PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913435

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913435

In-car Wi-Fi Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

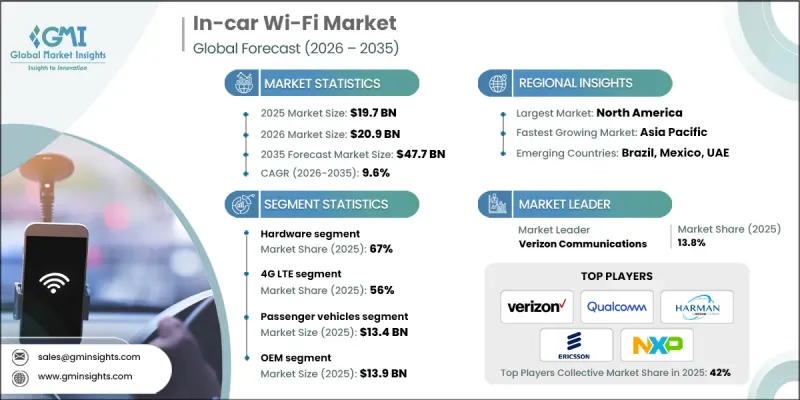

The Global In-car Wi-Fi Market was valued at USD 19.7 billion in 2025 and is estimated to grow at a CAGR of 9.6% to reach USD 47.7 billion by 2035.

Growth is supported by the rising penetration of connected vehicles and increasing consumer expectations for uninterrupted digital access while traveling. Vehicle manufacturers and mobility providers are increasingly embedding wireless connectivity as a standard vehicle capability to improve user comfort, system intelligence, and operational performance. Continuous progress in mobile network infrastructure and vehicle electronics has transformed in-car connectivity into a high-speed, low-latency service that supports multiple users simultaneously. Advanced data processing, cloud integration, and intelligent network management have improved reliability and strengthened data protection. As vehicles become more software-driven, in-car Wi-Fi has evolved into a central platform that supports communication, system monitoring, and remote updates, reinforcing its role as a core element of modern automotive design. Market growth is further supported by the expanding connected mobility ecosystem and the rising integration of advanced vehicle technologies. Increased adoption of shared mobility models and next-generation vehicles has intensified the need for constant connectivity. In-car Wi-Fi enables real-time data exchange that improves navigation accuracy, vehicle oversight, passenger services, and emergency response capabilities, supporting both safety and efficiency across personal and fleet-based transportation.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $19.7 Billion |

| Forecast Value | $47.7 Billion |

| CAGR | 9.6% |

The hardware segment held 67% share in 2025 and is projected to grow at a CAGR of 9.9% from 2026 to 2035. This dominance reflects strong demand for built-in connectivity components integrated during vehicle production. High adoption of advanced communication modules and network equipment has made hardware the foundation of in-car Wi-Fi systems, delivering stable connectivity, fast data transfer, and support for multiple connected users.

The 4G LTE segment accounted for 56% share in 2025 and is anticipated to grow at a CAGR of 9.2% through 2035. Its leadership is driven by broad network availability, proven performance, and cost efficiency. Widespread infrastructure and compatibility with existing vehicle systems have made this technology the preferred choice across a wide range of vehicle categories.

United States In-car Wi-Fi Market held 87% share and generated USD 6.3 billion in 2025. Regional leadership is supported by a well-established automotive ecosystem, advanced digital infrastructure, and early adoption of intelligent connectivity solutions, reinforcing North America's strong position in the global market.

Key companies operating in the Global In-car Wi-Fi Market include Qualcomm, Verizon Communications, Harman International, Ericsson, AT&T, NXP Semiconductors, Broadcom, Berkshire Hathaway, Swiss Re, and Munich Re. Companies in the Global In-car Wi-Fi Market strengthen their competitive position through continuous technology development, strategic collaborations, and long-term agreements with vehicle manufacturers. Firms invest in advanced connectivity solutions that deliver higher speeds, improved reliability, and stronger security. Expanding product portfolios to support both passenger and commercial vehicles helps address the diverse needs of the market. Partnerships with network providers enable broader coverage and service consistency. Companies also focus on scalable platforms that support future upgrades without major hardware changes.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Technology

- 2.2.4 Vehicle

- 2.2.5 Distribution Channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for connected vehicles

- 3.2.1.2 Expansion of 4G/5G networks

- 3.2.1.3 Growth of electric and autonomous vehicles

- 3.2.1.4 Increasing adoption of fleet and mobility services

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation and subscription costs

- 3.2.2.2 Cybersecurity and data privacy concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with 5G, V2X, and smart mobility ecosystems

- 3.2.3.2 Monetization through digital services and subscriptions

- 3.2.3.3 Connected and autonomous vehicle adoption

- 3.2.3.4 IoT and smart mobility applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 NAIC In-car Wi-Fi Regulations (U.S.)

- 3.4.1.2 U.S. State Insurance Departments

- 3.4.1.3 OSFI In-car Wi-Fi Guidelines (Canada)

- 3.4.2 Europe

- 3.4.2.1 Germany BaFin In-car Wi-Fi Rules

- 3.4.2.2 France ACPR In-car Wi-Fi Regulations

- 3.4.2.3 UK PRA & FCA In-car Wi-Fi Guidelines

- 3.4.2.4 Italy IVASS In-car Wi-Fi Standards

- 3.4.3 Asia Pacific

- 3.4.3.1 China CBIRC In-car Wi-Fi Rules

- 3.4.3.2 Japan FSA In-car Wi-Fi Regulations

- 3.4.3.3 South Korea FSC & FSS In-car Wi-Fi Guidelines

- 3.4.3.4 India IRDAI In-car Wi-Fi Standards

- 3.4.4 Latin America

- 3.4.4.1 Brazil SUSEP In-car Wi-Fi Rules

- 3.4.4.2 Mexico CNSF In-car Wi-Fi Guidelines

- 3.4.5 Middle East and Africa

- 3.4.5.1 UAE Central Bank In-car Wi-Fi Guidelines

- 3.4.5.2 Saudi Arabia SAMA In-car Wi-Fi Regulations

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Use case scenarios

- 3.12.1 Fleet Management & Telematics for Commercial Vehicles

- 3.12.2 Over-the-Air (OTA) Updates & Vehicle Diagnostics

- 3.12.3 Premium In-Vehicle Infotainment & Passenger Experience

- 3.12.4 Autonomous Vehicle & ADAS Support

- 3.12.5 Insurance & Risk Management

- 3.13 Cybersecurity, Data Privacy & Compliance Framework

- 3.13.1 Cybersecurity Architecture

- 3.13.2 Data Privacy Compliance

- 3.13.3 Threat Landscape

- 3.13.4 Security-by-Design Principles

- 3.13.5 Data Governance

- 3.13.6 Third-Party Risk Management

- 3.13.7 Security Incident Management

- 3.13.8 Compliance Maturity Models

- 3.13.9 Customer Trust & Brand Impact

- 3.14 Over-the-Air (OTA) Updates: Infrastructure, Deployment & Fleet Management

- 3.14.1 OTA Update Architecture

- 3.14.2 Zero-Touch Provisioning

- 3.14.3 Software Deployment Strategies

- 3.14.4 Fleet-Specific Challenges

- 3.14.5 Connectivity Dependency

- 3.14.6 Update Frequency & Cadence

- 3.14.7 Cost Structure

- 3.14.8 Connected Services Enablement

- 3.14.9 Predictive Maintenance Integration

- 3.14.10 Regulatory Compliance via OTA

- 3.14.11 Fleet Management Platform Integration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2022 - 2035 ($ Bn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Wi-Fi routers

- 5.2.2 Embedded modules

- 5.2.3 OBD-II devices

- 5.2.4 Antennas & receivers

- 5.3 Software & services

- 5.3.1 Connectivity management

- 5.3.2 Cloud-based solutions

- 5.3.3 Infotainment applications

Chapter 6 Market Estimates & Forecast, By Technology, 2022 - 2035 ($ Bn, Units)

- 6.1 Key trends

- 6.2 4G LTE

- 6.3 5G NR

- 6.4 Wi-Fi 6

Chapter 7 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($ Bn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light commercial vehicles (LCV)

- 7.3.2 Medium commercial vehicle (MCV)

- 7.3.3 Heavy commercial vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035 ($ Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 ($ Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Belgium

- 9.3.7 Netherlands

- 9.3.8 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Singapore

- 9.4.6 South Korea

- 9.4.7 Vietnam

- 9.4.8 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Global Player

- 10.1.1 AT&T

- 10.1.2 Berkshire Hathaway

- 10.1.3 Broadcom

- 10.1.4 Ericsson

- 10.1.5 Harman International

- 10.1.6 Munich Re

- 10.1.7 NXP Semiconductors

- 10.1.8 Qualcomm

- 10.1.9 Swiss Re

- 10.1.10 Verizon Communications

- 10.2 Regional Player

- 10.2.1 China Re

- 10.2.2 Hannover Re

- 10.2.3 Lloyd’s

- 10.2.4 MTN

- 10.2.5 PartnerRe

- 10.2.6 Reliance Jio

- 10.2.7 SCOR

- 10.2.8 SoftBank

- 10.2.9 Telefonica

- 10.2.10 Telstra

- 10.3 Emerging Players

- 10.3.1 Autotalks

- 10.3.2 CalAmp

- 10.3.3 Cohda Wireless

- 10.3.4 Icomera

- 10.3.5 Veniam