PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913368

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913368

Wireless Fire Detection System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

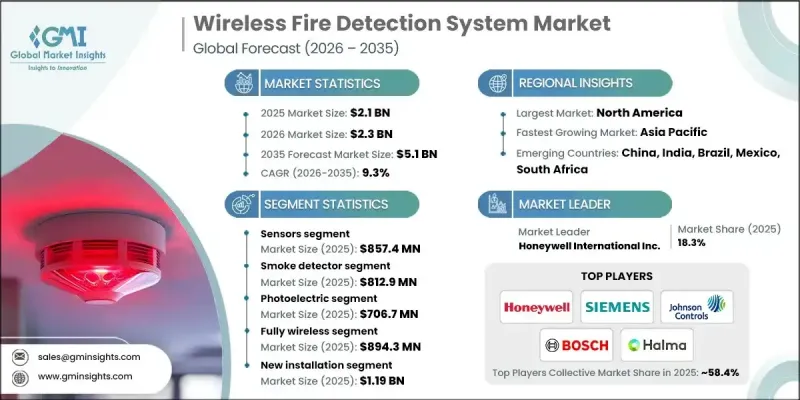

The Global Wireless Fire Detection System Market was valued at USD 2.1 billion in 2025 and is estimated to grow at a CAGR of 9.3% to reach USD 5.1 billion by 2035.

The growth is driven by the rising demand for enhanced fire safety and security across residential, commercial, and industrial spaces. The integration of smart building technologies, IoT-enabled solutions, and wireless communication is enabling real-time monitoring and faster responses to fire emergencies. Wireless fire detection systems eliminate the need for wired infrastructure, offering flexible installation, faster deployment, and efficient fire management across diverse environments. These systems include wireless smoke and heat detectors, control panels, alarm modules, and communication gateways. Their ability to operate effectively in complex layouts, including heritage buildings and large facilities with multiple zones, makes them increasingly preferred over traditional wired systems. With predictive maintenance, automated alerts, and remote monitoring, these solutions enhance operational efficiency while reducing human intervention in fire safety management.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.1 Billion |

| Forecast Value | $5.1 Billion |

| CAGR | 9.3% |

The sensors segment generated USD 857.4 million in 2025. Sensors are vital to any wireless fire detection system, providing real-time alerts for smoke, heat, and fire events. Wireless sensors, including smoke, heat, and multi-sensor detectors, offer installation flexibility, reliability, and suitability for retrofitted or complex building structures.

The photoelectric segment reached USD 706.7 million in 2025. Photoelectric detectors are highly sensitive to smoldering fires, enabling early detection and minimizing false alarms. Their widespread use in residential, commercial, and industrial setups is supported by improved battery life, wireless connectivity, and integration with smart building platforms, enhancing overall fire safety performance.

North America Wireless Fire Detection System Market held 32.3% share in 2025, driven by advanced technological adoption, strong regulatory frameworks, and robust investments in digital safety solutions. The U.S. hosts leading manufacturers and technology innovators, fostering continuous advancements, rapid commercialization of next-generation detectors, and seamless integration with IoT and cloud-based monitoring systems.

Key market participants in the Global Wireless Fire Detection System Market include Siemens AG, Kidde Technologies Inc., Schneider Electric, Honeywell International Inc., Robert Bosch GmbH (Bosch Security Systems), EMS Security Group, EuroFyre Ltd., System Sensor, Gentex Corporation, Securiton AG, Apollo Fire Detectors Ltd., Johnson Controls International plc (Tyco/SimplexGrinnell), Hochiki Corporation, Electro Detectors Ltd., and Halma PLC (Apollo, Advanced, etc.). Companies operating in the Global Wireless Fire Detection System Market are employing several strategies to strengthen their market position. These include developing next-generation detectors with enhanced sensitivity and IoT connectivity, forming strategic alliances with smart building and security solution providers, and expanding distribution networks across residential, commercial, and industrial sectors. They focus on continuous R&D to improve battery life, reduce false alarms, and enhance interoperability with building automation systems.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot

- 2.2 Key market trends

- 2.2.1 Component trends

- 2.2.2 Sensor type trends

- 2.2.3 Type trends

- 2.2.4 Model trends

- 2.2.5 Installation trends

- 2.2.6 Application trends

- 2.2.7 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing adoption of smart buildings and IoT-enabled fire safety systems.

- 3.2.1.2 Stricter government regulations and building safety standards.

- 3.2.1.3 Rising demand for retrofit low-wiring fire detection solutions.

- 3.2.1.4 Advancements in wireless communication, sensors, and AI-based detection.

- 3.2.1.5 Growing fire-safety awareness across residential, commercial, and industrial sectors.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Concerns regarding network reliability and potential signal interference in dense urban areas.

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing Strategies

- 3.10 Emerging Business Models

- 3.11 Compliance Requirements

- 3.12 Sustainability Measures

- 3.13 Consumer Sentiment Analysis

- 3.14 Patent and IP analysis

- 3.15 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2022-2025

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Component, 2022 - 2035 (USD Million)

- 5.1 Key trends

- 5.2 Sensors

- 5.3 Call Points

- 5.4 Fire Alarm Panels

- 5.5 Input/Output Modules

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Sensor Type, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Smoke Detector

- 6.3 Heat Detector

- 6.4 Gas Detector

- 6.5 Multi-sensor Detector

Chapter 7 Market Estimates and Forecast, By Type, 2022 - 2035 (USD Million)

- 7.1 Key trends

- 7.2 Photoelectric

- 7.3 Ionization

- 7.4 Dual Sensor

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Model, 2022 - 2035 (USD Million)

- 8.1 Key trends

- 8.2 Fully Wireless

- 8.3 Hybrid

Chapter 9 Market Estimates and Forecast, By Installation, 2022 - 2035 (USD Million)

- 9.1 Key trends

- 9.2 New Installation

- 9.3 Retrofit

Chapter 10 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Million)

- 10.1 Key trends

- 10.2 Residential

- 10.3 Industrial

- 10.4 Commercial

- 10.4.1 BFSI

- 10.4.2 Education

- 10.4.3 Government

- 10.4.4 Healthcare

- 10.4.5 Hospitality

- 10.4.6 Retail

- 10.4.7 Others

Chapter 11 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Million)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Apollo Fire Detectors Ltd.

- 12.2 Electro Detectors Ltd.

- 12.3 EMS Security Group

- 12.4 EuroFyre Ltd.

- 12.5 Gentex Corporation

- 12.6 Halma PLC (Apollo, Advanced, etc.)

- 12.7 Hochiki Corporation

- 12.8 Honeywell International Inc.

- 12.9 Johnson Controls International plc (Tyco / SimplexGrinnell)

- 12.10 Kidde Technologies Inc.

- 12.11 Robert Bosch GmbH (Bosch Security Systems)

- 12.12 Schneider Electric

- 12.13 Securiton AG

- 12.14 Siemens AG

- 12.15 System Sensor