PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913369

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913369

Stroke Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

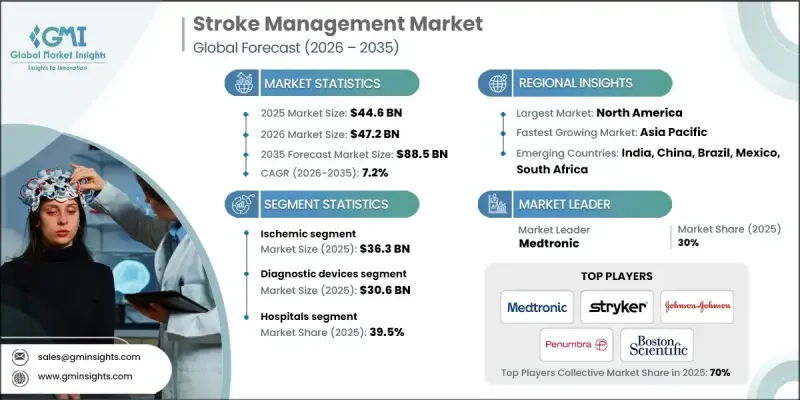

The Global Stroke Management Market was valued at USD 44.6 billion in 2025 and is estimated to grow at a CAGR of 7.2% to reach USD 88.5 billion by 2035.

Market growth is supported by a rising shift toward less invasive treatment approaches, the increasing global incidence of stroke-related conditions, and continuous technological progress across diagnosis, treatment, and post-stroke care. Health systems worldwide are placing stronger emphasis on early detection, faster response times, and coordinated care pathways to reduce long-term disability and mortality. Growing investments in remote care platforms and mobile healthcare delivery models are helping improve access to stroke services in underserved and rural regions. As prevention strategies and timely clinical intervention become higher priorities for public health authorities, demand for advanced solutions and integrated stroke care frameworks continues to increase, creating sustained growth opportunities across the market.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $44.6 Billion |

| Forecast Value | $88.5 Billion |

| CAGR | 7.2% |

The rising global prevalence of cardiovascular conditions remains a major contributor to market expansion. The close relationship between heart-related disorders and stroke risk has intensified the need for advanced stroke care solutions that support rapid diagnosis and timely intervention. Health systems are increasingly prioritizing coordinated disease management approaches to address these overlapping conditions, aiming to improve survival rates and long-term patient outcomes through early intervention and optimized treatment workflows.

The ischemic stroke segment accounted for USD 36.3 billion in 2025 and represented 81.4% share. This segment remains central to stroke management due to the urgent need for immediate diagnosis, fast therapeutic response, and structured rehabilitation pathways. The high time sensitivity associated with this stroke type continues to drive investment in specialized care solutions and advanced clinical infrastructure.

The diagnostic devices segment generated USD 30.6 billion in 2025, reflecting their essential role in identifying stroke type and severity at early stages. Accurate and rapid diagnostics guide clinical decision-making and directly influence treatment effectiveness, making this segment a critical component of the overall stroke management ecosystem.

U.S. Stroke Management Market was valued at USD 37.4 billion in 2025. Market growth is strongly linked to increasing rates of cardiac-related conditions and continued investment in advanced care technologies that enable faster intervention, improved outcomes, and reduced complications.

Key companies active in the Global Stroke Management Market include Medtronic, Siemens Healthineers, Abbott Laboratories, GE HealthCare, Philips Healthcare, Stryker Corporation, Boston Scientific, Penumbra, Johnson & Johnson, Imperative Care, Kaneka Medix Corp, and NeuroVasc Technologies. Companies in the Global Stroke Management Market are strengthening their market position through continuous innovation, strategic collaborations, and expansion of comprehensive care portfolios. Many players are investing heavily in research and development to enhance diagnostic accuracy, treatment efficiency, and post-stroke recovery solutions. Partnerships with healthcare providers and academic institutions are helping accelerate technology adoption and clinical validation. Firms are also expanding geographically to tap into underserved markets while aligning products with evolving regulatory requirements. Integration of digital health platforms and data-driven decision support tools is being prioritized to improve care coordination.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Type trends

- 2.2.3 Product trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing preference for minimally invasive procedures

- 3.2.1.2 Increasing prevalence of stroke and cardiovascular diseases worldwide

- 3.2.1.3 Technological advancement in stroke management

- 3.2.1.4 Rising geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory framework

- 3.2.2.2 High cost of procedures

- 3.2.3 Market opportunities

- 3.2.3.1 Telemedicine and telestroke services

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pricing analysis, 2024

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Ischemic

- 5.3 Hemorrhagic

- 5.4 Transient Ischemic Attack (TIA)

- 5.5 Other types

Chapter 6 Market Estimates and Forecast, By Product, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Diagnostic devices

- 6.2.1 Magnetic Resonance Imaging (MRI)

- 6.2.2 Computed Tomography Scan (CT scan)

- 6.2.3 Electrocardiography

- 6.2.4 Carotid Ultrasound

- 6.2.5 Cerebral Angiography

- 6.2.6 Other

- 6.3 Therapeutic devices

- 6.3.1 Magnetic Resonance Imaging (MRI)

- 6.3.2 Computed Tomography Scan (CT scan)

- 6.3.3 Electrocardiography

- 6.3.4 Carotid Ultrasound

- 6.3.5 Cerebral Angiography

- 6.3.6 Other

Chapter 7 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory Surgery Centers

- 7.4 Diagnostic Centers

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Medtronic

- 9.2 Abbott laboratories

- 9.3 GE HealthCare

- 9.4 Siemens Healthineers

- 9.5 Philips Healthcare

- 9.6 Stryker Corporation

- 9.7 Johnson & Johnson

- 9.8 Penumbra

- 9.9 Boston Scientific

- 9.10 Imperative Care

- 9.11 NeuroVasc Technologies

- 9.12 Kaneka Medix Corp