PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913441

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913441

Vinyl Acetate Monomer (VAM) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

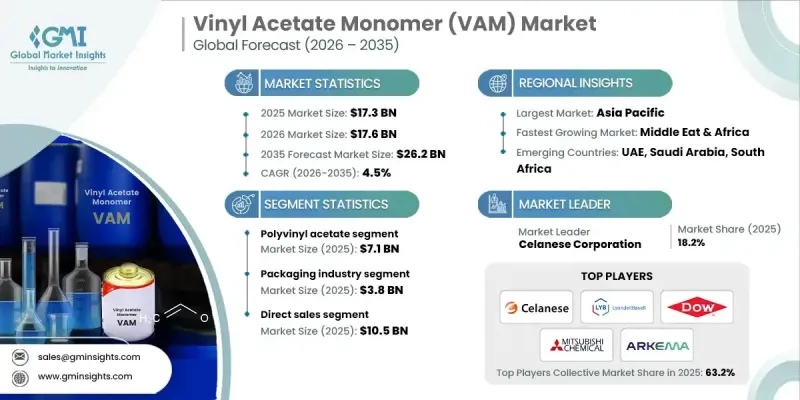

The Global Vinyl Acetate Monomer (VAM) Market was valued at USD 17.3 billion in 2025 and is estimated to grow at a CAGR of 4.5% to reach USD 26.2 billion by 2035.

The market is propelled by the rising demand for high-performance, sustainable packaging solutions and the expanding use of VAM-derived polymers such as polyvinyl acetate, ethylene-vinyl acetate, and polyvinyl alcohol. These polymers are favored in packaging films and flexible laminates due to their excellent bonding, waterproofing, and versatility. The demand is further fueled by increased consumption of consumer goods, industrial packaging, and growth across the construction, automotive, and industrial coatings sectors. Rising urbanization, infrastructure development, and renovation activities are increasing the use of adhesives, sealants, coatings, and composites based on VAM resins. Environmental regulations promoting low-VOC and water-based formulations are shifting some applications from traditional solvent-based materials. Advanced production technologies and optimized manufacturing processes are enhancing efficiency, ensuring supply reliability, and strengthening competitive positions in the global market.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $17.3 Billion |

| Forecast Value | $26.2 Billion |

| CAGR | 4.5% |

The polyvinyl acetate segment generated USD 7.1 billion in 2025, driven by its widespread use in adhesives, paints, coatings, and construction materials. Its superior bonding, easy formulation, and compatibility with water-based applications make it a key ingredient in packaging, woodworking, and paper applications. The growing preference for environmentally friendly, low-VOC adhesives continues to reinforce its importance in the global VAM landscape.

The packaging industry reached USD 3.8 billion in 2025, accounting for the highest consumption of VAM. Polymers such as PVA, PVB, and EVOH, derived from VAM, provide exceptional adhesion, clarity, and barrier properties essential for moisture- and oxygen-resistant packaging. Growth in e-commerce, FMCG distribution networks, and the shift toward lightweight, recyclable packaging materials drives demand in this segment.

North America Vinyl Acetate Monomer (VAM) Market accounted for USD 4.5 billion in 2025. The region holds a 26% share due to its integrated petrochemical infrastructure, abundant supply of feedstocks like ethylene and acetic acid, and a mature downstream market for adhesives, water-based coatings, packaging films, and construction polymers. This strong industrial base ensures consistent high-volume VAM consumption and stable market growth.

Major players operating in the Global Vinyl Acetate Monomer (VAM) Market include Celanese Corporation, LyondellBasell Industries, Dow, Mitsubishi Chemical Corporation, Arkema, Wacker Chemie AG, Henan GP Chemicals Co., Ltd., Suneco Chem, Meru Chem Pvt. Ltd., Tiankai Chemical, Gantrade Corporation, Opes International, Jubilant Ingrevia, and Vinipul Chemicals. Companies in the Vinyl Acetate Monomer (VAM) Market strengthen their foothold by investing heavily in research and development to improve product performance, sustainability, and application versatility. They expand manufacturing capacities and establish integrated production facilities to secure reliable supply chains and reduce costs. Strategic partnerships, collaborations with downstream polymer producers, and geographic market expansion help target high-growth regions. Firms also adopt environmentally compliant production processes and low-VOC formulations to meet regulatory standards and attract eco-conscious clients.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Usage

- 2.2.3 End use industry

- 2.2.4 Distribution

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for waterborne adhesives & coatings

- 3.2.1.2 Expansion of packaging industry

- 3.2.1.3 Shift from solvent-based to water-based formulations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Raw material price volatility

- 3.2.2.2 Stringent VOC emission regulations

- 3.2.3 Market opportunities

- 3.2.3.1 High-barrier EVOH films for food packaging

- 3.2.3.2 Medical-grade EVA for pharmaceutical delivery systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By Usage

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Usage, 2022 - 2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Polyvinyl acetate

- 5.3 Polyvinyl alcohol

- 5.4 Polyvinyl butyral

- 5.5 Ethylene vinyl alcohol

- 5.6 Vinyl chloride-vinyl acetate copolymer

- 5.7 Polyvinyl formal

- 5.8 Others

Chapter 6 Market Estimates and Forecast, By End Use Industry, 2022 - 2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Polyvinyl acetate (PVAc)

- 6.2.1 Emulsion polymers

- 6.2.2 Adhesives

- 6.2.3 Paints & binders

- 6.3 Ethylene vinyl acetate (EVA)

- 6.3.1 Films

- 6.3.2 Foams

- 6.3.3 Hot-melt adhesives

- 6.3.4 Solar encapsulants

- 6.4 Polyvinyl alcohol (PVOH)

- 6.4.1 Fibers

- 6.4.2 Paper coatings

- 6.5 Coatings & paints

- 6.5.1 Architectural coatings

- 6.5.2 Industrial coatings

- 6.6 Textile chemicals

- 6.6.1 Sizing agents

- 6.6.2 Finishing agents

- 6.7 Paper Chemicals

- 6.7.1 Paper binders

- 6.7.2 Laminates

- 6.8 Others

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Direct sales

- 7.3 Distributors

- 7.4 Merchant traders

- 7.5 Online sales

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Celanese Corporation

- 9.2 LyondellBasell Industries

- 9.3 Dow

- 9.4 Mitsubishi Chemical Corporation

- 9.5 Arkema

- 9.6 Wacker Chemie AG

- 9.7 Henan GP Chemicals Co., Ltd.

- 9.8 Suneco Chem

- 9.9 Meru Chem Pvt.Ltd.

- 9.10 Tiankai Chemical

- 9.11 Gantrade Corporation

- 9.12 Opes International

- 9.13 Jubilant Ingrevia

- 9.14 Vinipul Chemicals