PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913460

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913460

Smart Medical Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

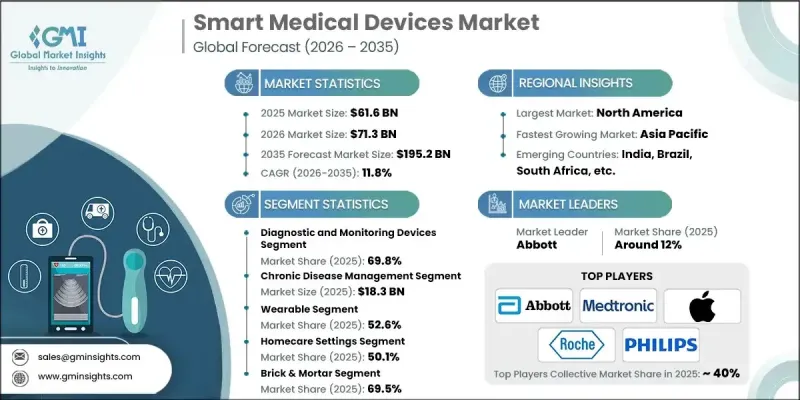

The Global Smart Medical Devices Market was valued at USD 61.6 billion in 2025 and is estimated to grow at a CAGR of 11.8% to reach USD 195.2 billion by 2035.

The growth is fueled by the rising prevalence of chronic conditions such as diabetes and asthma, coupled with the increasing demand for home healthcare solutions and remote patient monitoring (RPM) devices. Expansion of telemedicine and digital health platforms, alongside technological advancements in IoT, AI, and cloud-based integrations, are driving the adoption of smart medical devices. Trends such as wearable and miniaturized devices, preventive care, and hospital-at-home models are further boosting market demand. Leading players such as Abbott, Apple, Medtronic, Roche, and Philips are focusing on geographic expansion, product innovation, affordability, and collaboration with healthcare providers to strengthen market presence. Rising health awareness and the shift toward personalized, real-time patient monitoring are significantly contributing to industry growth.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $61.6 Billion |

| Forecast Value | $195.2 Billion |

| CAGR | 11.8% |

The diagnostic and monitoring devices segment held 69.8% share in 2025. This segment includes continuous glucose monitors (CGMs), wearable ECG patches, smart blood pressure monitors, and pulse oximeters. These devices continuously collect physiological data in real time and transmit it to connected platforms for analysis. Partnerships between technology providers and healthcare organizations are expected to drive further growth in this category by enhancing the accessibility and efficiency of patient monitoring.

The chronic disease management segment reached USD 18.3 billion in 2025. Smart devices for chronic disease management integrate wearable sensors, home monitoring equipment, and medication adherence systems to track vital signs, symptoms, and therapy usage. Real-time data collection allows clinicians and patients to assess risk scores and manage multiple conditions effectively, supporting long-term treatment and improving patient outcomes.

North America Smart Medical Devices Market held a 34.8% share in 2025. Regional growth is driven by a well-established healthcare system, high incidence of chronic diseases, widespread use of digital health technologies, and favorable reimbursement policies. The availability of health insurance and advanced telehealth infrastructure further supports the adoption of smart devices in the region, positioning North America as a leading market for innovation and growth in smart healthcare solutions.

Key players operating in the Global Smart Medical Devices Market include Abbott, Apple, Biobeat Medical, Boston Scientific, Dexcom, Fitbit, Masimo, Medtronic, NeuroMetrix, Novo Nordisk, OMRON Healthcare, Philips, Roche, SAMSUNG, Shenzhen Ztsense Hi Tech, SmartCardia, VitalConnect, Vital Health Ring, West Pharmaceutical Services, and WS Audiology. Companies in the Global Smart Medical Devices Market are focusing on multiple strategies to strengthen their market position. They invest heavily in research and development to launch innovative, miniaturized, and wearable solutions that integrate AI, IoT, and cloud platforms. Geographic expansion allows access to emerging markets with rising healthcare demands. Strategic collaborations with hospitals, clinics, and telemedicine providers enhance device adoption and distribution. Companies are also prioritizing affordability, regulatory compliance, and real-time data capabilities to improve patient engagement.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of diabetes, asthma and other diseases

- 3.2.1.2 Booming medical device industry

- 3.2.1.3 Increasing internet penetration rate and adoption of big data

- 3.2.1.4 Rising importance of real time data driven approach for diagnostics and treatment

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Privacy concerns

- 3.2.2.2 Lack of suitable infrastructure in low- and middle-income countries

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Reimbursement scenario

- 3.6 Technological landscape

- 3.7 Pricing analysis

- 3.8 Future market trends

- 3.9 Supplier landscape

- 3.10 M&A activities

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

- 3.13 Gap analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2032 ($ Mn)

- 5.1 Key trends

- 5.2 Diagnostic and monitoring devices

- 5.2.1 Blood glucose monitors

- 5.2.2 Heart rate monitors

- 5.2.3 Pulse oximeters

- 5.2.4 Blood pressure monitors

- 5.2.5 Breathalyzers

- 5.2.6 Other diagnostic and monitoring devices

- 5.3 Therapeutic devices

- 5.3.1 Portable oxygen concentrators and ventilators

- 5.3.2 Insulin pumps

- 5.3.3 Hearing aid

- 5.3.4 Other therapeutic devices

- 5.4 Other product types

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2032 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Homecare settings

- 6.4 Other End Use

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2032 ($ Mn)

- 7.1 Key trends

- 7.2 Brick & mortar

- 7.3 E-commerce

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2032 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott

- 9.2 Apple

- 9.3 Biobeat

- 9.4 Boston Scientific Corporation

- 9.5 Dexcom

- 9.6 F Hoffmann-La Roche

- 9.7 Fitbit

- 9.8 Medtronic

- 9.9 NeuroMetrix

- 9.10 Novo Nordisk

- 9.11 Omron Corporation

- 9.12 SAMSUNG

- 9.13 VitalConnect

- 9.14 West Pharmaceutical Services