PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913430

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913430

Smart Card Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

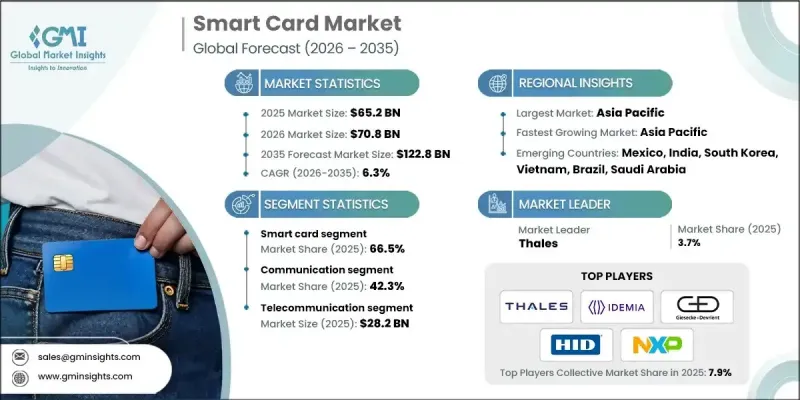

The Global Smart Card Market was valued at USD 65.2 billion in 2025 and is estimated to grow at a CAGR of 6.3% to reach USD 122.8 billion by 2035.

Smart cards have revolutionized payment methods, enabling users to conduct transactions through contactless interfaces instead of traditional magnetic stripe or contract cards. Beyond payments, smart cards have transformed security applications by storing preloaded user data for authentication purposes, helping organizations validate access to buildings, computer systems, and other secured areas. Their use has expanded across healthcare, government, and transportation sectors, providing functionalities such as medical record tracking, electronic passenger lists, and secure identification. In the U.S., contactless transactions have exceeded 17 billion by 2023 and continue to grow as consumers increasingly prefer digital payment methods over cash. The adoption of smart card technology has become critical in sectors where secure access and seamless digital interaction are essential.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $65.2 Billion |

| Forecast Value | $122.8 Billion |

| CAGR | 6.3% |

The smart cards segment held a 66.5% share in 2025. They have become a cornerstone of digital access, with widespread adoption in banking, finance, government, and security applications. Key distribution partners have accelerated growth by offering smart cards for multiple purposes.

The telecommunication segment was valued at USD 28.2 billion in 2025, supported by the rise in smartphone users globally. By late 2025, over 6 billion people were using the internet, indicating the sector's strong influence.

U.S. Smart Card Market reached USD 12.1 billion in 2025. The country leads in smart card adoption, with federal agencies utilizing the technology for credentialing, secure identification, and contactless applications. Smart card implementation in government programs demonstrates the nation's commitment to security and digital transformation.

Prominent companies operating in the Global Smart Card Market include Thales, IDEMIA, Giesecke & Devrient, HID Global, NXP Semiconductors, CPI Card, Infineon Technologies, Eastcompeace, Hengbao, and Watchdata Technologies. To strengthen their presence, companies in the Smart Card Market are focusing on product innovation by developing advanced, multi-functional cards with enhanced security features and contactless capabilities. Strategic collaborations with payment networks, telecommunications providers, and government agencies are being leveraged to expand reach and increase adoption. Firms are also investing in R&D to integrate emerging technologies such as AI and biometrics into smart cards, improving functionality and user experience.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Offering

- 2.2.3 Functionality

- 2.2.4 Application

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for contactless payment solutions

- 3.2.1.2 Government digitalization initiatives and e-governance programs

- 3.2.1.3 Expansion of banking services in emerging markets

- 3.2.1.4 Growing transportation and mobility applications

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Growing competition from mobile payment and digital wallet solutions

- 3.2.2.2 Short card lifecycle and replacement costs

- 3.2.3 Market opportunities

- 3.2.3.1 Development of sustainable and eco-friendly card materials

- 3.2.3.2 Enhanced loyalty programs and multi-application cards

- 3.2.3.3 Growth in telecom and sim card applications

- 3.2.3.4 Smart cities and urban infrastructure development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S. Federal Information Processing Standards (FIPS)

- 3.4.1.2 Canadian Personal Information Protection and Electronic Documents Act

- 3.4.2 Europe

- 3.4.2.1 EU General Data Protection Regulation (GDPR)

- 3.4.2.2 German electronic identity card (eID) regulations

- 3.4.2.3 French carte vitale health insurance smart card standards

- 3.4.2.4 UK biometric residence permit (BRP)

- 3.4.3 Asia Pacific

- 3.4.3.1 China's Resident Identity Card (eID card) law

- 3.4.3.2 Japan My Number card system regulations

- 3.4.3.3 Indian Aadhaar authentication and eKYC regulations

- 3.4.4 Latin America

- 3.4.4.1 Brazil PIX instant payment system security requirements

- 3.4.4.2 Mexican CURP electronic identity card standards

- 3.4.5 Middle East & Africa

- 3.4.5.1 UAE Emirates ID card system regulations

- 3.4.5.2 Saudi Arabian national ID (Absher) smart card framework

- 3.4.5.3 South African smart ID card act 1997

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Sustainability and environmental impact

- 3.10.1 Environmental impact assessment

- 3.10.2 Social impact & community benefits

- 3.10.3 Governance & corporate responsibility

- 3.10.4 Sustainable finance & investment trends

- 3.11 Industry adoption patterns

- 3.11.1 Banking and financial services sector adoption

- 3.11.2 Government and public sector implementation

- 3.11.3 Transportation and mobility sector trends

- 3.11.4 Healthcare sector adoption drivers

- 3.11.5 Telecommunications industry usage patterns

- 3.12 Future outlook & opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Offering, 2022 - 2035 ($Bn, units)

- 5.1 Key trends

- 5.2 Smart Card

- 5.2.1 Interface

- 5.2.1.1 Contact

- 5.2.1.2 Contactless

- 5.2.1.2.1 NFC-enabled

- 5.2.1.2.2 RFID-based

- 5.2.1.3 Dual Interface

- 5.2.2 Chip

- 5.2.3 Memory cards

- 5.2.4 Microprocessor cards

- 5.2.1 Interface

- 5.3 Smart Card Readers

- 5.3.1 Interface

- 5.3.1.1 Contact-based

- 5.3.1.2 Contactless

- 5.3.1.3 Dual Interface

- 5.3.2 Component

- 5.3.2.1 Hardware

- 5.3.2.2 Software

- 5.3.2.3 Services

- 5.3.1 Interface

Chapter 6 Market Estimates & Forecast, By Functionality, 2022 - 2035 ($Bn, units)

- 6.1 Key trends

- 6.2 Transaction

- 6.3 Communication

- 6.4 Security & Access Control

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn, units)

- 7.1 Key trends

- 7.2 BFSI

- 7.3 Telecommunication

- 7.4 Government & healthcare

- 7.5 Retail & ecommerce

- 7.6 Transportation

- 7.7 Media & entertainment

- 7.8 Education & academic institutions

- 7.9 Others

Chapter 8 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 US

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.3.8 Benelux

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Singapore

- 8.4.7 Malaysia

- 8.4.8 Indonesia

- 8.4.9 Vietnam

- 8.4.10 Thailand

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Colombia

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Global companies

- 9.1.1 Thales

- 9.1.2 IDEMIA

- 9.1.3 Giesecke+Devrient

- 9.1.4 NXP Semiconductors

- 9.1.5 Infineon

- 9.1.6 STMicroelectronics

- 9.1.7 CPI Card

- 9.1.8 HID Global

- 9.1.9 Watchdata

- 9.1.10 Eastcompeace

- 9.1.11 Samsung Electronics

- 9.1.12 Valid

- 9.1.13 Ingenico

- 9.1.14 Hengbao

- 9.2 Regional companies

- 9.2.1 Linxens

- 9.2.2 Paragon ID

- 9.2.3 Perfect Plastic Printing

- 9.2.4 Identiv

- 9.2.5 VeriFone

- 9.2.6 SecureID

- 9.2.7 CardLogix

- 9.2.8 Bartronics

- 9.3 Emerging companies

- 9.3.1 Kona I

- 9.3.2 BrilliantTS

- 9.3.3 Goldpac

- 9.3.4 Wuhan Tianyu Information Industry

- 9.3.5 Feitian