PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913451

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913451

Automotive Differential Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

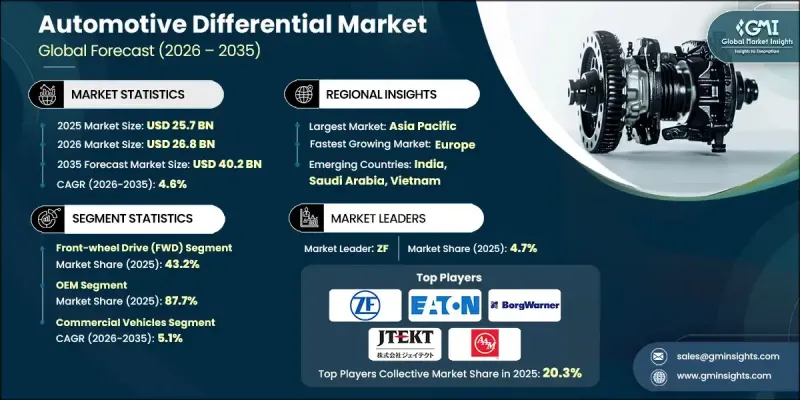

The Global Automotive Differential Market was valued at USD 25.7 billion in 2025 and is estimated to grow at a CAGR of 4.6% to reach USD 40.2 billion by 2035.

Market growth is supported by rising global vehicle production, driven by higher disposable income levels among middle-class consumers and continued expansion within the transportation and logistics sectors. Increasing demand for personal mobility and freight movement is contributing to sustained production of both passenger and commercial vehicles, which directly supports demand for automotive differentials. Growth in public transportation systems and logistics operations has further accelerated manufacturing of buses, vans, and trucks, strengthening market momentum. Differential manufacturers are increasingly developing vehicle-specific solutions to align with changing powertrain architectures. The growing presence of electric and hybrid vehicles is encouraging suppliers to redesign and integrate differential systems suited to new drivetrain requirements. Technology advancement is shifting focus toward electronically controlled and smart differential systems that enhance torque distribution, traction management, and vehicle stability. As vehicle systems become more software-driven and sensor-integrated, electronically advanced differentials are gaining greater relevance across multiple vehicle categories.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $25.7 Billion |

| Forecast Value | $40.2 Billion |

| CAGR | 4.6% |

The front-wheel drive segment held 43.2% share and generated USD 11.1 billion in 2025. Front-wheel drive configurations are widely adopted due to their cost efficiency and compact design, where power delivery components are integrated into a single assembly. This structure reduces manufacturing complexity and overall vehicle cost, supporting widespread use across global markets.

The original equipment manufacturer segment accounted for 87.7% share in 2025 and is expected to reach USD 35.9 billion by 2035. OEMs remain the primary channel for differential supply due to their ability to deliver high-quality, application-specific components that align with integrated vehicle production strategies and evolving performance requirements.

U.S. Automotive Differential Market reached USD 3.83 billion in 2025. Market growth is supported by rising vehicle production activity and increasing collaboration between automakers and component suppliers. High manufacturing costs associated with in-house production are encouraging OEMs to partner with specialized differential manufacturers to meet customized drivetrain needs.

Key companies operating in the Global Automotive Differential Market include Dana, ZF, Magna, Eaton, BorgWarner, GKN Automotive, Schaeffler, American Axle & Manufacturing, Linamar, and JTEKT. Companies active in the Global Automotive Differential Market are strengthening their market position through technology innovation, strategic partnerships, and platform-specific product development. Many manufacturers are investing in advanced differential technologies that improve efficiency, durability, and electronic control compatibility. Collaboration with vehicle OEMs is being prioritized to co-develop integrated drivetrain solutions tailored to evolving powertrain architectures. Firms are expanding their global manufacturing footprint to serve regional markets more efficiently and reduce supply chain risks. Emphasis on lightweight materials and precision engineering is helping improve performance and fuel efficiency.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research trail & confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation

- 1.7 Forecast model

- 1.8 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Differential

- 2.2.3 Component

- 2.2.4 Vehicle

- 2.2.5 Drive

- 2.2.6 Propulsion

- 2.2.7 Sales Channel

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global vehicle production

- 3.2.1.2 Growing demand for SUVs and all-wheel drive vehicles

- 3.2.1.3 Growth in off-road and recreational vehicle segment

- 3.2.1.4 Increasing penetration of commercial vehicles

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Weight and packaging constraints in vehicles

- 3.2.2.2 Complexity in design and maintenance

- 3.2.3 Market opportunities

- 3.2.3.1 Rising adoption of electric differentials in EVs

- 3.2.3.2 Increasing aftermarket demand for performance differentials

- 3.2.3.3 Growth in emerging automotive markets

- 3.2.3.4 Development of lightweight and compact differential solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 SAE (Society of Automotive Engineers)

- 3.4.1.2 FMVSS (Federal Motor Vehicle Safety Standards - NHTSA)

- 3.4.1.3 ASTM International

- 3.4.1.4 CSA Group

- 3.4.2 Europe

- 3.4.2.1 UNECE Regulations (ECE)

- 3.4.2.2 ISO (International Organization for Standardization)

- 3.4.2.3 EN Standards (CEN)

- 3.4.2.4 TUV Standards/Certifications

- 3.4.3 Asia Pacific

- 3.4.3.1 JIS (Japanese Industrial Standards)

- 3.4.3.2 GB/T Standards (China)

- 3.4.3.3 AIS (Automotive Industry Standards - India)

- 3.4.4 Latin America

- 3.4.4.1 ABNT Standards (Brazil)

- 3.4.4.2 NOM Standards (Mexico)

- 3.4.4.3 IRAM Standards (Argentina)

- 3.4.5 Middle East & Africa

- 3.4.5.1 GSO Standards (Gulf Cooperation Council)

- 3.4.5.2 SASO Standards (Saudi Arabia)

- 3.4.5.3 SABS Standards (South Africa)

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Sustainability and environmental impact

- 3.11.1 Environmental impact assessment

- 3.11.2 Social impact & community benefits

- 3.11.3 Governance & corporate responsibility

- 3.11.4 Sustainable finance & investment trends

- 3.12 Electrification impact assessment

- 3.12.1 EV differential design differences

- 3.12.2 E-axle integration trends

- 3.12.3 Torque vectoring in EVs

- 3.12.4 Transition challenges for traditional manufacturers

- 3.13 Performance & efficiency benchmarking

- 3.13.1 Differential efficiency ratings by type

- 3.13.2 Durability and lifespan analysis

- 3.13.3 Noise, vibration, and harshness (NVH) performance

- 3.13.4 Thermal management capabilities

- 3.14 Case studies

- 3.15 Future outlook & opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Differential, 2022 - 2035 ($Bn, Units)

- 5.1 Key trends

- 5.2 Open differential

- 5.3 Limited-slip differential (LSD)

- 5.4 Electronic limited-slip differential (ELSD)

- 5.5 Locking differential

- 5.5.1 Manual Locking (Driver-activated)

- 5.5.2 Automatic Locking (Sensing wheel slip)

- 5.6 Torque differential

Chapter 6 Market Estimates & Forecast, By Component, 2022 - 2035 ($Bn, Units)

- 6.1 Key trends

- 6.2 Differential Gears

- 6.3 Differential Case/Housing

- 6.4 Bearings & Seals

- 6.5 Electronic Control Components

Chapter 7 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 LCV

- 7.3.2 MCV

- 7.3.3 HCV

Chapter 8 Market Estimates & Forecast, By Drive, 2022 - 2035 ($Bn, Units)

- 8.1 Key trends

- 8.2 Front-wheel drive (FWD)

- 8.3 Rear-wheel drive (RWD)

- 8.4 All-wheel drive (AWD)/Four-wheel drive (4WD)

Chapter 9 Market Estimates & Forecast, By Propulsion, 2022 - 2035 ($Bn, Units)

- 9.1 Key trends

- 9.2 ICE

- 9.3 EV

- 9.4 Hybrid

Chapter 10 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($Bn, Units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.3.8 Benelux

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 ANZ

- 11.4.6 Singapore

- 11.4.7 Malaysia

- 11.4.8 Indonesia

- 11.4.9 Vietnam

- 11.4.10 Thailand

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Colombia

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global companies

- 12.1.1 ZF

- 12.1.2 American Axle & Manufacturing (AAM)

- 12.1.3 Dana

- 12.1.4 BorgWarner

- 12.1.5 GKN Automotive

- 12.1.6 Eaton

- 12.1.7 JTEKT

- 12.1.8 Linamar

- 12.1.9 Schaeffler

- 12.1.10 Magna

- 12.1.11 Hyundai Mobis

- 12.1.12 Meritor (Cummins)

- 12.1.13 Continental

- 12.1.14 NSK

- 12.2 Regional companies

- 12.2.1 Bharat Gears

- 12.2.2 Neapco

- 12.2.3 Huayu Automotive Systems

- 12.2.4 Tata Motors

- 12.2.5 Sona Comstar

- 12.2.6 AmTech

- 12.2.7 Univance

- 12.3 Emerging companies

- 12.3.1 Auburn Gear

- 12.3.2 Drexler Automotive

- 12.3.3 RT Quaife

- 12.3.4 Xtrac