PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913397

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913397

Polytetramethylene Ether Glycol Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

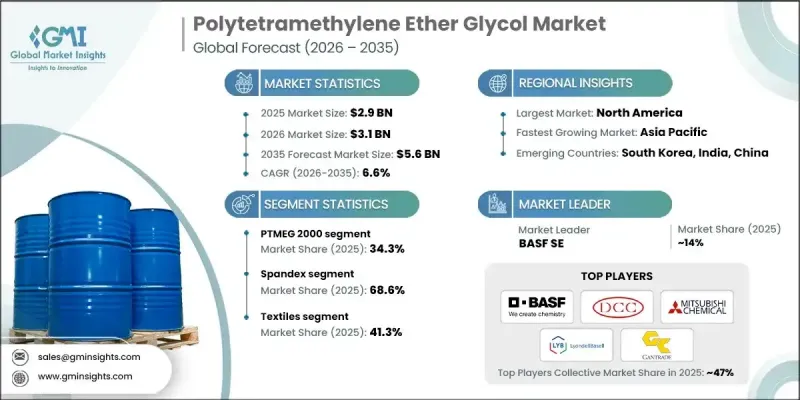

The Global Polytetramethylene Ether Glycol Market was valued at USD 2.9 billion in 2025 and is estimated to grow at a CAGR of 6.6% to reach USD 5.6 billion by 2035.

Market expansion is driven by rising demand for high-performance polymers across textiles, automotive components, and advanced material applications. Polytetramethylene ether glycol, also referred to as polytetrahydrofuran, is recognized for its role as a core building block in elastic fibers, thermoplastic elastomers, and specialty polymers. Availability across a broad range of molecular weights enables its use in applications requiring flexibility, resilience, and mechanical stability. Growth in textile manufacturing, increasing adoption of lightweight materials in automotive production, and ongoing innovation in performance polymers are collectively shaping market dynamics. Producers are investing in modern manufacturing techniques to enhance consistency, purity, and process efficiency, which is supporting wider adoption across demanding end-use industries. At the same time, sustainability considerations are influencing production strategies, with a greater focus on reducing environmental impact, improving resource efficiency, and aligning with circular economy principles. These trends are ensuring continued global demand across both mature and emerging markets.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.9 billion |

| Forecast Value | $5.6 billion |

| CAGR | 6.6% |

The PTMEG 2000 accounted for 34.3% share in 2025 and is expected to grow at a CAGR of 6.6% from 2026 to 2035. This grade maintains a leading position due to its balanced molecular structure, which supports strong elasticity, tensile strength, and processing flexibility. Its performance profile makes it a preferred option for applications requiring durability and consistent mechanical properties.

The spandex segment held 68.6% share in 2025 and is projected to grow at a CAGR of 7% through 2035. Strong growth in demand for stretchable and comfortable apparel is sustaining high consumption of PTMEG-based fibers, supported by its ability to deliver excellent recovery, durability, and aesthetic performance.

United States Polytetramethylene Ether Glycol Market generated USD 397.9 million in 2025. Demand remains strong due to established elastic fiber production, widespread use of thermoplastic polyurethanes, and continuous innovation in technical textiles and performance materials, reinforcing the country's leading regional position.

Key companies operating in the Global Polytetramethylene Ether Glycol Market include BASF SE, Mitsubishi Chemical Corporation, LyondellBasell Industries N.V., Kuraray Co., Ltd., Lanxess AG, Ashland Global Holdings Inc., Dairen Chemical Corporation, Chang Chun Petrochemical, Shanxi Sanwei Group, Korea PTG Co., Ltd., China Petrochemical Corporation, SINOPEC Great Wall Energy, Gantrade Corporation, Brenntag, and IMCD Group. Companies active in the Global Polytetramethylene Ether Glycol Market are strengthening their competitive position through capacity expansion, product differentiation, and technology advancement. Manufacturers are prioritizing process optimization to achieve higher purity levels, consistent molecular weight distribution, and improved production efficiency. Strategic investments in sustainable manufacturing practices and alternative feedstocks are helping align operations with evolving environmental expectations. Firms are also expanding global distribution networks and forming long-term supply agreements with downstream users to secure stable demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product grade

- 2.2.2 Application

- 2.2.3 End use industry

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product grade

- 3.9 Future market trends

- 3.10 Technology and innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent landscape

- 3.12 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Grade, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 PTMEG 250

- 5.3 PTMEG 650

- 5.4 PTMEG 1000

- 5.5 PTMEG 1400

- 5.6 PTMEG 1800

- 5.7 PTMEG 2000

- 5.8 Others

Chapter 6 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Spandex

- 6.3 Thermoplastic urethane elastomer

- 6.4 Co-polyester ether elastomers

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Coatings

- 7.3 Construction

- 7.4 Adhesives & sealants

- 7.5 Textiles

- 7.6 Artificial leather

- 7.7 Automotive

- 7.8 Industrial

- 7.9 Leisure & sports

- 7.10 Others

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 BASF SE

- 9.2 Dairen Chemical Corporation

- 9.3 Mitsubishi Chemical Corporation

- 9.4 LyondellBasell Industries N.V.

- 9.5 Gantrade Corporation

- 9.6 Ashland Global Holdings Inc.

- 9.7 Lanxess AG

- 9.8 Kuraray Co., Ltd.

- 9.9 Chang Chun Petrochemical

- 9.10 Shanxi Sanwei Group

- 9.11 Korea PTG Co., Ltd.

- 9.12 China Petrochemical Corporation

- 9.13 Brenntag

- 9.14 SINOPEC Great Wall Energy

- 9.15 IMCD Group