PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913338

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913338

U.S. Wound Care Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

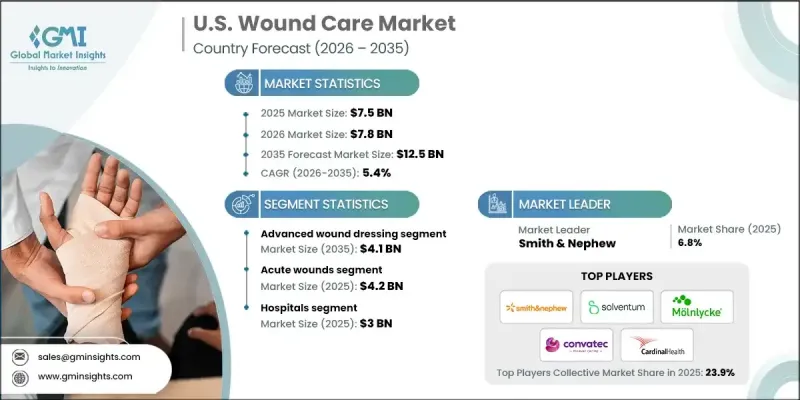

U.S. Wound Care Market was valued at USD 7.5 billion in 2025 and is estimated to grow at a CAGR of 5.4% to reach USD 12.5 billion by 2035.

Growth is supported by the increasing incidence of chronic conditions, a rising volume of surgical interventions, and consistent efforts by public health authorities to expand access to effective wound management solutions. Continuous progress in wound care technologies has reshaped clinical practices by improving healing efficiency and patient outcomes. Modern wound care solutions increasingly focus on infection prevention, faster tissue regeneration, and improved comfort during recovery. Products used in wound care are designed to come into direct contact with injured tissue to support healing while minimizing complications. Selection of wound dressings varies based on wound type, severity, and treatment goals, reinforcing the importance of a broad and advanced product portfolio across care settings. These factors collectively contribute to sustained demand for both conventional and advanced wound care solutions across the United States.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $7.5 Billion |

| Forecast Value | $12.5 Billion |

| CAGR | 5.4% |

The advanced wound dressing segment is expected to reach USD 4.1 billion by 2035. Growth in this category is driven by the ability of advanced dressings to regulate moisture levels, support tissue regeneration, and accelerate recovery timelines. Dressings that incorporate enhanced therapeutic properties or advanced pressure-based systems create optimal healing conditions and outperform traditional alternatives.

The acute wounds segment generated USD 4.2 billion in 2025, representing a substantial share of the overall market. Demand in this segment is fueled by a high number of medical procedures and injury-related treatments requiring effective and immediate wound protection. Specialized dressings are widely adopted to reduce infection risk and support rapid healing in acute care environments.

Key companies operating in the U.S. Wound Care Market include Medtronic, Smith and Nephew, Coloplast, Baxter International, B. Braun Melsungen, Molnlycke Health Care, ConvaTec Group, Medline Industries, URGO Medical, Ethicon, Advancis Medical, Derma Sciences, and Solventum. Companies in the U.S. Wound Care Market strengthen their competitive position through continuous product innovation, clinical effectiveness, and portfolio diversification. Manufacturers invest heavily in research to develop advanced dressings that improve healing outcomes and reduce treatment duration. Strategic partnerships with healthcare providers and distributors enhance market reach and adoption. Emphasis on regulatory compliance, evidence-based solutions, and clinician education supports brand credibility. Companies also focus on expanding offerings across acute and chronic wound categories to address diverse patient needs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product trends

- 2.2.2 Application trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of diabetes in U.S.

- 3.2.1.2 Growing technological advancements in wound care products

- 3.2.1.3 Increasing number of surgical procedures

- 3.2.1.4 Surge in government initiatives aimed at improving access to wound care

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs associated with advanced wound care products

- 3.2.2.2 Stringent regulatory framework

- 3.2.3 Market opportunities

- 3.2.3.1 Rising preference for home-based wound care

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Patent analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Advanced wound dressing

- 5.2.1 Foam dressings

- 5.2.2 Hydrocolloid dressings

- 5.2.3 Film dressings

- 5.2.4 Alginate dressings

- 5.2.5 Hydrogel dressings

- 5.2.6 Collagen dressings

- 5.2.7 Other advanced dressings

- 5.3 Surgical wound care

- 5.3.1 Sutures and staples

- 5.3.2 Tissue adhesive and sealants

- 5.3.3 Anti-infective dressing

- 5.4 Traditional wound care

- 5.4.1 Medical tapes

- 5.4.2 Cotton

- 5.4.3 Bandages

- 5.4.4 Gauzes

- 5.4.5 Sponges

- 5.4.6 Cleansing agents

- 5.5 Wound therapy devices

- 5.5.1 Negative pressure wound therapy

- 5.5.2 Oxygen and hyperbaric oxygen equipment

- 5.5.3 Electric stimulation devices

- 5.5.4 Pressure relief devices

- 5.5.5 Other wound therapy devices

- 5.6 Wound care biologics

- 5.6.1 Skin substitutes

- 5.6.1.1 Biological

- 5.6.1.1.1 Allograft

- 5.6.1.1.2 Xenograft

- 5.6.1.1.3 Other biologicals

- 5.6.1.2 Synthetic

- 5.6.1.1 Biological

- 5.6.2 Topical agents

- 5.6.1 Skin substitutes

Chapter 6 Market Estimates and Forecast, By Application, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.1.1 Chronic wounds

- 6.1.2 Diabetic foot ulcers

- 6.1.3 Pressure ulcers

- 6.1.4 Venous leg ulcers

- 6.1.5 Other chronic wounds

- 6.2 Acute wounds

- 6.2.1 Surgical wounds

- 6.2.2 Traumatic wounds

- 6.2.3 Burns

Chapter 7 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Specialty clinics

- 7.4 Home care settings

- 7.5 Other end use

Chapter 8 Company Profiles

- 8.1 Advancis Medical

- 8.2 B. Braun Melsungen

- 8.3 Baxter International

- 8.4 Coloplast

- 8.5 ConvaTec Group

- 8.6 Ethicon

- 8.7 Derma Sciences

- 8.8 Medline Industries

- 8.9 Medtronic

- 8.10 Molnlycke Health Care

- 8.11 Smith and Nephew

- 8.12 Solventum

- 8.13 URGO Medical