PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913395

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913395

Traffic Sensors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

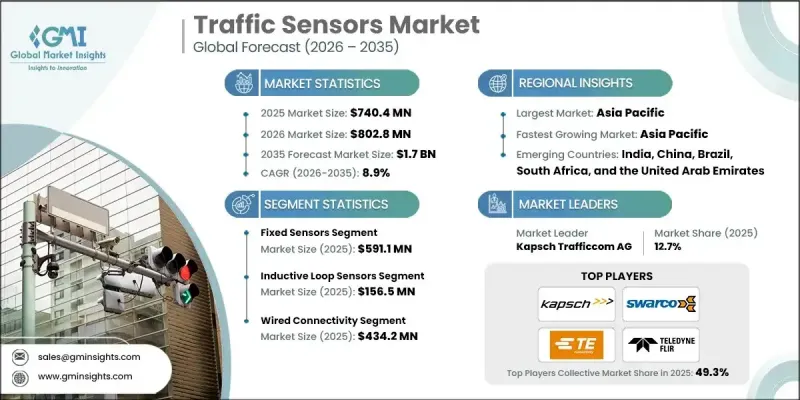

The Global Traffic Sensors Market was valued at USD 740.4 million in 2025 and is estimated to grow at a CAGR of 8.9% to reach USD 1.7 billion by 2035.

Market growth is driven by accelerating adoption of smart city frameworks, increasing need for real-time traffic observation, closer integration with connected and autonomous mobility ecosystems, public-sector focus on intelligent transportation programs, and continuous progress in sensor design and IoT-enabled connectivity. Traffic authorities are increasingly deploying real-time traffic management platforms that rely on continuous data streams from sensors and connected infrastructure to improve traffic flow, limit congestion, and enhance roadway safety. These systems enable faster operational responses, dynamic control of traffic signals, and improved performance across urban and intercity transport networks. Governments are prioritizing intelligent mobility systems that incorporate advanced sensing and monitoring technologies to support safer road usage and better compliance. Integrated traffic intelligence platforms are supporting predictive traffic analysis, coordinated incident response, and more efficient mobility planning, aligning with broader urban transportation and safety objectives.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $740.4 million |

| Forecast Value | $1.7 billion |

| CAGR | 8.9% |

Government agencies are described as intensifying investments in smart transportation networks that embed advanced sensing capabilities to improve operational efficiency and roadway safety. These initiatives focus on real-time traffic visibility, predictive incident detection, and coordinated response mechanisms that collectively support safer and more reliable road infrastructure while advancing urban mobility strategies.

The portable and mobile sensors segment will grow at a CAGR of 11.6% during 2026 to 2035. Growth in this segment is attributed to demand for flexible traffic monitoring solutions that allow rapid deployment and cost-efficient data collection without permanent infrastructure requirements, supporting wider adoption across planning and operational use cases.

The wired connectivity segment generated USD 434.2 million in 2025. Wired sensor systems are described as being widely implemented due to their reliability and capacity to support high-volume data transmission for centralized traffic control systems. Continued investment in fiber-based intelligent transportation infrastructure is supporting adaptive traffic control and improved safety across dense urban corridors.

North America Traffic Sensors Market accounted for 28.7% share in 2025. Regional growth is driven by sustained public investment in smart city development and intelligent transportation programs, led by the United States and Canada. Integration of AI-driven analytics, IoT connectivity, and adaptive traffic control technologies is enhancing real-time traffic operations and emergency management. Governments globally are also pursuing modernization and retrofit initiatives that incorporate non-intrusive sensors and edge-based analytical capabilities.

Key companies operating in the Global Traffic Sensors Market include NXP Semiconductors, Kapsch Trafficcom AG, SWARCO, TE Connectivity, Sensys Networks, Econolite, Microchip Technology Inc., Q-Free ASA, Iteris, Inc., Infineon Technologies AG, Kistler Group, Sick AG, Smart Microwave Sensors GmbH, ST Engineering, International Road Dynamics Inc., Kyosan Electric Mfg. Co., Ltd., and Teledyne FLIR LLC. Companies active in the Traffic Sensors Market are strengthening their market position through continuous technology innovation, system integration, and strategic partnerships. Many players are focusing on enhancing sensor accuracy, durability, and interoperability with smart transportation platforms. Expansion of IoT-enabled and edge analytics solutions is helping deliver faster data processing and improved decision-making. Firms are also investing in scalable architectures to support urban expansion and infrastructure upgrades.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type trends

- 2.2.2 Installation type trends

- 2.2.3 Connectivity trends

- 2.2.4 Application trends

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2026-2035 (USD Million)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing adoption of smart city infrastructure

- 3.2.1.2 Rising demand for real-time traffic management and monitoring

- 3.2.1.3 Integration with autonomous and connected vehicle systems

- 3.2.1.4 Government initiatives for road safety and intelligent transportation

- 3.2.1.5 Advancements in sensor technologies and IoT connectivity

- 3.2.2 Pitfalls and challenges

- 3.2.2.1 High installation and maintenance costs

- 3.2.2.2 Data privacy and security concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging Business Models

- 3.9 Compliance Requirements

- 3.10 Sustainability Initiatives

- 3.11 Supply Chain Resilience

- 3.12 Geopolitical Analysis

- 3.13 Digital Transformation

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Product portfolio comparison

- 4.3.1.1 Product range breadth

- 4.3.1.2 Technology

- 4.3.1.3 Innovation

- 4.3.2 Geographic presence comparison

- 4.3.2.1 Global footprint analysis

- 4.3.2.2 Service network coverage

- 4.3.2.3 Market penetration by region

- 4.3.3 Competitive positioning matrix

- 4.3.3.1 Leaders

- 4.3.3.2 Challengers

- 4.3.3.3 Followers

- 4.3.3.4 Niche players

- 4.3.4 Strategic outlook matrix

- 4.3.1 Product portfolio comparison

- 4.4 Key developments, 2022-2025

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Product Type, 2022 - 2035 (USD Million & Units)

- 5.1 Key trends

- 5.2 Inductive loop sensors

- 5.3 Magnetic sensors

- 5.4 Radar sensors

- 5.5 Infrared sensors

- 5.6 Video/image processing sensors

- 5.7 Laser/LiDAR sensors

- 5.8 Others

Chapter 6 Market Estimates and Forecast, By Installation Type, 2022 - 2035 (USD Million & Units)

- 6.1 Key trends

- 6.2 Fixed sensors

- 6.2.1 Embedded (in-road)

- 6.2.2 Above-ground (pole/gantry mounted)

- 6.3 Portable / mobile sensors

- 6.3.1 Temporary roadside units

- 6.3.2 Vehicle-mounted systems

Chapter 7 Market Estimates and Forecast, By Connectivity, 2022 - 2035 (USD Million & Units)

- 7.1 Key trends

- 7.2 Wired connectivity

- 7.3 Wireless connectivity

- 7.3.1 Cellular (4G/5G)

- 7.3.2 LPWAN (LoRa, NB-IoT)

- 7.3.3 Wi-Fi/BLE

Chapter 8 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Million & Units)

- 8.1 Key trends

- 8.2 Traffic flow & incident monitoring

- 8.3 Electronic toll collection

- 8.4 Vehicle weight enforcement

- 8.5 Vehicle classification & profiling

- 8.6 Access & parking management

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Key Players

- 10.1.1 TE Connectivity

- 10.1.2 Microchip Technology Inc.

- 10.1.3 ST Engineering

- 10.1.4 NXP Semiconductors

- 10.1.5 Infineon Technologies AG

- 10.2 Regional Key Players

- 10.2.1 North America

- 10.2.1.1 Econolite

- 10.2.1.2 International Road Dynamics Inc.

- 10.2.1.3 Iteris, Inc.

- 10.2.1.4 Sensys Networks

- 10.2.1.5 Teledyne FLIR LLC

- 10.2.2 Europe

- 10.2.2.1 Kapsch Trafficcom AG

- 10.2.2.2 Q-Free ASA

- 10.2.2.3 SWARCO

- 10.2.2.4 Smart Microwave Sensors GmbH

- 10.2.2.5 Sick AG

- 10.2.3 Asia Pacific

- 10.2.3.1 Kyosan Electric Mfg. Co., Ltd.

- 10.2.3.2 Kistler Group

- 10.2.1 North America

- 10.3 Niche / Disruptors

- 10.3.1 Iteris, Inc.

- 10.3.2 Sensys Networks