PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913417

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913417

North America Variable Frequency Drives Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

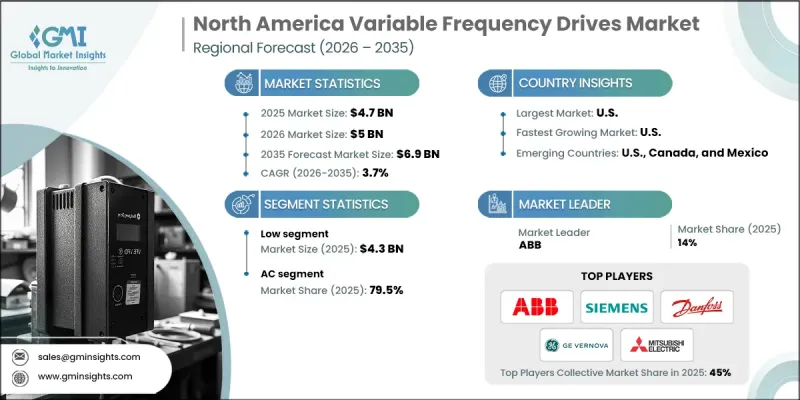

North America Variable Frequency Drives Market was valued at USD 4.7 billion in 2025 and is estimated to grow at a CAGR of 3.7% to reach USD 6.9 billion by 2035.

Market growth is supported by the rising need for efficient motor control solutions across manufacturing, processing, and industrial operations. Industries across the region are increasingly focused on improving productivity, reducing energy consumption, and enhancing operational precision, which is accelerating the adoption of variable frequency drives. The transition toward digitally connected and automated industrial environments, supported by advanced control architectures and intelligent systems, is reshaping demand patterns. Increasing emphasis on sustainability, combined with regulatory pressure to improve energy efficiency and reduce emissions, is further strengthening the market outlook. Ongoing industrial modernization, supported by policy-driven investments in resilient and high-performance infrastructure, continues to drive steady product penetration. Regional initiatives focused on long-term efficiency improvements and operational optimization across industrial facilities are reinforcing adoption trends. As manufacturers seek to balance cost control with performance reliability, variable frequency drives are becoming an integral component within modern industrial systems, supporting consistent growth across North America.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $4.7 Billion |

| Forecast Value | $6.9 Billion |

| CAGR | 3.7% |

The low voltage segment was valued at USD 4.3 billion in 2025 and is expected to grow at a CAGR of 3% through 2035. Growth in this segment is being driven by strong demand for energy-efficient solutions, rising automation levels, and continued advancements in drive technologies. Increased adoption across industrial facilities seeking reliable and economical motor control systems is supporting widespread deployment. Government-led efficiency programs and sustained investment in automation infrastructure are further accelerating segment expansion, as organizations aim to improve performance while minimizing operational expenses.

The DC drives segment is forecast to grow at a CAGR of 2% from 2026 to 2035. This segment is gaining traction due to rising investments in advanced manufacturing technologies and growing demand for systems that offer operational simplicity and efficiency. DC drives are increasingly being utilized across a broad range of industrial applications due to their adaptability, cost advantages, and suitability for demanding operational environments, contributing positively to overall market development.

United States Variable Frequency Drives Market held 72% share in 2025, generating USD 3.4 billion. Strong focus on improving energy efficiency, combined with accelerated adoption of advanced drive technologies to enhance production processes, is shaping favorable market conditions. Increased investment in manufacturing capacity, clean energy initiatives, and regulatory support for automation-driven industrial transformation are further strengthening market dynamics across the country.

Key companies active in the North America Variable Frequency Drives Market include Siemens, ABB, Schneider Electric, Rockwell Automation, Danfoss, Eaton, Emerson Electric, Mitsubishi Electric Corporation, Yaskawa America, GE Vernova, WEG, PARKER HANNIFIN, Nidec Industrial Solutions, Delta Electronics, Johnson Controls, Hitachi Industrial Equipment & Solutions America, Fuji Electric Corp. of America, TMEIC, Anaheim Automation, Inc., TRIOL CORPORATION, and Phase Technologies, LLC. Companies operating in the North America Variable Frequency Drives Market are strengthening their market presence through continuous product innovation and technology upgrades aimed at improving efficiency, reliability, and system integration. Many manufacturers are expanding their solution portfolios to address diverse industrial requirements while emphasizing compliance with energy efficiency standards. Strategic partnerships with industrial clients, system integrators, and automation providers are helping companies secure long-term contracts and expand customer reach. Firms are also investing in regional manufacturing capabilities, service networks, and technical support to enhance responsiveness and customer satisfaction.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.3 Forecast model

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.1.1 Sources, by region

- 1.5.1 Paid Sources

- 1.6 Research Trail & confidence scoring

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.2 Business trends

- 2.3 Voltage trends

- 2.4 Drive trends

- 2.5 Application trends

- 2.6 End-Use trends

- 2.7 Country trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Key factors affecting the value chain

- 3.1.3 Disruptions

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of variable frequency drives

- 3.8 Emerging opportunities & trends

- 3.8.1 Digital transformation with IoT technologies

- 3.8.2 Emerging market penetration

- 3.9 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by country, 2024

- 4.2.1 U.S.

- 4.2.2 Canada

- 4.2.3 Mexico

- 4.3 Strategic initiatives

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Product innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Voltage, 2022 - 2035 (‘000 Units & USD Million)

- 5.1 Key trends

- 5.2 Low

- 5.3 Medium

Chapter 6 Market Size and Forecast, By Drive, 2022 - 2035 (‘000 Units & USD Million)

- 6.1 Key trends

- 6.2 AC

- 6.3 DC

- 6.4 Servo

Chapter 7 Market Size and Forecast, By Application, 2022 - 2035 (‘000 Units & USD Million)

- 7.1 Key trends

- 7.2 Pump

- 7.3 Fan

- 7.4 Conveyor

- 7.5 Compressor

- 7.6 Extruder

- 7.7 Others

Chapter 8 Market Size and Forecast, By End-Use, 2022 - 2035 (‘000 Units & USD Million)

- 8.1 Key trends

- 8.2 Oil & Gas

- 8.3 Power Generation

- 8.4 Mining & Metals

- 8.5 Pulp & Paper

- 8.6 Marine

- 8.7 Others

Chapter 9 Market Size and Forecast, By Country, 2022 - 2035 (‘000 Units & USD Million)

- 9.1 Key trends

- 9.2 U.S.

- 9.3 Canada

- 9.4 Mexico

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Anaheim Automation, Inc.

- 10.3 Danfoss

- 10.4 Delta Electronics

- 10.5 Eaton

- 10.6 Emerson Electric

- 10.7 Fuji Electric Corp. of America

- 10.8 GE Vernova

- 10.9 Hitachi Industrial Equipment & Solutions America

- 10.10 Johnson Controls

- 10.11 Mitsubishi Electric Corporation

- 10.12 Nidec Industrial Solutions

- 10.13 PARKER HANNIFIN

- 10.14 Phase Technologies, LLC

- 10.15 Rockwell Automation

- 10.16 Schneider Electric

- 10.17 Siemens

- 10.18 TMEIC

- 10.19 TRIOL CORPORATION

- 10.20 WEG

- 10.21 Yaskawa America