PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913382

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913382

Decentralized Identity Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

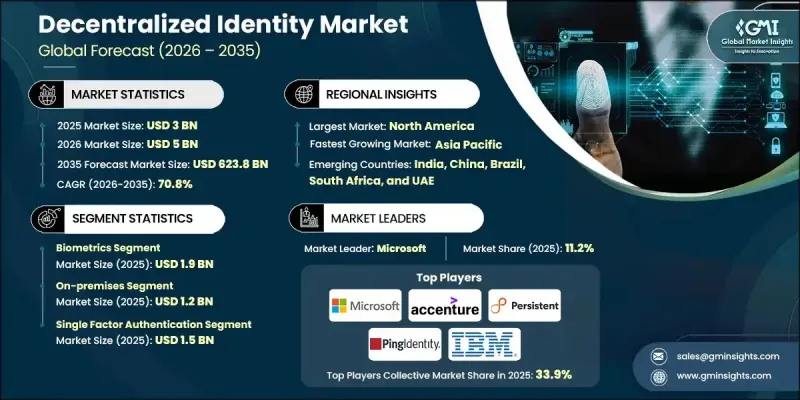

The Global Decentralized Identity Market was valued at USD 3 billion in 2025 and is estimated to grow at a CAGR of 70.8% to reach USD 623.8 billion by 2035.

The rapid growth is driven by the global transition toward digital identity ecosystems that emphasize privacy, security, and user control. Governments and enterprises are increasingly adopting decentralized identity frameworks to support secure digital interactions across public and private platforms. Regulatory requirements related to data protection, identity verification, and compliance are accelerating adoption, while the expansion of digital services continues to increase demand for reliable identity onboarding solutions. Secure digital identity wallets enable reusable and cryptographically verified credentials, reducing repetitive authentication processes and operational friction. These systems also lower compliance costs while preserving user privacy. Regulatory initiatives across multiple regions are reinforcing this momentum, encouraging standardized and interoperable identity infrastructures that support cross-border and cross-sector digital engagement.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $3 Billion |

| Forecast Value | $623.8 Billion |

| CAGR | 70.8% |

The biometrics segment reached USD 1.9 billion in 2025. Rising concerns related to identity misuse and advanced impersonation techniques are driving demand for biometric-based credentials that offer higher assurance levels. Regulated industries are increasingly relying on biometric authentication as a foundational element of decentralized identity systems, supporting secure and tamper-resistant verification processes.

The on-premises deployment model generated USD 1.2 billion in 2025. Organizations with strict data governance and sovereignty requirements favor on-premises decentralized identity platforms to retain full control over sensitive information. These solutions allow customization, seamless integration with existing identity management infrastructures, and enforcement of internal security frameworks.

U.S. Decentralized Identity Market reached USD 924.3 million in 2025 and is expected to grow at a CAGR of 66.7% from 2026 to 2035. Market growth is supported by increasing investment in blockchain-enabled digital wallets and enterprise identity integration initiatives. Public sector frameworks and industry standards are accelerating adoption across multiple regulated sectors, prompting technology providers to invest in advanced cloud-based solutions and collaborative development programs.

Key companies active in the Global Decentralized Identity Market include Microsoft, IBM, Accenture, Ping Identity, 1Kosmos Inc., Civic Technologies, Inc., Evernym Inc., Ontology, Wipro DICE ID, Persistent Systems, Validated ID, SL, Gen Digital Inc., Affinidi, Alchemy Insights, Inc., Datarella GmbH, Dragonchain Inc., Finema Co., Ltd., Nuggets, and Kiva Microfunds, Inc. These organizations continue to shape market evolution through innovation, partnerships, and large-scale deployments. Companies operating in the Global Decentralized Identity Market are strengthening their market position through investments in advanced cryptographic technologies and interoperable identity frameworks. Many players are focusing on biometric integration and verifiable credentials to enhance trust and security. Strategic partnerships with governments, enterprises, and standards bodies are helping expand adoption and ensure regulatory alignment. Firms are also prioritizing scalability through cloud and hybrid deployment models while maintaining data privacy compliance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Identity type trends

- 2.2.2 Component trends

- 2.2.3 Deployment mode trends

- 2.2.4 Authentication method trends

- 2.2.5 Enterprise size trends

- 2.2.6 Industry vertical trends

- 2.2.7 Regional trends

- 2.3 TAM Analysis, 2026-2035 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical Success Factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Government-led digital ID programs

- 3.2.1.2 Rising fraud, data breaches & identity theft costs

- 3.2.1.3 Enterprise need for streamlined & compliant onboarding

- 3.2.1.4 Growth of Web3, tokenized assets & digital wallet ecosystems

- 3.2.1.5 Increased multi-cloud & zero-trust adoption

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Lack of global trust frameworks & legal recognition

- 3.2.2.2 Poor user experience & interoperability gaps

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging Business Models

- 3.9 Compliance Requirements

- 3.10 Sustainability Measures

- 3.11 Consumer Sentiment Analysis

- 3.12 Patent and IP analysis

- 3.13 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive Benchmarking of key Players

- 4.3.1 Financial Performance Comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit Margin

- 4.3.1.3 R&D

- 4.3.2 Product Portfolio Comparison

- 4.3.2.1 Product Range Breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic Presence Comparison

- 4.3.3.1 Global Footprint Analysis

- 4.3.3.2 Service Network Coverage

- 4.3.3.3 Market Penetration by Region

- 4.3.4 Competitive Positioning Matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche Players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial Performance Comparison

- 4.4 Key developments, 2022-2025

- 4.4.1 Mergers and Acquisitions

- 4.4.2 Partnerships and Collaborations

- 4.4.3 Technological Advancements

- 4.4.4 Expansion and Investment Strategies

- 4.4.5 Sustainability Initiatives

- 4.4.6 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Identity Type, 2022-2035 (USD Billion)

- 5.1 Key trends

- 5.2 Biometrics

- 5.3 Non-biometrics

Chapter 6 Market Estimates & Forecast, By Component, 2022-2035 (USD Billion)

- 6.1 Key trends

- 6.2 Solutions/platforms

- 6.2.1 Decentralized identity platforms

- 6.2.2 Identity wallets

- 6.2.3 Verifiable credential management systems

- 6.2.4 Blockchain identity networks

- 6.3 Services

- 6.3.1 Consulting & implementation

- 6.3.2 Integration & interoperability services

- 6.3.3 Managed services

- 6.3.4 Identity governance services

Chapter 7 Market Estimates & Forecast, By Deployment Mode, 2022-2035 (USD Billion)

- 7.1 Key trends

- 7.2 On-premises

- 7.3 Cloud-based

- 7.4 Hybrid

Chapter 8 Market Estimates & Forecast, By Authentication Method, 2022-2035 (USD Billion)

- 8.1 Key trends

- 8.2 Single-factor authentication

- 8.3 Multi-factor authentication

Chapter 9 Market Estimates & Forecast, By Enterprise Size, 2022-2035 (USD Billion)

- 9.1 Key trends

- 9.2 Large enterprises

- 9.3 Small and medium-sized enterprises

Chapter 10 Market Estimates & Forecast, By Industry Vertical, 2022-2035 (USD Billion)

- 10.1 Key trends

- 10.2 BFSI

- 10.3 Retail & eCommerce

- 10.4 IT & telecommunication

- 10.5 Government & public sector

- 10.6 Healthcare

- 10.7 Real estate

- 10.8 Media & entertainment

- 10.9 Others

Chapter 11 Market Estimates & Forecast, By Region, 2022-2035 (USD Billion)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Key Players

- 12.1.1 Accenture

- 12.1.2 Microsoft

- 12.1.3 IBM

- 12.1.4 Gen Digital Inc.

- 12.1.5 Ping Identity

- 12.2 Regional Key Players

- 12.2.1 North America

- 12.2.1.1 1Kosmos Inc.

- 12.2.1.2 Evernym Inc.

- 12.2.1.3 Civic Technologies, Inc.

- 12.2.1.4 Kiva Microfunds, Inc.

- 12.2.2 Europe

- 12.2.2.1 Datarella GmbH

- 12.2.2.2 Validated ID, SL

- 12.2.2.3 Nuggets

- 12.2.3 Asia Pacific

- 12.2.3.1 Finema Co., Ltd.

- 12.2.3.2 Ontology

- 12.2.3.3 Persistent Systems

- 12.2.3.4 Wipro DICE ID

- 12.2.1 North America

- 12.3 Niche / Disruptors

- 12.3.1 Affinidi

- 12.3.2 Alchemy Insights, Inc.

- 12.3.3 Dragonchain Inc.