 3.2.3.1 Sustainability & bio-based nonwovens

- 3.2.3.2 Smart filters & functional coatings

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022 - 2035 (USD Billion) (Million Square Meters)

- 5.1 Key trends

- 5.2 Carded

- 5.3 Wetlaid

- 5.4 Meltblown

- 5.5 Spunbonded

- 5.6 Airlaid

- 5.7 Others (needlepunch etc.)

Chapter 6 Market Estimates and Forecast, By Filtration Media, 2022 - 2035 (USD Billion) (Million Square Meters)

- 6.1 Key trends

- 6.2 Air filtration

- 6.3 Liquid filtration

Chapter 7 Market Estimates and Forecast, By End Use, 2022 - 2035 (USD Billion) (Million Square Meters)

- 7.1 Key trends

- 7.2 Commercial

- 7.3 Industrial

- 7.4 HVAC

- 7.5 Transportation

- 7.6 Water Filtration

- 7.7 Food & Beverages

- 7.8 Manufacturing

- 7.9 Others (healthcare etc.)

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Billion) (Million Square Meters)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion) (Million Square Meters)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 3M

- 10.2 Ahlstrom

- 10.3 Americo

- 10.4 Avintiv

- 10.5 Camfil Group

- 10.6 Donaldson

- 10.7 DuPont

- 10.8 Freudenberg Group

- 10.9 Gessner

- 10.10 Glatfelter

- 10.11 Johns Manville

- 10.12 Kimberly-Clark

- 10.13 Mann+Hummel

- 10.14 Mogul

- 10.15 Sandler Group