PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913444

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913444

Quantum Sensors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

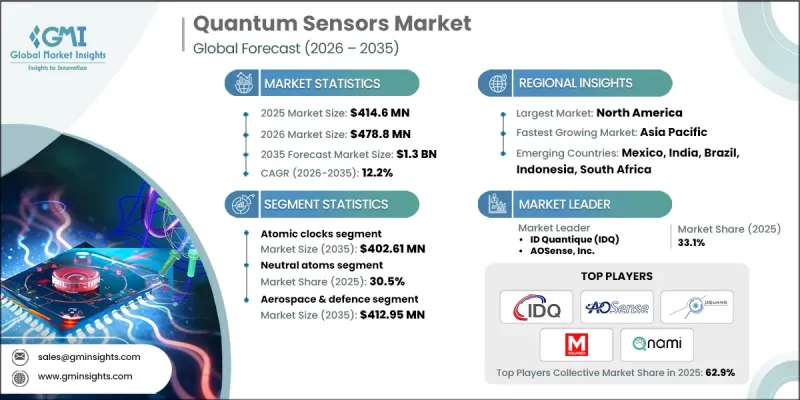

The Global Quantum Sensors Market was valued at USD 414.6 million in 2025 and is estimated to grow at a CAGR of 12.2% to reach USD 1.3 billion by 2035.

Market growth is fueled by the rapid expansion of the automotive sector, the integration of IoT and cloud technologies, increasing demand for precise measurements, and continuous advancements in quantum technologies. Government initiatives and increased funding for research and development are further driving innovation. Breakthroughs in quantum control and sensor sensitivity, supported by investments from research institutions, governments, and private enterprises, are expanding potential applications. Between 2026 and 2032, standardized quantum sensing protocols and secure data acquisition will become critical. Enhanced software, calibration tools, and integration solutions are improving precision and functionality across industrial, medical, and IoT applications, accelerating adoption globally.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $414.6 Million |

| Forecast Value | $1.3 Billion |

| CAGR | 12.2% |

The atomic clocks segment is expected to reach USD 402.61 million by 2035. Its unmatched timing stability is driving strong demand and enabling advancements in navigation, telecommunications, and synchronization systems, with growing adoption in aerospace, defense, and infrastructure monitoring.

The neutral atoms segment accounted for 30.5% share in 2025. Improvements in coherence control and scalable system architectures are boosting the performance of neutral-atom-based sensors, providing high precision for environmental monitoring, field measurements, and navigation. Collaboration between manufacturers and research labs is essential to optimize stability and create field-ready solutions.

North America Quantum Sensors Market accounted for 35.5% share in 2025 and is anticipated to grow at a CAGR of 11.9% from 2026 to 2035. Strong R&D infrastructure, enterprise adoption, and government support are driving the market. The region is expected to remain a hub for industrial applications, precision measurement, and advanced sensor deployment. Partnerships between technology companies and research institutions are accelerating commercialization and bringing innovative solutions to market.

Key players in the Global Quantum Sensors Market include LI-COR, Inc., AOSense Inc., Apogee Instruments, Atomionics, Kipp & Zonen, Campbell Scientific, Inc., and ID Quantique SA. Companies in the Global Quantum Sensors Market are strengthening their position by investing heavily in research and development to improve the sensitivity, stability, and integration of their sensors. Strategic collaborations with research institutions and technology partners enable faster commercialization and enhanced product portfolios. Firms are also focusing on creating field-ready, scalable solutions suitable for industrial, medical, and IoT applications. Expanding into emerging geographic markets, participating in government-funded programs, and offering advanced software and calibration tools further enhance competitiveness.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Type trends

- 2.2.2 Platform trends

- 2.2.3 End-use trends

- 2.2.4 Application trends

- 2.2.5 Regional trends

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand from the automotive industry

- 3.2.1.2 Rapid IoT and cloud computing integration

- 3.2.1.3 Demand for unprecedented precision and sensitivity

- 3.2.1.4 Advancements in quantum technology and research initiatives

- 3.2.1.5 Supportive government initiatives, public-private partnerships and increased R&D funding

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and maintenance cost of quantum sensor

- 3.2.2.2 Limited availability of skilled quantum computing professionals

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with industrial automation and smart manufacturing

- 3.2.3.2 Development of portable and miniaturized quantum sensors

- 3.2.3.3 Increasing use in environmental monitoring and geospatial mapping

- 3.2.3.4 Expansion in defense and aerospace applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Patent and IP analysis

- 3.11 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Type, 2022 - 2035 (USD Million & Units)

- 5.1 Key trends

- 5.2 Atomic clocks

- 5.3 Magnetometers

- 5.4 Gravimeters

- 5.5 Gyroscopes

- 5.6 Acoustic sensors

- 5.7 Interferometers

- 5.8 Quantum imaging

Chapter 6 Market Estimates and Forecast, By Platform, 2022 - 2035 (USD Million & Units)

- 6.1 Key trends

- 6.2 Neutral atoms

- 6.3 Photons

- 6.4 Trapped ions

- 6.5 Nuclear magnetic resonance

- 6.6 Optomechanics

Chapter 7 Market Estimates and Forecast, By End Use, 2022 - 2035 (USD Million & Units)

- 7.1 Key trends

- 7.2 Aerospace & defence

- 7.3 Agriculture & environment

- 7.4 Oil & gas

- 7.5 Transportation

- 7.6 Healthcare

- 7.7 Automation

- 7.8 Construction

- 7.9 Others

Chapter 8 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Million & Units)

- 8.1 Key trends

- 8.2 Environmental monitoring

- 8.3 Medical imaging

- 8.4 Precision measurement

- 8.5 LiDAR

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Key Players

- 10.1.1 ID Quantique SA

- 10.1.2 AOSense Inc.

- 10.1.3 Muquans SAS

- 10.1.4 M Squared Lasers Ltd.

- 10.2 Regional Key Players

- 10.2.1 North America

- 10.2.1.1 Apogee Instruments

- 10.2.1.2 Campbell Scientific, Inc.

- 10.2.1.3 LI-COR, Inc.

- 10.2.2 Europe

- 10.2.2.1 Kipp & Zonen

- 10.2.2.2 Nomad Atomics

- 10.2.2.3 Qnami

- 10.2.3 APAC

- 10.2.3.1 Skye Instruments Ltd

- 10.2.3.2 Solar Light Company, LLC.

- 10.2.1 North America

- 10.3 Niche Players / Disruptors

- 10.3.1 Atomionics