PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913438

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913438

Dodecanedioic Acid (DDDA) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

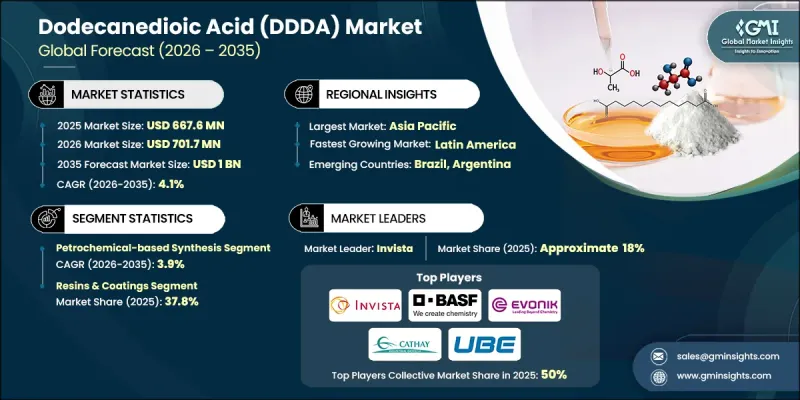

The Global Dodecanedioic Acid (DDDA) Market was valued at USD 667.6 million in 2025 and is estimated to grow at a CAGR of 4.1% to reach USD 1 billion by 2035.

The market growth is driven by rising demand for lightweight, high-performance automotive components that improve fuel efficiency. DDDA serves as a key monomer in nylon612, which is increasingly replacing metals and traditional polymers due to its superior mechanical strength, ductility, thermal stability, and durability under high-friction conditions. With the emphasis on reducing vehicle weight, DDDA-based nylons are also widely used in electric vehicle components to enhance range efficiency. Beyond automotive applications, DDDA-derived esters are gaining traction in synthetic lubricants for industrial applications, offering high oxidative stability, low volatility, and excellent viscosity indices. Regulatory emphasis on volatile organic compound (VOC) limits and biodegradability in Europe and North America has further accelerated the adoption of DDDA-based sustainable materials in coatings, lubricants, and specialty industrial products, positioning the market for steady growth across diverse sectors globally.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $667.6 Million |

| Forecast Value | $1 Billion |

| CAGR | 4.1% |

The petrochemical-based synthesis segment accounted for 63.2% share in 2025 and is projected to grow at a CAGR of 3.9% through 2035. This dominance is attributed to mature, cost-effective, and scalable production processes that utilize industrially available feedstocks such as butadiene, dodecanol, and lauric acid. The established infrastructure, efficient supply chain, and decades of industrial optimization have reinforced the segment's market leadership.

The resins and coatings segment held a 37.8% share in 2025 and is expected to grow at a CAGR of 3.9% from 2026 to 2035. DDDA enhances chemical resistance, flexibility, and cross-link density in coatings, making it ideal for demanding applications, including powder coatings, marine coatings, and automotive OEM finishes.

North America Dodecanedioic Acid (DDDA) Market held a 28.9% share in 2025, showing strong growth potential. The region's adoption is driven by specialty applications in environmentally conscious coatings, bio-based nylons, and high-performance lubricants. Regulatory frameworks emphasizing biodegradability and low VOC levels, along with industrial demand for sustainable materials, have propelled DDDA consumption across various end-use industries.

Key players in the Global Dodecanedioic Acid (DDDA) Market include Evonik Industries AG, BASF SE, Sigma-Aldrich, UBE Corporation, Cathay Biotech Inc., Merck KGaA, Shanghai Sebacic Acid Co., Ltd., TCI Chemicals, Alfa Aesar, Hairui Chemical Industry Co., Ltd., BOC Sciences, Henan Junheng Industrial Group Biotechnology Co., Ltd., Yufeng Biotechnology Co., Ltd., Zibo Guangtong Chemical Co., Ltd., Santa Cruz Biotechnology, Inc., Invista, UBE Industries, Ltd., Shanghai Kaleys Holding Co., Ltd., and SynQuest Labs, Inc. Companies in the Global Dodecanedioic Acid (DDDA) Market are strengthening their presence by investing in advanced R&D to improve process efficiency, product performance, and sustainability. Strategic partnerships with chemical distributors, automotive OEMs, and lubricant manufacturers help expand market reach and product adoption. Firms are focusing on geographic expansion in high-demand regions and leveraging regulatory compliance to promote environmentally friendly DDDA derivatives.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Production method

- 2.2.3 Product form

- 2.2.4 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By Product form

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Production Method, 2022-2035 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Petrochemical-Based Synthesis

- 5.3 Biotechnology-Based (Bio-Based DDDA)

- 5.4 Oxidation of Dodecanol or Lauric Acid

- 5.5 Fermentation using Renewable Feedstocks

Chapter 6 Market Estimates and Forecast, By Product Form, 2022-2035 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Pellets

- 6.3 Powder

- 6.4 Liquid/Solution

Chapter 7 Market Estimates and Forecast, By Application, 2022-2035 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Resins & Coatings

- 7.2.1 Powder Coatings

- 7.2.2 Liquid Coatings

- 7.2.3 UV-Curable Resins

- 7.2.4 Polyesters

- 7.3 Nylon & Polyamides

- 7.3.1 Nylon 612

- 7.3.2 Polyamide 1212

- 7.3.3 Engineering Thermoplastics

- 7.3.4 High-Performance Fibers

- 7.4 Lubricants

- 7.4.1 Synthetic Esters

- 7.4.2 Industrial Gear Oils

- 7.4.3 Compressor Oils

- 7.4.4 Automotive Lubricants

- 7.5 Adhesives

- 7.5.1 Structural Adhesives

- 7.5.2 Hot Melt Adhesives

- 7.5.3 Pressure-Sensitive Adhesives

- 7.6 Antimicrobial Agents

- 7.6.1 Hygiene Products

- 7.6.2 Medical Device Coatings

- 7.6.3 Antibacterial Materials

- 7.7 Corrosion Inhibitors

- 7.7.1 Metal Surface Treatment

- 7.7.2 Marine Applications

- 7.7.3 Oil & Gas Pipelines

- 7.8 Plasticizers

- 7.8.1 Polyvinyl Chloride (PVC) Applications

- 7.8.2 Flexible Plastics

- 7.8.3 Cable & Wire Insulation

- 7.9 Others

- 7.9.1 Water Repellents

- 7.9.2 Textile Finishes

- 7.9.3 Cosmetics / Personal Care Ingredients

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Alfa Aesar

- 9.2 BASF SE

- 9.3 BOC Sciences

- 9.4 Cathay Biotech Inc.

- 9.5 Evonik Industries AG

- 9.6 Hairui Chemical Industry Co., Ltd.

- 9.7 Henan Junheng Industrial Group Biotechnology Co., Ltd.

- 9.8 Invista

- 9.9 Merck KGaA

- 9.10 Santa Cruz Biotechnology, Inc.

- 9.11 Shanghai Kaleys Holding Co., Ltd.

- 9.12 Shanghai Sebacic Acid Co., Ltd.

- 9.13 Sigma-Aldrich

- 9.14 SynQuest Labs, Inc.

- 9.15 TCI Chemicals

- 9.16 UBE Corporation

- 9.17 Yufeng Biotechnology Co., Ltd.

- 9.18 Zhengzhou Yibang Industry & Commerce Co., Ltd.

- 9.19 Zibo Guangtong Chemical Co., Ltd.

- 9.20 Others