PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913448

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913448

Pressure Coffee Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

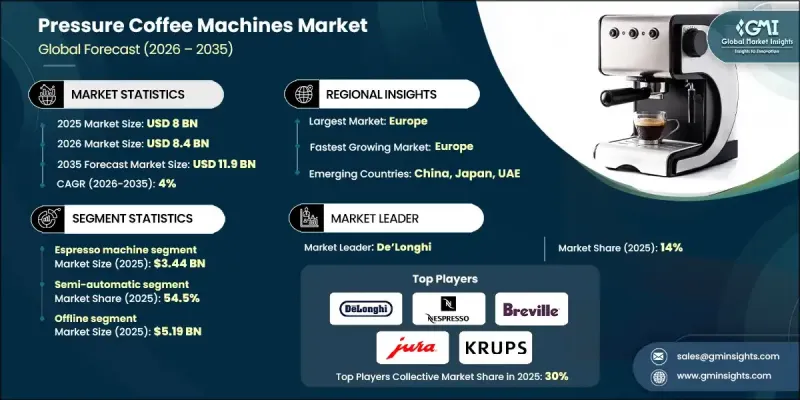

The Global Pressure Coffee Machines Market was valued at USD 8 billion in 2025 and is estimated to grow at a CAGR of 4% to reach USD 11.9 billion by 2035.

Rising global coffee consumption continues to support market development, driven by evolving lifestyles, increasing urban populations, and a growing appreciation for high-quality coffee. Consumers are becoming more selective about taste, preparation methods, and bean sourcing, which is elevating demand for premium brewing solutions. Coffee has become an integral part of daily routines, particularly among younger demographics, who associate it with social interaction and personal expression. This shift has increased spending on advanced brewing equipment that delivers consistent quality. The expanding cafe culture and wider presence of international coffee brands have further shaped expectations around convenience and beverage quality. As a result, consumers are increasingly investing in pressure-based coffee machines to recreate professional-grade coffee experiences at home and in commercial environments, reinforcing long-term market stability.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $8 Billion |

| Forecast Value | $11.9 Billion |

| CAGR | 4% |

The espresso machines segment generated USD 3.44 billion in 2025, reflecting its strong position within the overall market. These machines are widely used across residential and commercial settings due to their ability to produce concentrated coffee using pressurized extraction. Ongoing demand for specialty beverages continues to support adoption, while technological advancements have improved usability and consistency, broadening their appeal among both experienced users and new buyers.

The semi-automatic category accounted for 54.5% share in 2025. These machines remain popular because they balance user control with operational support. Users can influence key brewing variables while relying on the machine to manage pressure and temperature stability. This flexibility allows for customization without the complexity associated with fully manual systems, making semi-automatic models accessible and versatile.

U.S. Pressure Coffee Machines Market held 68% share and generated USD 1.52 billion in 2025. Strong domestic coffee culture and rising interest in premium home brewing solutions continue to drive demand. Consumers increasingly favor machines that offer convenience, personalization, and technological refinement, positioning pressure coffee machines as a core category across residential and professional settings.

Key companies operating in the Global Pressure Coffee Machines Market include De'Longhi, Breville, Bosch, Nespresso, Jura, Miele, Gaggia, Krups, Lavazza, SMEG S.p.A., BLACK+DECKER, Russell Hobbs, AGARO, ECM, and Continental. These brands remain competitive through product innovation, design differentiation, and global distribution strength. Companies in the Global Pressure Coffee Machines Market are strengthening their market position by focusing on innovation, product differentiation, and brand positioning. Manufacturers are investing in advanced engineering to improve consistency, durability, and ease of use while catering to both entry-level and premium segments. Design aesthetics and compact form factors are being emphasized to align with modern living spaces. Firms are also expanding their global retail and online presence to improve accessibility and brand visibility. Strategic collaborations with coffee brands and service providers help enhance product credibility.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Operation

- 2.2.4 Pressure range

- 2.2.5 Installation

- 2.2.6 End use

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising coffee consumption

- 3.2.1.2 Home-brewing culture

- 3.2.1.3 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High acquisition & maintenance costs

- 3.2.2.2 Counterfeit product risks

- 3.2.3 Opportunities

- 3.2.3.1 Smart & connected systems

- 3.2.3.2 Energy efficiency & sustainability credentials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By Region

- 3.6.2 By Type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2022 - 2035 (USD Billion)

- 5.1 Key trends

- 5.2 Espresso machine

- 5.3 Pump coffee machine

- 5.4 Drip coffee machine

- 5.5 Pour-over coffee machine

- 5.6 Others (French press)

Chapter 6 Market Estimates and Forecast, By Operation, 2022 - 2035 (USD Billion)

- 6.1 Key trends

- 6.2 Semi-automatic

- 6.3 Fully automatic

Chapter 7 Market Estimates and Forecast, By Pressure Range, 2022 - 2035 (USD Billion)

- 7.1 Key trends

- 7.2 Up to 5 bars

- 7.3 5 to 10 bars

- 7.4 10 to 15 bars

- 7.5 Above 15 bars

Chapter 8 Market Estimates and Forecast, By Installation, 2022 - 2035 (USD Billion)

- 8.1 Key trends

- 8.2 Freestanding

- 8.3 Built-in

Chapter 9 Market Estimates and Forecast, By End Use, 2022 - 2035 (USD Billion)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

- 9.3.1 Office/Corporate

- 9.3.2 Cafes/Restaurants

- 9.3.3 Hotels

- 9.3.4 Hospitals

- 9.3.5 Others (institutions, conference venues)

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Billion)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 AGARO

- 12.2 BLACK+DECKER

- 12.3 Bosch

- 12.4 Breville

- 12.5 Continental

- 12.6 De’Longhi

- 12.7 ECM

- 12.8 Gaggia

- 12.9 Jura

- 12.10 Krups

- 12.11 Lavazza

- 12.12 Miele

- 12.13 Nespresso

- 12.14 Russell Hobbs

- 12.15 SMEG S.p.A.