PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913334

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913334

Food Encapsulation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

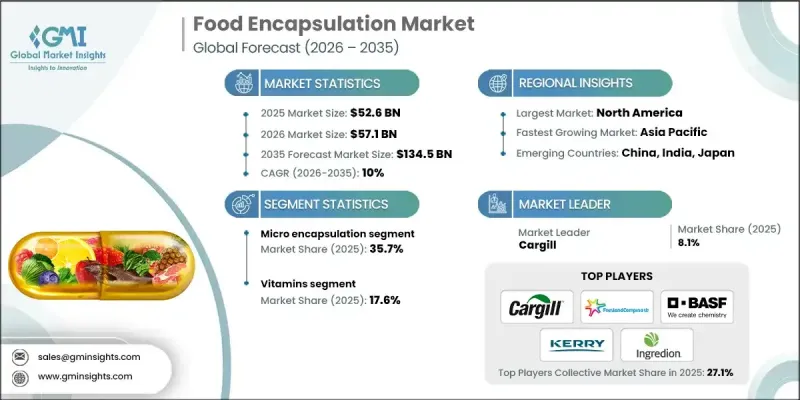

The Global Food Encapsulation Market was valued at USD 52.6 billion in 2025 and is estimated to grow at a CAGR of 10% to reach USD 134.5 billion by 2035.

Market growth is fueled by the widening use of encapsulation across multiple food categories, as manufacturers focus on enhancing product stability, sensory quality, and nutritional value. Encapsulation technologies are increasingly applied to improve visual appeal, flavor retention, and taste consistency, which supports stronger consumer acceptance of packaged foods. Rising utilization of encapsulated ingredients in sweetener formulations is contributing to broader adoption, supported by continuous investments in ingredient innovation and food preservation research. Growing consumer awareness regarding nutrition, combined with higher demand for fortified and value-added food products, continues to support market expansion. The need to safeguard sensitive and volatile food components has strengthened demand for advanced encapsulation solutions. Rapid adoption of modern preservation techniques is further improving ingredient protection and shelf-life performance. At the same time, advancements in controlled-release mechanisms are creating attractive growth opportunities for producers seeking to differentiate their offerings through functional performance and enhanced health benefits.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $52.6 Billion |

| Forecast Value | $134.5 Billion |

| CAGR | 10% |

The microencapsulation segment accounted for 35.7% share in 2025, supported by its effectiveness in protecting sensitive ingredients through protective coating methods and its adaptability across diverse food formulations.

The vitamins segment held 17.6% share in 2025, driven by rising interest in nutritional enrichment and the role of vitamins in supporting long-term health and physiological functions.

North America Food Encapsulation Market held 36.6% share in 2025, supported by a mature packaged food industry, strong availability of encapsulation materials, and ongoing adoption of advanced preservation technologies.

Key companies operating in the Global Food Encapsulation Market include Ingredion Incorporated, Kerry Group, Symrise AG, Balchem Corporation, Cargill, Sensient Technologies Corporation, International Flavours & Fragrances Inc. (IFF), FrieslandCampina Kievit, BASF SE, Lycored Group, AVEKA Group, Royal DSM, and Firmenich SA. Companies in the Global Food Encapsulation Market are reinforcing their market position by investing heavily in research and development to improve encapsulation efficiency, stability, and controlled-release performance. Strategic partnerships with food manufacturers allow suppliers to co-develop customized solutions tailored to specific formulation needs. Expansion of production capacities and geographic presence helps companies meet rising global demand while improving supply reliability. Firms are also focusing on clean-label and health-oriented innovations to align with evolving consumer preferences.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Core phase

- 2.2.4 Technology

- 2.2.5 Shell material

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Type, 2022-2035 (USD Billion & Tons)

- 5.1 Key trends

- 5.2 Micro encapsulation

- 5.3 Nano encapsulation

- 5.4 Hybrid technology

- 5.5 Macro encapsulation

Chapter 6 Market Estimates and Forecast, By Core Phase, 2022-2035 (USD Billion & Tons)

- 6.1 Key trends

- 6.2 Vitamins

- 6.2.1 Fat soluble vitamins

- 6.2.1.1 Vitamin A

- 6.2.1.2 Vitamin D

- 6.2.1.3 Vitamin E

- 6.2.1.4 Vitamin K

- 6.2.2 Water soluble vitamins

- 6.2.2.1 Vitamin B complex

- 6.2.2.2 Vitamin C

- 6.2.1 Fat soluble vitamins

- 6.3 Organic acids

- 6.3.1 Citric acid

- 6.3.2 Lactic acid

- 6.3.3 Fumaric acid

- 6.3.4 Malic acid

- 6.3.5 Others

- 6.4 Minerals

- 6.5 Enzymes

- 6.6 Flavors & essences

- 6.7 Preservatives

- 6.8 Sweeteners

- 6.9 Colors

- 6.10 Prebiotics

- 6.11 Probiotics

- 6.12 Essential oils

- 6.13 Others

Chapter 7 Market Estimates and Forecast, By Technology, 2022-2035 (USD Billion & Tons)

- 7.1 Key trends

- 7.2 Physical process

- 7.2.1 Atomization

- 7.2.1.1 Spray drying

- 7.2.1.2 Spray chilling

- 7.2.1.3 Spinning disk

- 7.2.2 Extrusion

- 7.2.3 Fluid bed technique

- 7.2.4 Others

- 7.2.1 Atomization

- 7.3 Chemical & physicochemical process

Chapter 8 Market Estimates and Forecast, By Shell Material, 2022-2035 (USD Billion & Tons)

- 8.1 Key trends

- 8.2 Polysaccharides

- 8.3 Proteins

- 8.4 Lipids

- 8.5 Emulsifiers

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion & Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Cargill

- 10.2 FrieslandCampina Kievit

- 10.3 Royal DSM

- 10.4 BASF SE

- 10.5 Kerry Group

- 10.6 Ingredion Incorporated

- 10.7 Lycored Group

- 10.8 International Flavours & Fragrances Inc. (IFF)

- 10.9 Symrise AG

- 10.10 Sensient Technologies Corporation

- 10.11 Balchem Corporation

- 10.12 Firmenich SA

- 10.13 AVEKA Group