PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913459

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913459

Secure Logistics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

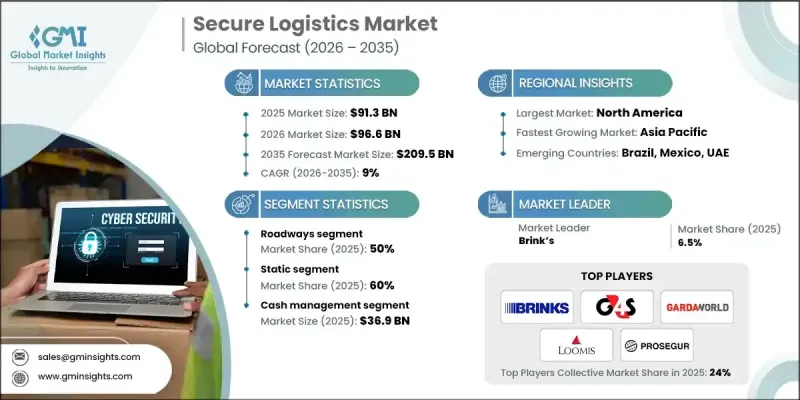

The Global Secure Logistics Market was valued at USD 91.3 billion in 2025 and is estimated to grow at a CAGR of 9% to reach USD 209.5 billion by 2035.

Growth is being driven by the steady rise in international trade, heightened concern around the protection of high-value shipments and increasing reliance on dependable and compliant supply chain operations. Organizations across multiple sectors are placing greater emphasis on safeguarding monetary assets, sensitive materials, regulated goods, and critical business documents, which is elevating demand for specialized logistics services. Ongoing digital transformation within logistics operations is reshaping traditional transport and storage models by improving visibility, traceability, and risk control throughout the movement lifecycle. End-to-end oversight of assets during collection, transit, and delivery is becoming a standard requirement as businesses seek to minimize loss, enhance operational efficiency, and meet regulatory expectations. Market expansion is further supported by the growth of online commerce, rising international shipment volumes, evolving payment ecosystems, and increased focus on risk mitigation and insurance alignment for valuable cargo. Secure logistics services have become a foundational component of business continuity and operational resilience.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $91.3 Billion |

| Forecast Value | $209.5 Billion |

| CAGR | 9% |

The roadways segment accounted for 50% share in 2025 and is projected to grow at a CAGR of 8.4% from 2026 to 2035. This segment maintains its lead due to its ability to provide adaptable, dependable, and cost-efficient movement of high-value and sensitive consignments. Broad deployment of digitally enabled fleet management and monitoring capabilities supports reliable delivery performance, risk reduction, and compliance across domestic and regional supply chains. The operational reach and scalability of road-based transport continue to make it the preferred option across industries.

The static segment held 60% share in 2025 and is expected to register a CAGR of 8% through 2035. This segment leads due to its role in providing secure storage environments, centralized control functions, and continuous oversight of assets. Advanced data-driven management tools and integrated monitoring frameworks enable improved workflow efficiency, enhanced protection standards, and consistent compliance across distributed operations. Static services form the structural backbone of comprehensive secure logistics networks and support seamless coordination with mobile operations.

United States Secure Logistics Market accounted for 76% share and generated USD 24.2 billion in 2025. Market leadership is supported by a strong concentration of large enterprises handling high-value assets, advanced digital adoption, and well-established regulatory systems. Widespread use of integrated logistics platforms, real-time visibility tools, and predictive risk management solutions continues to drive market expansion across the country.

Key companies operating in the Global Secure Logistics Market include Prosegur, Brink's, Loomis, GardaWorld, G4S, Transguard, Securitas, DHL Secure Logistics, CMS Info Systems, and Maltacourt Global Logistics. Companies in the Global Secure Logistics Market are strengthening their market position through technology-driven service enhancement and geographic expansion. Many providers are investing in advanced digital platforms to improve visibility, control, and risk assessment across logistics operations. Strategic partnerships with financial institutions, retailers, and technology firms are helping expand service portfolios and client reach. Firms are also focusing on fleet modernization, infrastructure upgrades, and workforce training to improve service reliability and compliance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Service

- 2.2.3 Mode of Transportation

- 2.2.4 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for cash-in-transit and high-value goods protection

- 3.2.1.2 Technological advancements

- 3.2.1.3 Regulatory compliance requirements

- 3.2.1.4 Growth in e-commerce and cross-border trade

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High operational costs

- 3.2.2.2 Security risks and theft

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets

- 3.2.3.2 Integration of digital solutions

- 3.2.3. 3 Specialized secure solutions for high-value and sensitive goods

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S. DOT & FMCSA Guidelines

- 3.4.1.2 OSHA Standards

- 3.4.1.3 Canada Transport of Valuable Goods Regulations & Labour Code

- 3.4.2 Europe

- 3.4.2.1 Germany BMAS & Bundespolizei Regulations

- 3.4.2.2 France CNIL & Ministry of the Interior Guidelines

- 3.4.2.3 United Kingdom ACPO & HSE Guidelines

- 3.4.2.4 Italy Ministry of the Interior & Ministry of Labour Compliance

- 3.4.3 Asia Pacific

- 3.4.3.1 China MOHURD & Public Security Bureau Guidelines

- 3.4.3.2 Japan MLIT Compliance

- 3.4.3.3 South Korea MOEL Regulations

- 3.4.3.4 India MoRTH Guidelines

- 3.4.4 Latin America

- 3.4.4.1 Brazil Ministry of Transport & MTE Guidelines

- 3.4.4.2 Mexico SCT & STPS Guidelines

- 3.4.5 Middle East and Africa

- 3.4.5.1 UAE Ministry of Human Resources & Emiratisation Guidelines

- 3.4.5.2 Saudi Arabia HRSD & Transport Ministry Regulations

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Use case scenarios

- 3.13 Risk, Threat & Loss Profile Analysis

- 3.13.1 Theft, hijacking & armed robbery risk profiling

- 3.13.2 Insider threat & collusion risks

- 3.13.3 Cyber-physical security threats (GPS spoofing, data breaches)

- 3.13.4 Regional risk intensity mapping (high-risk corridors)

- 3.14 Insurance, liability & risk transfer mechanisms

- 3.14.1 Insurance coverage models for high-value cargo

- 3.14.2 Liability allocation between shipper, logistics provider & insurer

- 3.14.3 Impact of loss history on premiums

- 3.14.4 Regulatory limits on liability by region

- 3.15 Service-Level Architecture & Contract Models

- 3.15.1 End-to-end vs modular secure logistics services

- 3.15.2 SLA structures (response time, loss thresholds, penalties)

- 3.15.3 Contract duration & pricing structures

- 3.15.4 Vendor lock-in and exit risks

- 3.16 Secure Infrastructure & Asset Deployment Analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Service, 2022 - 2035 ($ Bn)

- 5.1 Key trends

- 5.2 Static

- 5.3 Mobile

Chapter 6 Market Estimates & Forecast, By Mode of Transportation, 2022 - 2035 ($ Bn)

- 6.1 Key trends

- 6.2 Roadways

- 6.3 Airways

- 6.4 Railways

- 6.5 Waterways

Chapter 7 Market Estimates & Forecast, By Application, 2022 - 2035 ($ Bn)

- 7.1 Key trends

- 7.2 Cash Management

- 7.3 Precious Metals

- 7.4 Confidential Documents

- 7.5 Sensitive Electronics

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Region, 2022 - 2035 ($ Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 US

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Belgium

- 8.3.7 Netherlands

- 8.3.8 Sweden

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 Singapore

- 8.4.6 South Korea

- 8.4.7 Vietnam

- 8.4.8 Indonesia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Global Player

- 9.1.1 Brink’s

- 9.1.2 DHL Secure Logistics

- 9.1.3 G4S

- 9.1.4 GardaWorld

- 9.1.5 Loomis

- 9.1.6 Loomis International

- 9.1.7 Malca-Amit

- 9.1.8 Prosegur

- 9.1.9 Securitas

- 9.1.10 Transguard

- 9.2 Regional Player

- 9.2.1 Brink’s UK

- 9.2.2 CMS Info Systems

- 9.2.3 G4S South Africa

- 9.2.4 GardaWorld Canada

- 9.2.5 Loomis France

- 9.2.6 Maltacourt Global Logistics

- 9.2.7 Prosegur Cash Mexico

- 9.2.8 SecurCash Europe

- 9.2.9 Transnational Secure Logistics

- 9.2.10 Tristar Secure Logistics

- 9.3 Emerging Players

- 9.3.1 Apex Cash Transport

- 9.3.2 Elite Armored Transport

- 9.3.3 Quantum Secure Logistics

- 9.3.4 Sentinel Cash Solutions

- 9.3.5 Swift Secure Logistics