PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913378

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913378

Fluorosilicic Acid Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

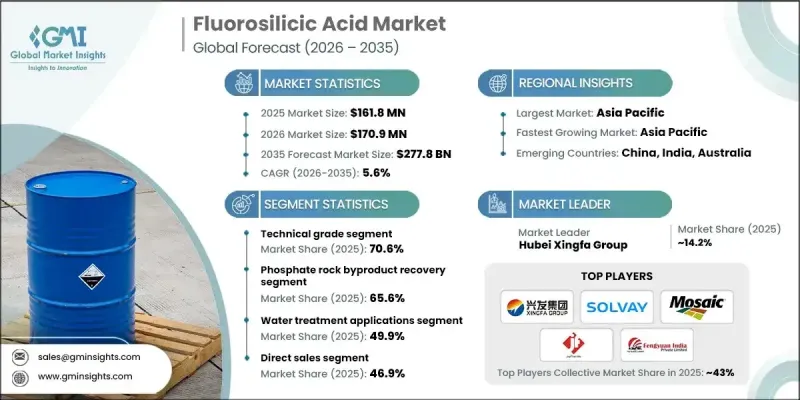

The Global Fluorosilicic Acid Market was valued at USD 161.8 million in 2025 and is estimated to grow at a CAGR of 5.6% to reach USD 277.8 million by 2035.

Fluosilicic acid, chemically identified as H2SiF6, is produced as an aqueous inorganic compound and is commercially supplied in multiple purity levels ranging from technical specifications to highly refined grades suitable for regulated applications. The market continues to advance as demand strengthens across water treatment systems, aluminum-related processing, and high-precision manufacturing industries. Ongoing investments in recovery efficiency, process optimization, and quality assurance are reshaping supply dynamics and supporting long-term demand stability. Producers are actively enhancing production standards while aligning output with stricter application requirements. The market is also evolving through grade differentiation, allowing suppliers to meet specialized performance and compliance needs. This evolution supports stronger pricing structures, deeper customer engagement, and broader adoption across industrial and regulated end-use environments, reinforcing the global relevance of fluorosilicic acid.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $161.8 million |

| Forecast Value | $277.8 million |

| CAGR | 5.6% |

The electronic grade fluorosilicic acid segment will grow at a CAGR of 6.8% from 2026 to 2035. This segment benefits from rising demand for ultra-pure chemical inputs that meet strict compositional and contamination thresholds required in advanced manufacturing environments. Continuous improvements in purification capabilities are enabling suppliers to deliver highly consistent product quality aligned with increasingly stringent technical specifications.

The phosphate rock byproduct recovery segment accounted for 65.6% share in 2025 and is forecast to grow at a CAGR of 5.2% through 2035. This production route maintains dominance due to cost efficiency, integrated processing infrastructure, and effective utilization of recoverable fluorine compounds, transforming byproduct streams into commercially valuable materials while lowering overall operational costs.

U.S. Fluorosilicic Acid Market reached USD 31.9 million in 2025. Market strength in the country is supported by steady demand from water treatment programs, established phosphate processing capacity, and consistent industrial consumption. Strong regulatory oversight and structured quality requirements continue to reinforce demand across multiple application areas.

Key companies active in the Global Fluorosilicic Acid Market include Solvay, American Elements, The Mosaic Company, ICL Group, Honeywell International, Jayfluoride Private Limited, Hydrite Chemical, Simplot Company, Hubei Xingfa Group, Sinograce Chemical, Fengyuan Group, IXOM, Spectrum Chemical, Derivados Del Flour, and SoleChem S.R.L. Companies operating in the Global Fluorosilicic Acid Market are strengthening their competitive position through capacity optimization, grade diversification, and long-term supply agreements. Manufacturers are prioritizing investments in purification technologies to support higher-value product offerings while ensuring regulatory compliance across applications. Strategic focus on consistent quality, process reliability, and customized specifications is helping suppliers secure stable customer relationships. Firms are also enhancing logistics efficiency and regional supply capabilities to reduce delivery risks and improve responsiveness.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Purity grade

- 2.2.2 Production method

- 2.2.3 Application

- 2.2.4 Distribution channel

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By purity grade

- 3.9 Future market trends

- 3.10 Technology and innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent landscape

- 3.12 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Purity Grade, 2022-2035 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 technical grade

- 5.3 reagent grade

- 5.4 electronic grade

- 5.5 food/pharmaceutical grade

Chapter 6 Market Estimates and Forecast, By Production Method, 2022-2035 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Phosphate Rock Byproduct Recovery

- 6.3 Direct Synthesis from Silicon Compounds

- 6.4 Fluorosilicate Salt Decomposition

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2022-2035 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Water treatment applications

- 7.2.1 Municipal water fluoridation

- 7.2.2 Industrial water treatment

- 7.3 Chemical production applications

- 7.3.1 Aluminum fluoride production

- 7.3.2 Hydrogen fluoride production

- 7.3.3 Silicofluorides production

- 7.4 Electronics & semiconductor applications

- 7.4.1 Wafer cleaning

- 7.4.2 Etching

- 7.5 Industrial processing applications

- 7.5.1 Metal surface treatment

- 7.5.2 Glass manufacturing

- 7.5.3 Oil well acidizing

- 7.6 Manufacturing applications

- 7.6.1 Textile processing

- 7.6.2 Construction and masonry hardening

- 7.6.3 Wood preservation

- 7.7 Specialty applications

- 7.7.1 Food and beverage sterilization

- 7.7.2 Ph adjustment

- 7.7.3 Others

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2022-2035 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Chemical distributors & wholesalers

- 8.4 Chemical trading companies

- 8.5 Other channels

Chapter 9 Market Estimates and Forecast, By Region, 2022-2035 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 American Elements

- 10.2 Jayfluoride Private Limited

- 10.3 Honeywell International

- 10.4 Hubei Xingfa Group

- 10.5 Hydrite Chemical

- 10.6 ICL Group

- 10.7 Simplot Company

- 10.8 The Mosaic Company

- 10.9 Sinograce Chemical

- 10.10 Solvay

- 10.11 Fengyuan Group

- 10.12 IXOM

- 10.13 Derivados Del Fluor

- 10.14 Spectrum Chemical

- 10.15 SoleChem S.R.L.