PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913344

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913344

Tungsten Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

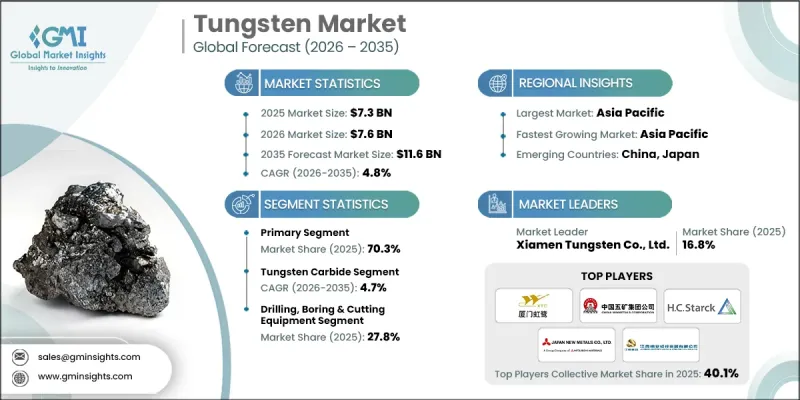

The Global Tungsten Market was valued at USD 7.3 billion in 2025 and is estimated to grow at a CAGR of 4.8% to reach USD 11.6 billion by 2035.

The market is undergoing a structural shift as circular economy practices become increasingly embedded across supply chains, driven by cost efficiency, regulatory pressure, and the need for long-term material security. Recycling is gaining strategic importance as recovery technologies now allow secondary tungsten to achieve the same chemical purity, crystalline structure, and performance consistency as primary material. Modern thermal and chemical recycling processes enable high recovery yields while significantly lowering energy use and emissions compared to conventional mining and refining. These improvements strengthen the economic rationale for recycled tungsten, particularly in regions facing high energy prices or carbon-related costs. At the same time, geopolitical concentration of primary resources continues to influence market behavior, encouraging diversification and investment in alternative sourcing routes. Growing demand from advanced manufacturing, industrial tooling, and high-performance materials applications continues to underpin steady market expansion, while sustainability-driven procurement policies further reinforce long-term growth potential across global end-use industries.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $7.3 Billion |

| Forecast Value | $11.6 Billion |

| CAGR | 4.8% |

The primary tungsten segment accounted for 70.3% share in 2025, supported by mining and concentrate production derived mainly from wolframite and scheelite ores. Production remains highly concentrated geographically, creating supply risk and driving policy actions aimed at reducing dependence on a single source region through trade measures and supply chain diversification initiatives.

The tungsten carbide segment held 60% share in 2025 and is projected to grow at a CAGR of 4.7% through 2035. Its dominance reflects unmatched hardness, structural stability, and resistance to extreme operating conditions, making it indispensable for high-wear and precision-critical industrial applications.

U.S. Tungsten Market was valued at USD 1.2 billion in 2025 and is forecast to reach USD 3 billion by 2035. North America held 18.9% share in 2025, with the region characterized by strong downstream processing capacity and heavy reliance on imported raw materials. Policy measures aimed at strengthening domestic capabilities and reducing external dependence continue to influence regional market dynamics.

Key participants in the Global Tungsten Market include Kennametal Inc., Xiamen Tungsten Co., Ltd., H.C. Starck Tungsten GmbH, China Minmetals Corporation, Global Tungsten & Powders, Sumitomo Electric Industries, Ltd., Buffalo Tungsten Inc., Elmet Technologies, Japan New Metals Co., Ltd., Chongyi ZhangYuan Tungsten Co., Ltd., Betek GmbH & Co. KG, Soloro S.L.U, Accumet Materials Co., WOLFRAM Company JSC, and Cleveland Tungsten, Inc. Companies operating in the Global Tungsten Market are strengthening their competitive position through a combination of vertical integration, recycling investments, and technology-driven process optimization. Many players are expanding secondary material recovery capabilities to improve supply security and reduce exposure to raw material volatility. Strategic partnerships with industrial end users support customized product development and long-term contracts. Firms are also prioritizing geographic diversification of sourcing and processing assets to mitigate geopolitical risks. Continuous investment in high-purity powders and advanced carbide solutions enables differentiation in premium applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Origin

- 2.2.3 Product

- 2.2.4 End-use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Origin, 2022-2035 (USD Billion & Tons)

- 5.1 Key trends

- 5.2 Primary

- 5.3 Secondary

Chapter 6 Market Estimates and Forecast, By Product, 2022-2035 (USD Billion & Tons)

- 6.1 Key trends

- 6.2 Tungsten Hexafluoride

- 6.3 Tungsten carbide

- 6.4 Metal alloys

- 6.5 Mill Products

- 6.6 Others

- 6.6.1 Electrical & electronics appliances

- 6.6.2 Others (catalyst, chemical, defense equipment, etc.)

Chapter 7 Market Estimates and Forecast, By End Use, 2022-2035 (USD Billion & Tons)

- 7.1 Key trends

- 7.2 Automotive parts

- 7.3 Aerospace components

- 7.4 Drilling, boring & cutting equipment

- 7.5 Logging equipment

- 7.6 Electrical & electronic appliances

- 7.7 Semiconductor

- 7.8 Others (catalyst, chemical, defense equipment, etc.)

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion & Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Chongyi ZhangYuan Tungsten Co., Ltd

- 9.2 Kennametal Inc.

- 9.3 Sumitomo Electric Industries, Ltd

- 9.4 China Minmetals Corporation

- 9.5 Global Tungsten & Powders

- 9.6 H.C. Starck Tungsten GmbH

- 9.7 Japan New Metals Co., Ltd

- 9.8 Soloro S.L.U

- 9.9 WOLFRAM Company JSC

- 9.10 Buffalo Tungsten Inc.

- 9.11 Elmet Technologies

- 9.12 Betek GmbH & Co. KG

- 9.13 Accumet Materials Co.

- 9.14 Xiamen Tungsten Co., Ltd

- 9.15 Cleveland Tungsten, Inc.