PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913403

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913403

Reinsurance Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

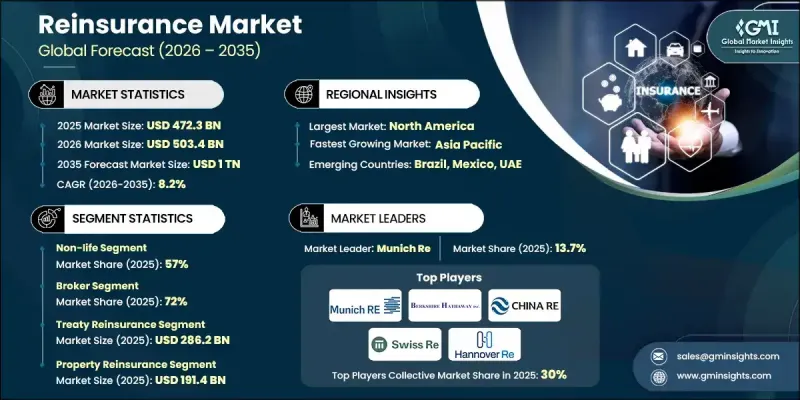

The Global Reinsurance Market was valued at USD 472.3 billion in 2025 and is estimated to grow at a CAGR of 8.2% to reach USD 1 trillion by 2035.

The market's growth is fueled by stronger regulatory enforcement, increasing exposure to catastrophic events, and the rising complexity of risk portfolios across insurance, banking, and corporate sectors. Insurance companies, brokers, and financial institutions are prioritizing risk transfer, capital optimization, and portfolio diversification, making advanced reinsurance solutions critical for mitigating potential losses, enhancing solvency, and ensuring regulatory compliance. Technological innovation, including AI and ML-based risk modeling, predictive analytics, blockchain-enabled risk sharing, and cloud-based portfolio management platforms, is reshaping the industry. These tools provide end-to-end risk visibility, improve claims accuracy, optimize capital allocation, and streamline operations. The rising adoption of digital insurance platforms, parametric insurance, and cross-border reinsurance contracts is driving demand for intelligent, automated, and scalable solutions while strengthening risk management practices and operational resilience.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $472.3 Billion |

| Forecast Value | $1 Trillion |

| CAGR | 8.2% |

The non-life segment held 57% share in 2025 and is expected to grow at a CAGR of 7.6% through 2035. Non-life reinsurance dominates due to its critical coverage of property, casualty, natural catastrophes, liability, and specialty risks. Advanced risk modeling, AI and ML-driven underwriting, catastrophe analytics, and cloud-based portfolio management platforms help insurers and reinsurers efficiently assess, transfer, and manage high-severity risks, offering scalability and operational precision.

The broker segment accounted for 72% share in 2025 and is projected to grow at a CAGR of 7.8% through 2035. Brokers manage high-volume, cross-border risk transfers for major insurers and corporate clients, structuring contracts, negotiating terms, optimizing capital allocation, and ensuring compliance. Their expertise in aligning complex risks with suitable reinsurers makes them the dominant distribution channel for large-scale and specialized reinsurance programs.

U.S. Reinsurance Market held 91% share, generating USD 137.7 billion in 2025. North America's market leadership is supported by a mature insurance ecosystem, established networks of insurers and reinsurers, and strong regulatory oversight. Widespread adoption of AI and ML-based risk analytics, catastrophe modeling platforms, and cloud-enabled portfolio management systems enhances operational efficiency and positions the region as a global leader in reinsurance solutions.

Major players operating in the Global Reinsurance Market include SCOR, Munich Re, Hannover Re, Lloyd's, Swiss Re, Everest Re, Korean Reinsurance, Berkshire Hathaway, Reinsurance Group of America (RGA), and China Reinsurance. Companies in the Global Reinsurance Market strengthen their position by investing heavily in technology-driven solutions such as AI, ML, and blockchain for predictive risk modeling and automated portfolio management. Strategic collaborations with global insurers, brokers, and technology providers enable them to offer scalable and customized reinsurance products. Firms are also focusing on cross-border expansion, adopting parametric insurance, and participating in regulatory initiatives to improve compliance and risk management capabilities.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Type

- 2.2.4 Line of Business

- 2.2.5 Distribution Channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing Regulatory Compliance

- 3.2.1.2 Rising Exposure to Catastrophic Events

- 3.2.1.3 Technological Advancements

- 3.2.1.4 Global Insurance Market Expansion

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Operational Complexity

- 3.2.2.2 Exposure to Extreme Loss Events

- 3.2.3 Market opportunities

- 3.2.3.1 Parametric and digital reinsurance solutions

- 3.2.3.2 Integrated risk management platforms

- 3.2.3.3 Rising demand for reinsurance in emerging markets

- 3.2.3.4 Regulatory modernization in developing regions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 NAIC Reinsurance Regulations (U.S.)

- 3.4.1.2 U.S. State Insurance Departments

- 3.4.1.3 OSFI Reinsurance Guidelines (Canada)

- 3.4.2 Europe

- 3.4.2.1 Germany BaFin Reinsurance Regulations

- 3.4.2.2 France ACPR Reinsurance Standards

- 3.4.2.3 United Kingdom PRA & FCA Reinsurance Rules

- 3.4.2.4 Italy IVASS Reinsurance Compliance

- 3.4.3 Asia Pacific

- 3.4.3.1 China CBIRC Reinsurance Guidelines

- 3.4.3.2 Japan FSA Reinsurance Standards

- 3.4.3.3 South Korea FSC & FSS Reinsurance Compliance

- 3.4.3.4 India IRDAI Reinsurance Regulations

- 3.4.4 Latin America

- 3.4.4.1 Brazil SUSEP Reinsurance Guidelines

- 3.4.4.2 Mexico CNSF Reinsurance Regulations

- 3.4.5 Middle East and Africa

- 3.4.5.1 UAE Central Bank Reinsurance Guidelines

- 3.4.5.2 Saudi Arabia SAMA Reinsurance Regulations

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Use case scenarios

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2022 - 2035 ($ Bn)

- 5.1 Key trends

- 5.2 Life & Health

- 5.2.1 Facultative reinsurance

- 5.2.2 Treaty Reinsurance

- 5.3 Non-Life

- 5.3.1 Facultative reinsurance

- 5.3.2 Treaty Reinsurance

Chapter 6 Market Estimates & Forecast, By Type, 2022 - 2035 ($ Bn)

- 6.1 Key trends

- 6.2 Facultative reinsurance

- 6.3 Treaty reinsurance

Chapter 7 Market Estimates & Forecast, By Line of Business, 2022 - 2035 ($ Bn)

- 7.1 Key trends

- 7.2 Property reinsurance

- 7.2.1 Property Risk Reinsurance

- 7.2.2 Property Catastrophe Reinsurance

- 7.3 Casualty Reinsurance

- 7.3.1 General Liability Reinsurance

- 7.3.2 International Casualty Reinsurance

- 7.3.3 Liability Proportional or XL Reinsurance

- 7.4 Specialty Reinsurance

- 7.4.1 Engineering Reinsurance

- 7.4.2 Agriculture Reinsurance

- 7.4.3 Credit and Surety Reinsurance

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035 ($ Bn)

- 8.1 Key trends

- 8.2 Broker

- 8.3 Direct

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 ($ Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Belgium

- 9.3.7 Netherlands

- 9.3.8 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Singapore

- 9.4.6 South Korea

- 9.4.7 Vietnam

- 9.4.8 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Global Player

- 10.1.1 Berkshire Hathaway Reinsurance

- 10.1.2 China Reinsurance (China Re)

- 10.1.3 Everest Re

- 10.1.4 Hannover Re

- 10.1.5 Lloyd’s of London

- 10.1.6 Munich Re

- 10.1.7 PartnerRe

- 10.1.8 Reinsurance Group of America (RGA)

- 10.1.9 SCOR

- 10.1.10 Swiss Re

- 10.2 Regional Player

- 10.2.1 Africa Re

- 10.2.2 Asia Capital Re

- 10.2.3 CCR Re

- 10.2.4 Fairfax Asia Re

- 10.2.5 GIC Re

- 10.2.6 Korean Re

- 10.2.7 Mapfre Re

- 10.2.8 Saudi Re

- 10.2.9 Tokio Marine Kiln

- 10.2.10 Trust Re

- 10.3 Emerging Players

- 10.3.1 Barents Re

- 10.3.2 Emirates Re

- 10.3.3 Oman Re

- 10.3.4 Peak Re

- 10.3.5 Qatar Re