PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913375

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913375

Carboxymethyl Cellulose Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

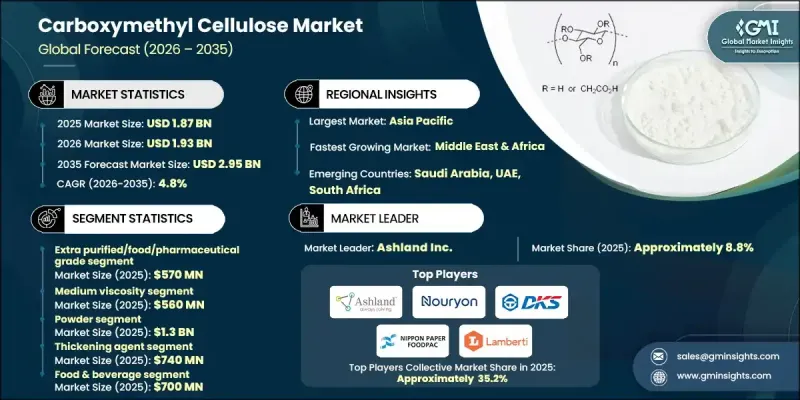

The Global Carboxymethyl Cellulose Market was valued at USD 1.87 billion in 2025 and is estimated to grow at a CAGR of 4.8% to reach USD 2.95 billion by 2035.

Market growth reflects the expanding adoption of carboxymethyl cellulose across multiple end-use industries due to its multifunctional performance characteristics. Demand continues to rise as manufacturers increasingly rely on CMC for viscosity control, stabilization, and binding functions, particularly in food processing, where convenience-oriented consumption patterns are accelerating adoption. Growth is further supported by rising awareness of hygiene, wellness, and product quality, especially across developing regions. In pharmaceutical manufacturing, CMC has become an essential material due to its formulation flexibility and ability to enhance product consistency, stability, and shelf life. As global demand for high-quality medicines continues to rise, the role of CMC in improving drug performance and reliability is becoming more prominent. The market is also benefiting from innovation in specialty grades and expanding industrial applications, positioning CMC as a critical ingredient for manufacturers seeking performance efficiency, regulatory compliance, and long-term product stability.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.87 Billion |

| Forecast Value | $2.95 Billion |

| CAGR | 4.8% |

The extra-purified, food, and pharmaceutical grade segment generated USD 570 million in 2025 and is projected to grow at a CAGR of 5.1% from 2026 to 2035. These high-purity grades are preferred for applications requiring strict quality control and performance precision. Battery-grade CMC is also gaining traction, aligning the market with energy storage and electric mobility trends.

The powder form segment reached USD 1.3 billion in 2025 and is forecast to grow at a CAGR of 4.5% through 2035. Strong demand is driven by ease of handling, storage efficiency, and broad industrial usability.

North America Carboxymethyl Cellulose Market accounted for USD 490 million in 2025 and is expected to witness steady growth. Expansion is supported by rising demand across food manufacturing, pharmaceuticals, personal care, paper processing, and energy-related applications.

Key companies operating in the Global Carboxymethyl Cellulose Market include Nouryon, Ashland Global Holdings, Nippon Paper Industries, Lamberti S.p.A., DKS Co. Ltd, and other established producers. Companies in the Global Carboxymethyl Cellulose Market are strengthening their competitive position through capacity expansion, grade innovation, and targeted application development. Manufacturers are investing in research to enhance purity levels, performance consistency, and functional efficiency. Strategic partnerships with end-use industries support customized product development and long-term supply agreements. Geographic expansion into high-growth regions is improving market penetration and revenue stability. Companies are also focusing on sustainable sourcing, efficient production processes, and regulatory compliance to meet evolving industry standards. Strengthening distribution networks and technical support capabilities further enhances customer engagement and brand reliability.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Grade

- 2.2.3 Viscosity Grade

- 2.2.4 Form

- 2.2.5 Function

- 2.2.6 End Use

- 2.2.7 Distribution Channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Grade, 2022- 2035 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Technical/industrial grade

- 5.3 Semi-purified grade

- 5.4 Purified grade

- 5.5 Extra purified/food/pharmaceutical grade

- 5.6 Battery grade

Chapter 6 Market Estimates and Forecast, By Viscosity Grade, 2022- 2035 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Extra low viscosity

- 6.3 Low viscosity

- 6.4 Medium viscosity

- 6.5 High viscosity

- 6.6 Extra high viscosity

- 6.7 Super high viscosity

Chapter 7 Market Estimates and Forecast, By Form, 2022 - 2035 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Powder

- 7.3 Granular

- 7.4 Liquid/solution

- 7.5 Flake

Chapter 8 Market Estimates and Forecast, By Function, 2022 - 2035 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 Thickening agent

- 8.3 Stabilizer

- 8.4 Binder

- 8.5 Film-former

- 8.6 Water retention agent

- 8.7 Suspending agent

Chapter 9 Market Estimates and Forecast, By End Use, 2022 - 2035 (USD Billion, Kilo Tons)

- 9.1 Key trends

- 9.2 Food & beverage

- 9.3 Pharmaceuticals

- 9.4 Personal care & cosmetics

- 9.5 Oil & gas

- 9.6 Pulp & paper

- 9.7 Detergents & laundry

- 9.8 Battery/energy storage

- 9.9 Textile

- 9.10 3d printing & biomedical

- 9.11 Mining & minerals

- 9.12 Others (construction, paints, adhesives, ceramics)

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Billion, Kilo Tons)

- 10.1 Key trends

- 10.2 Direct sales (B2B industrial)

- 10.3 Indirect sales (distributor/retail)

Chapter 11 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion, Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Rest of Latin America

- 11.6 Middle East & Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

- 11.6.4 Rest of Middle East & Africa

Chapter 12 Company Profiles

- 12.1 Zibo Hailan Chemical Co. Ltd

- 12.2 Ashland Global Holdings

- 12.3 Chongqing Lihong Fine Chemicals

- 12.4 Daicel Corporation

- 12.5 DKS Co. Ltd

- 12.6 PAC & CMC Manufacturing Co.,Ltd.

- 12.7 Nouryon

- 12.8 Lamberti S.p.A.

- 12.9 Nippon Paper Industries

- 12.10 Patel Industries

- 12.11 Pioma Chemicals

- 12.12 Qingdao Tianya Chemical

- 12.13 Mare Austria GmbH

- 12.14 AKKIM