PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913446

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913446

Farnesene Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

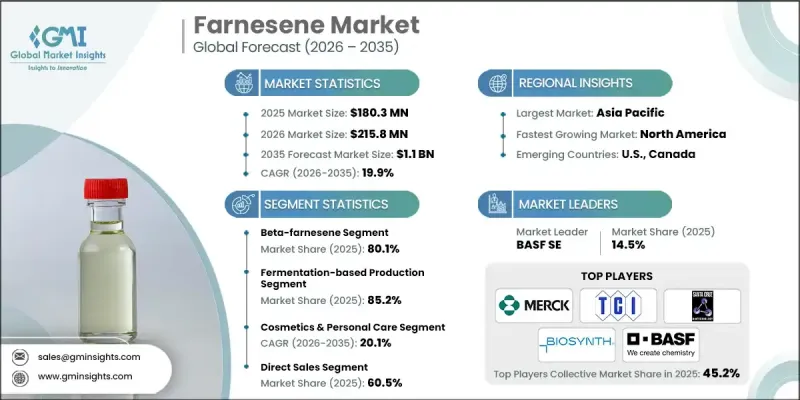

The Global Farnesene Market was valued at USD 180.3 million in 2025 and is estimated to grow at a CAGR of 19.9% to reach USD 1.1 billion by 2035.

The market is experiencing rapid expansion due to rising adoption across a wide range of industries. Farnesene is a naturally occurring sesquiterpene hydrocarbon derived primarily from renewable feedstocks, which aligns strongly with the global shift toward environmentally responsible and sustainable materials. Its growing acceptance is supported by increasing demand for naturally sourced ingredients across industrial value chains. Farnesene plays an essential role as a raw material in fragrance, flavor, and pharmaceutical formulations due to its naturally appealing aromatic profile. Its antioxidant and antimicrobial properties further support its use in personal care and cosmetic formulations by enhancing product stability and functional performance. Rising consumer preference for renewable and biodegradable ingredients continues to support market growth. Farnesene is also gaining momentum as a building block for bio-based alternatives used in industrial formulations, including sustainable materials and cleaning solutions. Expanding pharmaceutical applications for synthesizing therapeutic compounds are further broadening their commercial potential across global markets.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $180.3 Million |

| Forecast Value | $1.1 Billion |

| CAGR | 19.9% |

The beta-farnesene segment accounted for 80.1% share in 2025 and is expected to grow at a CAGR of 20% through 2035. Its strong market position is supported by increasing use in agricultural applications due to its natural origin, biodegradability, and compatibility with sustainable pest management practices. Demand is rising as industries seek bio-based alternatives that reduce reliance on synthetic chemical inputs, while ongoing research continues to expand its use in flavor, fragrance, and energy-related applications.

The fermentation-based production segment held an 85.2% share in 2025 and is projected to grow at a CAGR of 19.9% from 2026 to 2035. This production route is favored for its efficiency and alignment with biotechnology-driven manufacturing, utilizing renewable feedstocks to produce high-purity farnesene suitable for premium applications. The process supports reduced fossil fuel dependence and meets demand for natural-grade ingredients across multiple end-use industries.

North America Farnesene Market held a 27.2% share in 2025. Regional expansion is driven by increasing adoption of sustainable ingredients across personal care and industrial applications, supported by regulatory pressure and consumer demand for environmentally responsible products. Advanced research capabilities and innovation across bio-based chemical manufacturing further contribute to market development.

Key players operating in the Global Farnesene Market include BASF SE, Merck (Sigma-Aldrich), TCI (Tokyo Chemical Industry), Alfa Chemistry, Paraiso Bioenergia, Biosynth, Santa Cruz Biotechnology, LGC Limited, Glentham Life Sciences, Clearsynth, BOC Sciences, and Sigma-aligned specialty chemical suppliers. Companies operating in the Global Farnesene Market are strengthening their market positions by investing in bio-based production technologies and expanding fermentation capacities to ensure scalability and cost efficiency. Strategic collaborations with biotechnology firms and research institutions are helping accelerate product development and application diversification. Many players are prioritizing sustainability-focused branding and regulatory compliance to align with evolving consumer expectations. Geographic expansion into high-growth regions, along with portfolio diversification across industrial, personal care, and pharmaceutical applications, remains a key focus.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Production method

- 2.2.4 Application

- 2.2.5 Distribution channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022-2035 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Alpha-farnesene

- 5.3 Beta-farnesene

Chapter 6 Market Estimates and Forecast, By Production Method, 2022-2035 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Fermentation-based production

- 6.3 Natural extraction

- 6.4 Chemical synthesis

Chapter 7 Market Estimates and Forecast, By Application, 2022-2035 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Cosmetics & personal care

- 7.2.1 Skincare applications

- 7.2.2 Haircare applications

- 7.2.3 Color cosmetics

- 7.3 Fuel applications

- 7.3.1 Aviation fuel

- 7.3.2 Diesel & marine fuel

- 7.4 Lubricants & functional fluids

- 7.5 Flavors & fragrances

- 7.5.1 Natural flavoring agent

- 7.5.2 Lime flavor & citrus applications

- 7.5.3 Fragrance additive applications

- 7.6 Solvents & industrial cleaners

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2022-2035 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Distributors & wholesalers

- 8.4 Online platforms

Chapter 9 Market Estimates and Forecast, By Region, 2022-2035 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Alfa Chemistry

- 10.2 BASF SE

- 10.3 Biosynth

- 10.4 BOC Sciences

- 10.5 Clearsynth

- 10.6 Glentham Life Sciences

- 10.7 LGC Limited

- 10.8 Merck (Sigma-Aldrich)

- 10.9 Paraiso Bioenergia

- 10.10 Santa Cruz Biotechnology

- 10.11 TCI (Tokyo Chemical Industry)