PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913421

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913421

Polyisobutylene Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

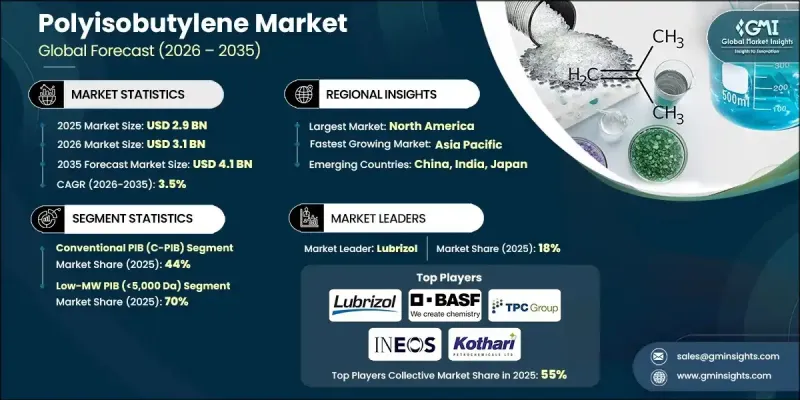

The Global Polyisobutylene Market was valued at USD 2.9 billion in 2025 and is estimated to grow at a CAGR of 3.5% to reach USD 4.1 billion by 2035.

The growth is driven by increasing safety and quality standards in industries such as food contact and personal care, which encourage the adoption of compliant PIB grades. Regulatory approvals, including those by the U.S. FDA, allow PIB in food-contact adhesives and coatings, with specific minimum number-average molecular weight thresholds to ensure safety. Cosmetic and hydrogenated PIB grades provide stability and skin compatibility for emollients and film-forming applications, supporting premium pricing in niche markets. The expansion of infrastructure in emerging regions fuels demand for adhesives, sealants, and glazing solutions, where PIB's tack, flexibility, chemical resistance, and extremely low moisture vapor transmission are highly valued. Additionally, sustainability trends and regulatory tightening are encouraging the development of bio-based PIB and cleaner production processes, while evolving compliance frameworks are directing R&D toward lower-impact catalysts and environmentally friendly feedstocks.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.9 Billion |

| Forecast Value | $4.1 Billion |

| CAGR | 3.5% |

The conventional PIB (C-PIB) segment held 44% share in 2025, owing to its extensive use in adhesives, sealants, industrial oils, chewing gum bases, and coatings. Demand for C-PIB closely follows construction and packaging sectors that rely on its flexibility, tack, and moisture barrier properties. Market prices for C-PIB typically range from USD 0.8-1.5 per kilogram, depending on molecular weight and purity, with major producers such as TPC Group, BASF, and INEOS maintaining strong supply positions.

The high-molecular-weight PIB (>100,000 Da) segment accounted for 10% share in 2025, serving niche applications like chewing gum bases, medical devices, and specialized sealants that require tastelessness, non-toxicity, and high barrier strength. Advances in production processes have increased yields and expanded temperature tolerance, broadening the application spectrum for medical and food-grade uses.

North America Polyisobutylene Market held 33% share in 2025, driven by a concentration of automotive hubs, strong merchant high-reactivity PIB supply, and a robust network of additive formulators. The U.S. remains a key contributor to production capacity, supported by integrated petrochemical complexes and abundant feedstocks, while Canada's automotive and lubricant sectors complement regional supply and downstream applications.

Key players in the Global Polyisobutylene Market include TPC Group, Braskem SA, Lanxess, RB Products, Infineum International Ltd, Kothari Petrochemicals, Janex, ExxonMobil Corporation, Berkshire Hathaway, Lubrizol, Chevron Oronite Company, and Mayzo. To strengthen their presence, companies in the Polyisobutylene Market focus on several strategic approaches. They invest heavily in process optimization and R&D to enhance product quality, expand molecular weight ranges, and develop bio-based and sustainable grades. Strategic collaborations and partnerships allow for technology sharing, faster commercialization, and access to new regional markets. Firms also pursue capacity expansions in key geographies, particularly near high-demand industrial hubs, ensuring reliable supply chains. Additionally, regulatory compliance and certifications are emphasized to support entry into food, cosmetic, and medical applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Molecular weight

- 2.2.3 Grade

- 2.2.4 Application

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Product Type, 2022-2035 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Conventional polyisobutylene (C-PIB)

- 5.3 Highly reactive polyisobutylene (HR-PIB)

Chapter 6 Market Size and Forecast, By Molecular Weight, 2022-2035 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Low molecular weight PIB (Mn < 5,000 Da)

- 6.3 Medium molecular weight PIB (Mn 40,000-100,000 Da)

- 6.4 High molecular weight PIB (Mn > 100,000 Da)

Chapter 7 Market Size and Forecast, By Application, 2022-2035 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Lubricant additives

- 7.3 Fuel additives

- 7.4 Adhesives & sealants

- 7.5 Tires & rubber products

- 7.6 Electrical insulation

- 7.7 Personal care & cosmetics

- 7.8 Food contact applications

- 7.9 Stretch films & packaging

- 7.10 Others

Chapter 8 Market Size and Forecast, By Grade, 2022-2035 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 Food-grade PIB

- 8.3 Cosmetic-grade PIB

- 8.4 Pharmaceutical-grade PIB

- 8.5 Others

Chapter 9 Market Size and Forecast, By Region, 2022-2035 (USD Billion, Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Braskem

- 10.2 RB Products

- 10.3 TPC Group

- 10.4 Lanxess

- 10.5 Infineum International

- 10.6 Kothari Petrochemicals

- 10.7 Janex

- 10.8 ExxonMobil Corporation

- 10.9 Berkshire Hathaway

- 10.10 Lubrizol

- 10.11 Chevron Oronite Company

- 10.12 Mayzo