PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913367

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913367

Infection Control Supplies Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

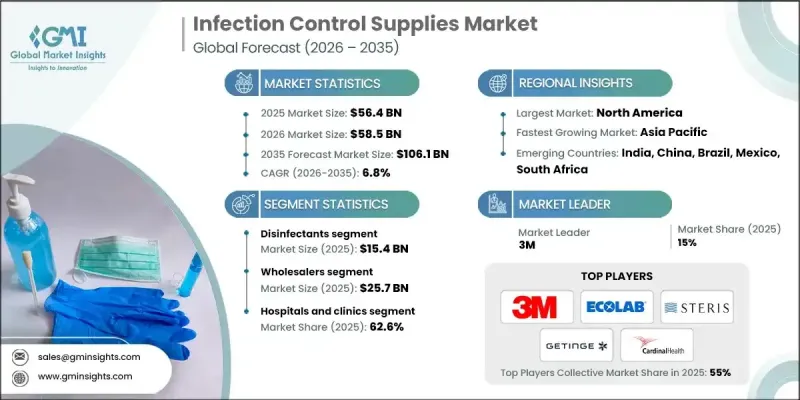

The Global Infection Control Supplies Market was valued at USD 56.4 billion in 2025 and is estimated to grow at a CAGR of 6.8% to reach USD 106.1 billion by 2035.

Market growth is supported by the rising incidence of infectious conditions within healthcare environments, increased emphasis on prevention protocols, and continuous innovation in protective and disinfection technologies. Healthcare systems worldwide are placing greater priority on minimizing infection risks to improve patient outcomes and reduce treatment costs. The growing burden of long-term health conditions has intensified interactions with healthcare facilities, increasing exposure risks and reinforcing the need for robust infection prevention measures. Patients with compromised immunity require heightened protection, further driving demand for advanced infection control solutions. Expansion of critical care and surgical capacity globally has also contributed to higher utilization of modern disinfection and sterilization technologies. As healthcare providers focus on safety, efficiency, and regulatory compliance, infection control supplies have become a fundamental component of clinical operations, supporting sustained market expansion across hospitals, clinics, and outpatient care settings.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $56.4 Billion |

| Forecast Value | $106.1 Billion |

| CAGR | 6.8% |

The disinfectants category generated USD 15.4 billion during 2025 and accounted for a 27.2% share. Strong demand continues across healthcare environments due to heightened awareness of sanitation standards and strict compliance requirements. Regulatory oversight and hygiene-focused policies continue to reinforce adoption across medical facilities.

The wholesalers distribution channel reached USD 25.7 billion in 2025. These intermediaries play a critical role in ensuring reliable access to essential infection control products. Their scale, pricing flexibility, and logistical capabilities make them a preferred sourcing option for large healthcare organizations that require consistent supply availability.

North America Infection Control Supplies Market represented 42.5% share in 2024. Regional dominance is supported by a well-developed healthcare infrastructure, high awareness of infection prevention, and strict regulatory enforcement. Rising procedural volumes and strong institutional compliance requirements continue to support stable demand across the region.

Key companies active in the Global Infection Control Supplies Market include Ecolab, 3M, Steris, Getinge, Cardinal Health, Kimberly-Clark Corporation, Henry Schein, Reckitt, Advanced Sterilization Products, Belimed Deutschland GmbH, Steelco, Cantel Medical, Matachana Group, Dentsply Sirona, and Envista Holdings Corporation. Companies operating in the Global Infection Control Supplies Market are strengthening their market position through innovation, portfolio expansion, and strategic partnerships. Manufacturers are investing in advanced product development to improve effectiveness, safety, and ease of use. Expansion of automated and digital-enabled solutions is enhancing efficiency and compliance for healthcare providers. Strategic collaborations with hospitals and distributors help secure long-term supply contracts.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Distribution channel trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surge in healthcare-associated infections (HAIs)

- 3.2.1.2 Rising geriatric population base

- 3.2.1.3 Growing prevalence of chronic diseases

- 3.2.1.4 Increasing public health awareness

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of awareness regarding infection control and prevention

- 3.2.2.2 Insufficient knowledge related to hygienic conditions

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of outpatient and ambulatory care facilities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pricing analysis, 2024

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Disinfectants

- 5.2.1 Product type

- 5.2.1.1 Hand disinfectants

- 5.2.1.2 Surface disinfectants

- 5.2.1.3 Skin disinfectants

- 5.2.1.4 Instrument disinfectants

- 5.2.2 Formulation

- 5.2.2.1 Disinfectant wipes

- 5.2.2.2 Liquid disinfectants

- 5.2.2.3 Disinfectant sprays

- 5.2.3 EPA classification

- 5.2.3.1 Low-level disinfectants

- 5.2.3.2 Intermediate-level disinfectants

- 5.2.3.3 High-level disinfectants

- 5.2.1 Product type

- 5.3 Cleaning accessories

- 5.4 Cleaning and disinfection equipment

- 5.4.1 Ultrasonic cleaners

- 5.4.2 Flusher disinfectors

- 5.4.3 UV-ray disinfectors

- 5.4.4 Washer disinfectors

- 5.5 Disposable safety products

- 5.5.1 Surgical drapes and gowns

- 5.5.2 Face masks

- 5.5.3 Goggles

- 5.5.4 Gloves

- 5.5.5 Covers and closures

- 5.5.6 Others disposable safety products

- 5.6 Other products

Chapter 6 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Wholesalers

- 6.3 Retailers

- 6.4 Pharmacies

- 6.5 E-commerce

- 6.6 Other distribution channels

Chapter 7 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals and clinics

- 7.3 Medical device companies

- 7.4 Pharmaceutical companies

- 7.5 Research laboratories

- 7.6 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3M

- 9.2 Advanced Sterilization Products (ASP)

- 9.3 Belimed Deutschland GmbH (Metal Zug Group)

- 9.4 Cardinal Health

- 9.5 Cantel Medical

- 9.6 Dentsply Sirona

- 9.7 Ecolab

- 9.8 Envista Holdings Corporation

- 9.9 Getinge

- 9.10 Henry Schein

- 9.11 Kimberly-Clark Corporation

- 9.12 Matachana Group

- 9.13 Reckitt

- 9.14 Steelco

- 9.15 Steris