PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913450

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913450

Autonomous Farm Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

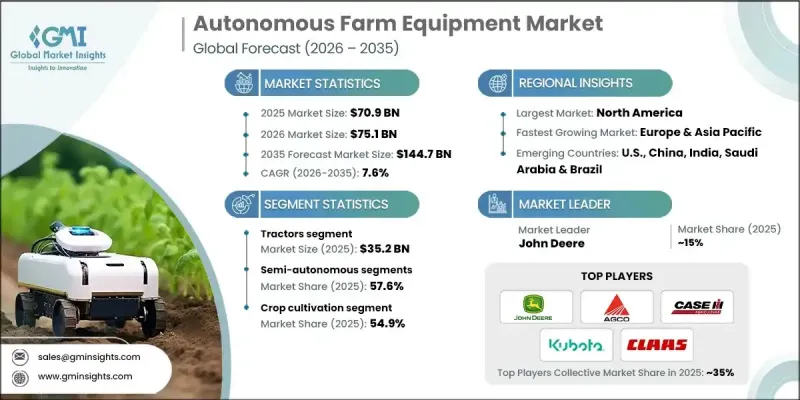

The Global Autonomous Farm Equipment Market was valued at USD 70.9 billion in 2025 and is estimated to grow at a CAGR of 7.6% to reach USD 144.7 billion by 2035.

Growth in this sector is fueled by the increasing adoption of precision farming techniques. These methods allow farmers to optimize input use, minimize resource wastage, and maximize crop output. Autonomous machines such as tractors, harvesters, and drones enable farmers to apply inputs at the most effective times, improving profitability while reducing environmental impact. The convergence of AI, IoT, robotics, and machine vision is revolutionizing agriculture, enabling sophisticated operations like crop monitoring, soil assessment, and automated harvesting with minimal human intervention. Advanced communication networks, including 5G and cloud platforms, allow real-time monitoring and remote operation, further enhancing efficiency and adoption.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $70.9 Billion |

| Forecast Value | $144.7 Billion |

| CAGR | 7.6% |

The tractors segment accounted for USD 35.2 billion in 2025 and is expected to grow at a CAGR of 7.4% from 2026 to 2035. They remain critical for essential farm operations, and the integration of AI, GPS navigation, and IoT connectivity has transformed them into highly efficient, semi- or fully-autonomous machines. Labor shortages and rising operational costs drive demand, as these tractors reduce reliance on manual work while boosting precision and productivity.

The semi-autonomous equipment segment held a 57.6% share and is projected to grow at a CAGR of 7.1% from 2026 to 2035. This equipment offers a balance between automation and human oversight, providing features like auto-steering and precision controls while allowing farmers to retain operational flexibility. This hybrid approach addresses concerns over investment costs and technical complexity, enabling smoother adoption of automated systems and improving efficiency for repetitive tasks.

U.S. Autonomous Farm Equipment Market was valued at USD 18.5 billion in 2025 and is forecasted to grow at a CAGR of 8.5% from 2026 to 2035. Large-scale farms and a technologically advanced agricultural sector drive the adoption of autonomous solutions. Substantial investments in AI, robotics, and IoT by both established manufacturers and startups accelerate deployment. Government incentives for smart farming technologies and sustainable practices further stimulate market expansion.

Key players in the Global Autonomous Farm Equipment Market include Case IH, John Deere, Kinze Manufacturing, Kubota Corporation, AGCO Corporation, Claas, Dot Technology Corp, DroneDeploy, Precision Planting, New Holland Agriculture, Fendt, Harvest Automation, Autonomous Solutions Inc., and Agrobot. Companies in the Autonomous Farm Equipment Market are focusing on multiple strategies to strengthen their foothold. They are investing heavily in research and development to enhance the capabilities of autonomous machines, including AI-driven navigation and advanced sensor integration. Strategic partnerships and collaborations with tech startups and agri-tech firms help expand product portfolios and enter new markets. Firms are also emphasizing after-sales services, training, and support programs to boost customer adoption.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Technology

- 2.2.4 Operation

- 2.2.5 Power output

- 2.2.6 Application

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing adoption of precision agriculture

- 3.2.1.2 Technological advancements

- 3.2.1.3 Government initiatives and subsidies

- 3.2.1.4 Labor shortages and rising costs

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and cost barriers

- 3.2.2.2 Connectivity and infrastructure limitations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product, 2022 - 2035, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Tractor

- 5.3 Harvesters

- 5.4 Planters

- 5.5 Sprayers

- 5.6 UAVs

- 5.7 Others (cultivators, irrigation equipment)

Chapter 6 Market Estimates & Forecast, By Technology, 2022 - 2035, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Guidance & navigation systems

- 6.3 Sensor technologies

- 6.4 Artificial intelligence & machine learning

- 6.5 Robotics & automation

- 6.6 Connectivity and communication systems

Chapter 7 Market Estimates & Forecast, By Operation, 2022 - 2035, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Fully autonomous

- 7.3 Semi-autonomous

Chapter 8 Market Estimates & Forecast, By Power Output, 2022 - 2035, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Below 30 HP

- 8.3 31-100 HP

- 8.4 Above 100 HP

Chapter 9 Market Estimates & Forecast, By Application, 2022 - 2035, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Crop cultivation

- 9.3 Horticulture & nursery

- 9.4 Dairy & livestock management

- 9.5 Forestry & timber management

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.4.6 Indonesia

- 11.4.7 Malaysia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 AGCO Corporation

- 12.2 Agrobot

- 12.3 Autonomous Solutions Inc.

- 12.4 Case IH

- 12.5 Claas

- 12.6 Dot Technology Corp

- 12.7 DroneDeploy

- 12.8 Fendt

- 12.9 Harvest Automation

- 12.10 John Deere

- 12.11 Kinze Manufacturing

- 12.12 Kubota Corporation

- 12.13 New Holland Agriculture

- 12.14 Precision Planting

- 12.15 Raven Industries