PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913416

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913416

Ethylene-Vinyl Alcohol Copolymer (EVOH) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

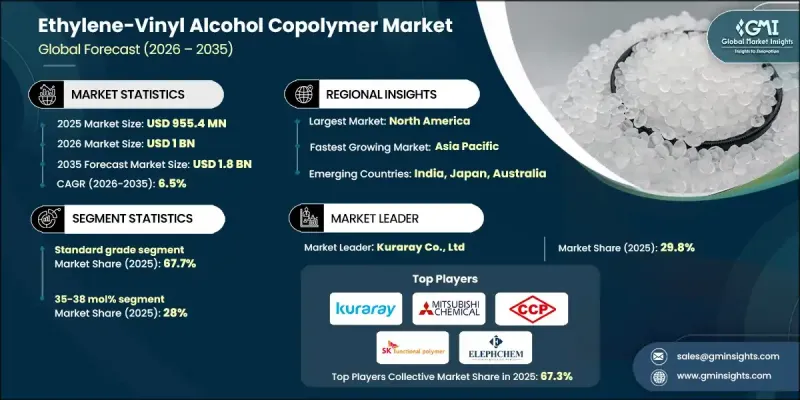

The Global Ethylene-Vinyl Alcohol Copolymer Market was valued at USD 955.4 million in 2025 and is estimated to grow at a CAGR of 6.5% to reach USD 1.8 billion by 2035.

Market growth is supported by rising demand for advanced barrier materials across multiple end-use industries. Ethylene-vinyl alcohol copolymer is widely recognized for its strong resistance to gas transmission, odor migration, and moisture penetration, making it a preferred solution for performance-driven applications. Increasing focus on product safety, preservation, and regulatory compliance has accelerated adoption of high-barrier materials, particularly within packaging value chains. Manufacturers are prioritizing solutions that extend product integrity while supporting waste reduction initiatives. In parallel, environmental compliance requirements are encouraging wider use of materials that help limit emissions and improve containment efficiency in technical applications. Automotive manufacturers are also increasing adoption of EVOH-based components to meet evolving vapor control and sustainability standards. Growing emphasis on material efficiency, combined with innovation in polymer processing, continues to strengthen demand. As industries seek durable, reliable, and regulation-ready materials, EVOH remains well positioned for steady long-term growth across global markets.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $955.4 Million |

| Forecast Value | $1.8 Billion |

| CAGR | 6.5% |

The standard grade EVOH accounted for 67.7% share in 2025 and is expected to grow at a CAGR of 6.2% through 2035. This grade continues to dominate due to its adaptability across multiple industries and its balance between cost efficiency and functional performance. Specialty grades are gaining traction in applications that require enhanced barrier strength, chemical resistance, or thermal stability.

The 35-38 mol% category held 28% share in 2025. This composition range is favored for its optimal balance between processability and barrier effectiveness, supporting consistent performance across packaging, automotive, and healthcare-related uses.

North America Ethylene-Vinyl Alcohol Copolymer Market is forecast to grow at a CAGR of 5.8% between 2026 and 2035. Demand is being driven by increased emphasis on sustainable material solutions, advancements in recycling technologies, and growing investment in circular economy initiatives. Regulatory alignment and government-supported sustainability programs continue to encourage adoption of advanced EVOH formulations.

Key companies operating in the Ethylene-Vinyl Alcohol Copolymer Market include Kuraray Co., Ltd, Mitsubishi Chemical Corporation, Dow Chemical Company, Mitsui Chemicals, Inc., Exxon Mobil Chemical, Mondi Group, Chang Chun Petrochemical Co., Ltd, SK Functional Polymer, Bouling Chemical Co., Limited, and Elephchem. Companies in the Ethylene-Vinyl Alcohol Copolymer (EVOH) Market are strengthening their competitive position through innovation, capacity expansion, and strategic collaboration. Manufacturers are investing in research to enhance barrier performance, recyclability, and material compatibility with sustainable packaging systems. Product portfolio diversification allows suppliers to address a wider range of application requirements. Strategic partnerships with packaging and automotive manufacturers support long-term supply agreements and early adoption of new grades.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Grade

- 2.2.3 Ethylene content

- 2.2.4 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for extended shelf life in food packaging

- 3.2.1.2 Stringent automotive fuel permeation regulations

- 3.2.1.3 Growth in pharmaceutical packaging demand

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High moisture sensitivity of low ethylene EVOH

- 3.2.2.2 Premium pricing vs commodity barrier materials

- 3.2.3 Market opportunities

- 3.2.3.1 Bio-based EVOH market development

- 3.2.3.2 Emerging applications in medical devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By grade

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)(Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Grade, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Standard grade

- 5.3 Specialty grade

Chapter 6 Market Estimates and Forecast, By Ethylene Content, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 <29 mol%

- 6.3 29-35 mol%

- 6.4 35-38 mol%

- 6.5 38-44 mol%

- 6.6 >44 mol%

Chapter 7 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.2.1 Fresh meat & poultry packaging

- 7.2.2 Dairy products

- 7.2.3 Processed foods & ready-to-eat meals

- 7.2.4 Snacks & confectionery

- 7.2.5 Condiments, sauces & dressings

- 7.2.6 Bakery products

- 7.2.7 Others

- 7.3 Pharmaceuticals

- 7.3.1 Blister packs

- 7.3.2 IV bags & infusion solutions

- 7.3.3 Drug pouches & sachets

- 7.3.4 Others

- 7.4 Automotive

- 7.5 Agriculture

- 7.5.1 Silage films

- 7.5.2 Greenhouse films

- 7.5.3 Mulch films

- 7.5.4 Others

- 7.6 Cosmetics & personal care

- 7.6.1 Skincare product packaging

- 7.6.2 Haircare product packaging

- 7.6.3 Fragrance & perfume packaging

- 7.6.4 Others

- 7.7 Construction

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Bouling Chemical Co., Limited

- 9.2 Chang Chun Petrochemical Co., Ltd

- 9.3 Dow Chemical Company

- 9.4 Elephchem

- 9.5 Exxon Mobil Chemical

- 9.6 Kuraray Co., Ltd

- 9.7 Mitsubishi Chemical Corporation

- 9.8 Mitsui Chemicals, Inc.

- 9.9 Mondi Group

- 9.10 SK Functional Polymer