PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913428

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913428

Structured Cabling Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

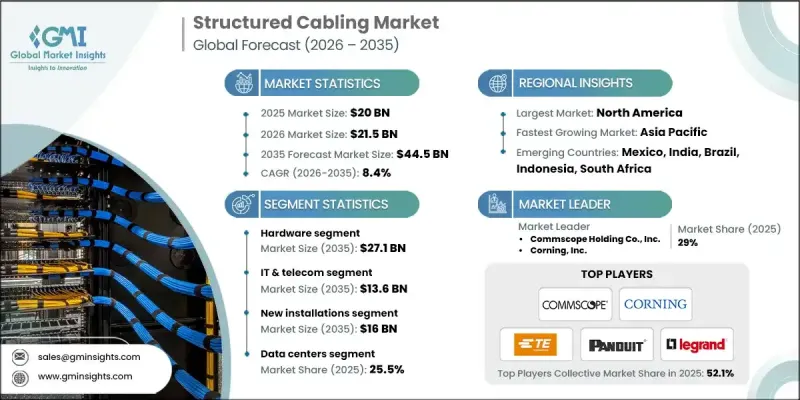

The Global Structured Cabling Market was valued at USD 20 billion in 2025 and is estimated to grow at a CAGR of 8.4% to reach USD 44.5 billion by 2035.

The market is driven by the increasing number of data centers, the adoption of high-speed networks, IoT integration, and the expansion of 5G and edge computing. Rising data traffic and cloud service deployment are creating demand for scalable, high-performance network infrastructure that delivers reliable connectivity across enterprise and industrial environments in emerging markets. Businesses are increasingly implementing unified network systems that integrate voice, video, and data transmission, fueling the adoption of advanced structured cabling. The rise of hybrid work models is pushing organizations to upgrade in-building network infrastructures with robust cabling systems to ensure higher bandwidth, consistent connectivity, and seamless access for distributed teams. Additionally, the growing deployment of Power over Ethernet (PoE) devices is increasing demand for advanced copper cabling capable of supporting higher power delivery for smart devices, security systems, and IoT applications.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $20 Billion |

| Forecast Value | $44.5 Billion |

| CAGR | 8.4% |

The hardware segment is expected to reach USD 27.1 billion by 2035, driven by demand for high-speed switches, connectors, fiber-optic systems, and other advanced cabling components. These solutions are essential to handle growing data traffic, low-latency requirements, and the modernization of enterprise and industrial networks.

The IT and telecom sector is projected to reach USD 13.6 billion by 2035, fueled by cloud adoption, 5G rollouts, and high-bandwidth connectivity demands. Businesses are increasingly seeking low-latency, high-density networks capable of supporting digital transformation initiatives. Manufacturers are focusing on providing solutions that offer future-proof expansion, easy installation, and simplified maintenance while supporting next-generation high-performance networks.

North America Structured Cabling Market accounted for 38.2% share in 2025 and is projected to grow at a CAGR of 7.3% from 2026 to 2035. Growth in this region is driven by automation, Industrial IoT (IIoT), smart factory implementation, and widespread 5G adoption. These technologies enable instant data transmission, predictive maintenance, and enhanced operational efficiency across industrial and manufacturing sectors. The region's focus on advanced wireless and wired network infrastructure continues to support structured cabling investments.

Major players operating in the Global Structured Cabling Market include Cisco Systems, Inc., ABB Ltd., Corning, Inc., Fujitsu, Commscope Holding Co., Inc., Legrand, CA Technologies, General Cable Technologies Corporation, and Anixter International. Key strategies adopted by companies in the structured cabling market include developing high-density, low-latency cabling systems to support enterprise, industrial, and telecom networks, investing in research and development to create future-proof solutions, and offering modular, scalable products to simplify network expansion. Manufacturers are strengthening their market presence through strategic partnerships with data center providers, telecom operators, and cloud service providers to enhance solution reach. Expanding regional footprints, focusing on emerging markets, and providing integrated services, including installation, maintenance, and consulting, further help companies capture new clients.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Component trends

- 2.2.2 Installation type trends

- 2.2.3 Application trends

- 2.2.4 End-use industry trends

- 2.2.5 Regional trends

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of data centers and cloud infrastructure

- 3.2.1.2 Rising adoption of high-speed networks and bandwidth-intensive applications

- 3.2.1.3 Growth of IoT, connected devices, and smart building deployments

- 3.2.1.4 Expansion of 5G infrastructure and edge computing ecosystems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial installation and deployment costs

- 3.2.2.2 Complexity in upgrading legacy cabling infrastructure

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of hyperscale and colocation data centers

- 3.2.3.2 Growing adoption of smart cities and intelligent building systems

- 3.2.3.3 Rising demand for fiber-optic cabling in high-speed networks

- 3.2.3.4 Integration of structured cabling with IoT and Industry 4.0 infrastructure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Patent and IP analysis

- 3.11 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Components, 2022 - 2035 (USD Million)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Cables

- 5.2.1.1 Copper cable

- 5.2.1.1.1 Category 5E (Cat 5E)

- 5.2.1.1.2 Category 6 (Cat 6)

- 5.2.1.1.3 Category 6A (Cat 6A)

- 5.2.1.1.4 Category 7 (Cat 7)

- 5.2.1.1.5 Category 8 (Cat 8)

- 5.2.1.2 Fiber-optic cable

- 5.2.1.2.1 Single-mode

- 5.2.1.2.2 Multi-mode

- 5.2.1.3 Communication outlet system

- 5.2.1.4 Patch cables & cable assemblies

- 5.2.1.5 Patch panels & cross connects

- 5.2.1.6 Racks & cable management

- 5.2.1.1 Copper cable

- 5.2.1 Cables

- 5.3 Software

- 5.4 Service

- 5.4.1 Consulting

- 5.4.2 Installation & deployment

- 5.4.3 Maintenance & support

Chapter 6 Market Estimates and Forecast, By Installation Type, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 New Installations

- 6.3 Upgrades & Maintenance

Chapter 7 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Million)

- 7.1 Key trends

- 7.2 Data Centers

- 7.3 Local Area Networks (LANs)

- 7.4 Telecommunications

- 7.5 Wide Area Networks (WANs)

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2022 - 2035 (USD Million)

- 8.1 Key trends

- 8.2 BFSI

- 8.3 Commercial

- 8.4 Energy

- 8.5 Government

- 8.6 Healthcare

- 8.7 Industrial

- 8.8 IT & telecom

- 8.9 Transportation

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Key Players

- 10.1.1 Commscope Holding Co., Inc.

- 10.1.2 Corning, Inc.

- 10.1.3 TE Connectivity

- 10.1.4 Cisco Systems, Inc.

- 10.2 Regional Key Players

- 10.2.1 North America

- 10.2.1.1 Panduit Corporation

- 10.2.1.2 Anixter International

- 10.2.1.3 General Cable Technologies Corporation

- 10.2.2 Europe

- 10.2.2.1 Legrand

- 10.2.2.2 Nexans S.A.

- 10.2.2.3 Rittal GmbH & Co. KG

- 10.2.3 APAC

- 10.2.3.1 Fujitsu

- 10.2.3.2 CA Technologies

- 10.2.3.3 Reichle & De-Massari AG

- 10.2.1 North America

- 10.3 Niche Players / Disruptors

- 10.3.1 ABB Ltd.

- 10.3.2 The Siemon Company