PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913340

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913340

Machine Learning in Logistics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

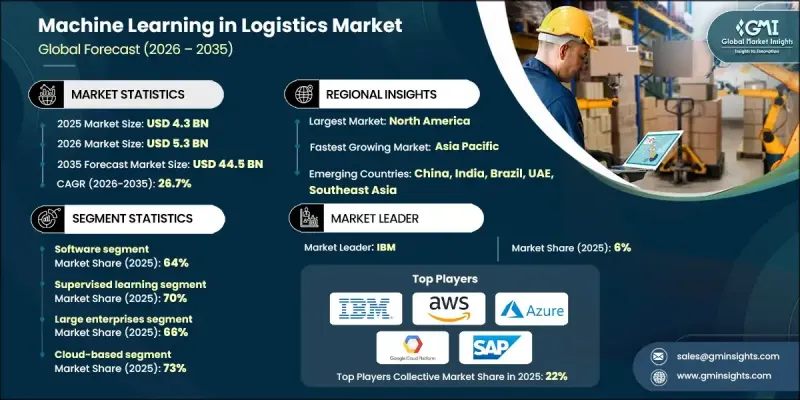

The Global Machine Learning in Logistics Market was valued at USD 4.3 billion in 2025 and is estimated to grow at a CAGR of 26.7% to reach USD 44.5 billion by 2035.

Machine learning is transforming logistics by enabling predictive decision-making, advanced automation, and real-time optimization across supply chain networks. Rapid digital commerce expansion, rising expectations for faster deliveries, and continued progress in artificial intelligence and connected technologies are accelerating adoption. Organizations are increasingly applying machine learning to enhance forecasting accuracy, optimize transportation routes, improve warehouse efficiency, balance inventory levels, manage fleets, and anticipate equipment issues before disruptions occur. As logistics ecosystems become more complex, machine learning solutions provide scalability, responsiveness, and operational visibility that traditional systems cannot deliver. This evolution supports improved service reliability, reduced costs, and stronger resilience across global supply chains, positioning machine learning as a foundational technology for the future of logistics.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $4.3 Billion |

| Forecast Value | $44.5 Billion |

| CAGR | 26.7% |

Advanced machine learning models significantly improve the performance of automated logistics systems by enabling continuous learning and operational adaptation. Businesses increasingly rely on intelligent automation to handle higher order volumes, tighter delivery timelines, and frequent shipment cycles. Machine learning-driven workflows enhance accuracy, efficiency, and workforce productivity while supporting growing consumer expectations for rapid fulfillment.

The software segment held a 64% share in 2025 and is expected to grow at a CAGR of 25.1% from 2026 to 2035. Software platforms deliver core machine learning capabilities that support forecasting, routing, asset utilization, and maintenance planning. Their ability to integrate seamlessly with existing enterprise and warehouse systems reinforces their dominance.

The supervised learning segment held a 70% share in 2025 and is growing at a CAGR of 25.6% through 2035. These models leverage historical data to improve operational planning, demand estimation, and performance prediction, delivering measurable gains in accuracy compared to traditional approaches.

North America Machine Learning in Logistics Market held a 32% share and is forecast to grow at a CAGR of 22.4% through 2035. Strong digital infrastructure, early technology adoption, and sustained investment in logistics innovation support regional leadership.

Major companies operating in the Global Machine Learning in Logistics Market include SAP SE, Oracle, IBM, Microsoft Azure, Google Cloud Platform, Amazon Web Services, Blue Yonder, Manhattan Associates, DHL Supply Chain, and FedEx Corporation. Companies in the Global Machine Learning in Logistics Market strengthen their position through continuous innovation, platform integration, and strategic partnerships. Firms invest heavily in scalable cloud-based solutions that support real-time analytics and automation across supply chains. Focus on interoperability with existing enterprise systems to enhance adoption and customer retention. Many players prioritize advanced data security, predictive capabilities, and customizable solutions to meet diverse logistics requirements. Expansion into emerging markets, along with industry-specific applications, supports revenue growth.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Technique

- 2.2.4 Organization Size

- 2.2.5 Deployment Model

- 2.2.6 Application

- 2.2.7 End Use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Increased optimization of supply chain operations

- 3.2.1.3 Automation of warehousing operations

- 3.2.1.4 Growth of e-commerce sector

- 3.2.1.5 Rising need for enhanced customer experience

- 3.2.1.6 Integration with IoT, real-time tracking, and advanced logistic infrastructure

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data quality and integration concern

- 3.2.2.2 Integration with legacy systems

- 3.2.3 Market opportunities

- 3.2.3.1 Real-time supply-chain visibility & dynamic optimization

- 3.2.3.2 Predictive analytics & demand forecasting for inventory and supply-chain planning

- 3.2.3.3 Warehouse automation, smart warehousing & robotics integration

- 3.2.3.4 Fleet management & predictive maintenance for transport assets

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Use cases & success stories

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Future outlook and opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2022 - 2035 ($Bn)

- 5.1 Key trends

- 5.2 Software

- 5.3 Services

- 5.3.1 Managed

- 5.3.2 Professional

Chapter 6 Market Estimates & Forecast, By Technique, 2022 - 2035 ($Bn)

- 6.1 Key trends

- 6.2 Supervised learning

- 6.3 Unsupervised learning

Chapter 7 Market Estimates & Forecast, By Organization Size, 2022 - 2035 ($Bn)

- 7.1 Key trends

- 7.2 Large enterprises

- 7.3 Small and medium-sized enterprises (SMEs)

Chapter 8 Market Estimates & Forecast, By Deployment Model, 2022 - 2035 ($Bn)

- 8.1 Key trends

- 8.2 Cloud-based

- 8.3 On-premises

Chapter 9 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn)

- 9.1 Key trends

- 9.2 Inventory management

- 9.3 Supply chain planning

- 9.4 Transportation management

- 9.5 Warehouse management

- 9.6 Fleet management

- 9.7 Risk management and security

- 9.8 Others

Chapter 10 Market Estimates & Forecast, By End Use, 2022 - 2035 ($Bn)

- 10.1 Key trends

- 10.2 Retail and e-commerce

- 10.3 Manufacturing

- 10.4 Healthcare

- 10.5 Automotive

- 10.6 Food & beverage

- 10.7 Consumer goods

- 10.8 Others

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035 (USD Mn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.3.8 Benelux

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Singapore

- 11.4.7 Thailand

- 11.4.8 Indonesia

- 11.4.9 Vietnam

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Colombia

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 Amazon Web Services

- 12.1.2 DHL Supply Chain

- 12.1.3 FedEx

- 12.1.4 Google Cloud Platform (GCP)

- 12.1.5 International Business Machines (IBM)

- 12.1.6 Microsoft

- 12.1.7 Oracle

- 12.1.8 SAP SE

- 12.1.9 Uber Technologies

- 12.1.10 United Parcel Service

- 12.2 Regional Players

- 12.2.1 Blue Yonder Group

- 12.2.2 C.H. Robinson Worldwide

- 12.2.3 Convoy

- 12.2.4 Coupa Software

- 12.2.5 Flexport

- 12.2.6 Infor

- 12.2.7 Locus Robotics

- 12.2.8 Manhattan Associates

- 12.2.9 Trimble

- 12.3 Emerging Technology Innovators

- 12.3.1 ClearMetal

- 12.3.2 FourKites

- 12.3.3 Project44

- 12.3.4 Shipwell

- 12.3.5 Waymo LLC