PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913410

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913410

Non-Alcoholic Beer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

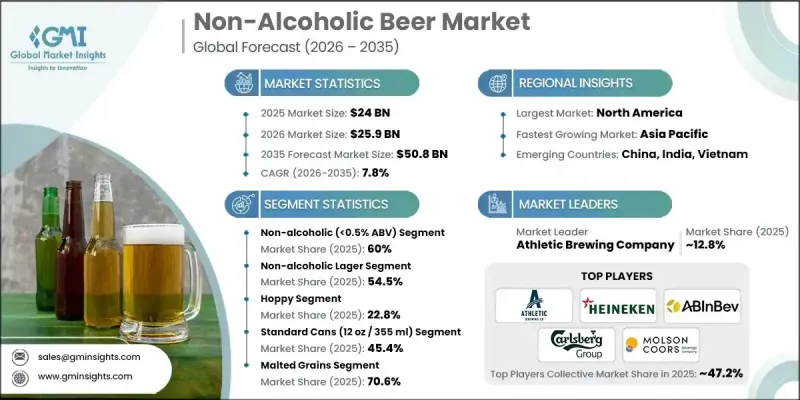

The Global Non-Alcoholic Beer Market was valued at USD 24 billion in 2025 and is estimated to grow at a CAGR of 7.8% to reach USD 50.8 billion by 2035.

Non-alcoholic beer, including alcohol-free (0% ABV), non-alcoholic (0.5% ABV), and low-alcohol (0.5% to 2.5% ABV) varieties, has become a notable segment in the global beverage industry. These beverages cater to health-conscious consumers, designated drivers, and those seeking the authentic taste of beer without alcohol's effects. The market spans multiple beer styles, from lagers and IPAs to wheat beers, stouts, and specialty brews, delivering genuine flavor experiences with minimal or no alcohol. Growth is driven by increasing health awareness, changing lifestyle preferences, and consumer interest in premium, innovative brewing options. Advancements in brewing technology, including vacuum distillation, reverse osmosis, and arrested fermentation, allow producers to improve taste and aroma, enhancing acceptance and reducing historical skepticism around non-alcoholic beers.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $24 Billion |

| Forecast Value | $50.8 Billion |

| CAGR | 7.8% |

The Non-alcoholic (0.5% ABV) segment held a 60% share in 2025 and is expected to grow at a CAGR of 7.6% through 2035. This segment balances authentic beer flavor with minimal alcohol, aligning with legal non-alcoholic standards while delivering a drinking experience closest to traditional beer. Established brewing techniques preserve flavor complexity, mouthfeel, and aroma better than fully alcohol-free alternatives.

The non-alcoholic lager segment accounted for a 54.5% share in 2025 and is forecast to grow at a CAGR of 7.6% through 2035. Its global appeal, clean taste, mild bitterness, and smooth finish make it a preferred choice for new and existing consumers in the non-alcoholic category.

U.S. Non-Alcoholic Beer Market was valued at USD 6.4 billion in 2025. The country leads North America's market due to strong health and wellness awareness, the mainstream adoption of the sober-curious movement, and a vibrant craft brewing culture that embraces innovation. Millennials and Gen Z consumers' emphasis on mindful drinking, premium craft product adoption, and marketing that positions non-alcoholic beer as a lifestyle choice drives sustained demand.

Major players in the Global Non-Alcoholic Beer Market include Athletic Brewing Company, Heineken N.V., Anheuser-Busch InBev, Carlsberg Group, Molson Coors, Clausthaler/Radeberger Group, BrewDog, Partake Brewing, Bravus Brewing Company, Nirvana Brewery, Big Drop Brewing Co., Erdinger Alkoholfrei, WellBeing Brewing, Gruvi, Surreal Brewing Company, Hairless Dog Brewing, Mikkeller, Infinite Session, and Rightside Brewing. Companies in the Non-Alcoholic Beer Market strengthen their position through strategies such as investing in advanced brewing technologies to enhance taste, aroma, and mouthfeel. They expand product portfolios across multiple ABV categories and beer styles to attract diverse consumer segments. Geographic expansion into emerging markets and urban centers helps tap growing health-conscious populations. Marketing campaigns focus on lifestyle branding, emphasizing wellness, mindful drinking, and premium craft experiences. Partnerships with distributors, retailers, and e-commerce platforms ensure wider availability, while collaborations with influencers and event sponsorships increase brand visibility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Alcohol content

- 2.2.2 Beer style

- 2.2.3 Flavor profile

- 2.2.4 Packaging type

- 2.2.5 Material

- 2.2.6 Distribution channel

- 2.2.7 Regional

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By alcohol content

- 3.9 Future market trends

- 3.10 Technology and innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent landscape

- 3.12 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Alcohol Content, 2022-2035 (USD Billion) (Million Liters)

- 5.1 Key trends

- 5.2 Alcohol-free (0% ABV)

- 5.3 Non-alcoholic (<0.5% ABV)

- 5.4 Low alcohol (0.5% to 2.5% ABV)

Chapter 6 Market Estimates and Forecast, By Beer Style, 2022-2035 (USD Billion) (Million Liters)

- 6.1 Key trends

- 6.2 Non-alcoholic lager

- 6.3 Non-alcoholic IPA

- 6.4 Non-alcoholic wheat beer

- 6.5 Non-alcoholic stout & porter

- 6.6 Non-alcoholic light beer

- 6.7 Non-alcoholic golden & blonde ale

- 6.8 Non-alcoholic copper & amber ale

- 6.9 Non-alcoholic sour beer

- 6.10 Non-alcoholic gose

- 6.11 Others

Chapter 7 Market Estimates and Forecast, By Flavor Profile, 2022-2035 (USD Billion) (Million Liters)

- 7.1 Key trends

- 7.2 Citrus

- 7.3 Hoppy

- 7.4 Malt-forward

- 7.5 Pine & resinous

- 7.6 Coffee & roasted

- 7.7 Fruit-forward

- 7.8 Honey

- 7.9 Bread & grain

- 7.10 Others

Chapter 8 Market Estimates and Forecast, By Packaging Type, 2022-2035 (USD Billion) (Million Liters)

- 8.1 Key trends

- 8.2 Standard cans (12 oz / 355 ml)

- 8.3 Tall cans (19.2 oz / 568 ml)

- 8.4 Glass bottles

- 8.5 Kegs & draft

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Material, 2022-2035 (USD Billion) (Million Liters)

- 9.1 Key trends

- 9.2 Malted grains

- 9.3 Hops

- 9.4 Yeasts

- 9.5 Enzymes

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2022-2035 (USD Billion) (Million Liters)

- 10.1 Off-trade (Retail)

- 10.1.1 Supermarkets & Hypermarkets

- 10.1.2 Convenience Stores

- 10.1.3 Specialty Beverage Stores

- 10.1.4 Online Retail / E-Commerce

- 10.1.5 Other

- 10.2 On-trade (HORECA)

- 10.3 Direct-to-consumer

- 10.4 Others

Chapter 11 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Million Liters)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Rest of Latin America

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

- 11.6.4 Rest of Middle East and Africa

Chapter 12 Company Profiles

- 12.1 Athletic Brewing Company

- 12.2 Heineken N.V.

- 12.3 Anheuser-Busch InBev

- 12.4 Carlsberg Group

- 12.5 Molson Coors

- 12.6 Clausthaler / Radeberger Group

- 12.7 BrewDog

- 12.8 Partake Brewing

- 12.9 Bravus Brewing Company

- 12.10 Nirvana Brewery

- 12.11 Big Drop Brewing Co.

- 12.12 Erdinger Alkoholfrei

- 12.13 WellBeing Brewing

- 12.14 Gruvi

- 12.15 Surreal Brewing Company

- 12.16 Hairless Dog Brewing

- 12.17 Mikkeller

- 12.18 Infinite Session

- 12.19 Rightside Brewing