PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913463

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913463

Millimeter Wave Technology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

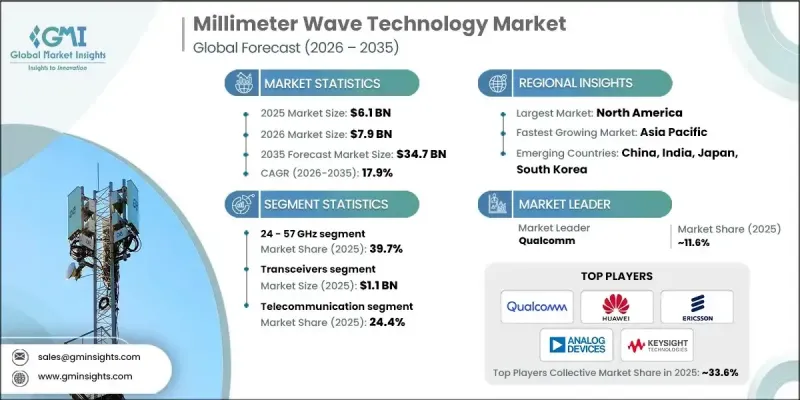

The Global Millimeter Wave Technology Market was valued at USD 6.1 billion in 2025 and is estimated to grow at a CAGR of 17.9% to reach USD 34.7 billion by 2035.

Growth is supported by rising requirements for ultra-fast data transmission, expanding deployment of next-generation wireless networks, and increasing capital allocation toward advanced communication infrastructure. Millimeter wave technology is gaining traction as network operators and technology providers prioritize higher capacity, reduced latency, and improved spectral efficiency. Demand is further strengthened by the wider adoption of bandwidth-intensive digital services and the need for enhanced imaging and sensing capabilities across multiple industries. Public and private sector investments aimed at strengthening connectivity frameworks are accelerating the deployment of millimeter wave solutions, particularly in dense network environments. Ongoing infrastructure development initiatives are increasingly incorporating these technologies to enable high-capacity network architectures. Additionally, growing interest in immersive digital platforms is supporting demand for faster and more reliable wireless performance. These combined factors are driving sustained global adoption of millimeter wave technology across diverse applications and regions.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $6.1 Billion |

| Forecast Value | $34.7 Billion |

| CAGR | 17.9% |

The 24-57 GHz frequency range accounted for 39.7% share in 2025. This band is widely used to support low-latency, high-throughput wireless communication and advanced sensing systems. Increasing focus on spectrum optimization and efficient signal transmission is encouraging the development of high-performance solutions operating within this frequency range to improve overall network reliability and capacity.

The transceivers segment generated USD 1.1 billion in 2025. These components play a critical role in enabling fast data exchange, efficient signal processing, and seamless system integration. Growing performance expectations are driving innovation in transceiver design to support higher data rates, reduced power consumption, and compatibility with next-generation wireless standards.

North America Millimeter Wave Technology Market represented 35% share in 2025. Market expansion in the region is supported by continuous network upgrades, strong investment in digital infrastructure, and accelerating deployment of connected technologies. Increasing urban development initiatives and widespread adoption of cloud-based services are further contributing to regional market growth.

Major companies operating in the Global Millimeter Wave Technology Market include Qualcomm, Ericsson, Huawei, Broadcom, Analog Devices, Inc., NEC Corporation, Infineon, Keysight Technologies Inc., Kyocera Corporation, Siklu Communication Ltd., Aviat Networks, Cambium Networks, Farran Technology Ltd., Bridgewave Communications Inc., L3Harris Technologies Inc., Smiths Interconnect Group Limited, Eravant (SAGE Millimeter Inc.), Millimeter Wave Products Inc., Ducommun Incorporated, and E-band Communications LLC. Companies in the Global Millimeter Wave Technology Market are focusing on strengthening their competitive position through continuous research and development aimed at improving signal efficiency, component integration, and system reliability. Many players are investing in advanced semiconductor technologies and compact designs to enhance performance while reducing power consumption. Strategic collaborations with network operators and infrastructure providers are helping accelerate commercialization and large-scale deployment.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Component trends

- 2.2.2 Frequency band trends

- 2.2.3 End use trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2026-2035 (USD Million)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry ecosystem analysis

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growing demand for 5G Networks

- 3.3.1.2 Increasing demand for high-bandwidth applications

- 3.3.1.3 Rising investments in telecommunication infrastructure

- 3.3.1.4 Increasing applications in healthcare imaging

- 3.3.1.5 Increasing deployment in security systems

- 3.3.2 Pitfalls and challenges

- 3.3.2.1 Limited range and penetration

- 3.3.2.2 Propagation challenges

- 3.3.3 Market opportunities

- 3.3.3.1 Advancements in smart cities

- 3.3.3.2 Expansion of AR/VR applications

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology and Innovation landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Emerging Business Models

- 3.10 Compliance Requirements

- 3.11 Sustainability Measures

- 3.12 Consumer Sentiment Analysis

- 3.13 Patent and IP analysis

- 3.14 Geopolitical and trade dynamics

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Component, 2022 - 2035 (USD Million)

- 5.1 Key trends

- 5.2 Switches

- 5.2.1 PIN diode switches

- 5.2.2 FET switches

- 5.2.3 MEMS switches

- 5.2.4 Coaxial switches

- 5.2.5 Waveguide switches

- 5.3 Antennas

- 5.3.1 Phased array antennas

- 5.3.1.1 Linear arrays

- 5.3.1.2 Planar arrays

- 5.3.1.3 Conformal arrays

- 5.3.2 Non-Phased array antennas

- 5.3.2.1 Patch antennas

- 5.3.2.2 Horn antennas

- 5.3.2.3 Reflector Antennas

- 5.3.1 Phased array antennas

- 5.4 Transceiver

- 5.5 Communications and networking

- 5.6 Interface

- 5.7 RF & radio

- 5.8 Imaging

- 5.9 Sensor & controls

- 5.10 Power & battery

- 5.11 Others

Chapter 6 Market Estimates and Forecast, By Frequency Band, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 24 - 57 GHz

- 6.3 57 - 86 GHz

- 6.4 86 - 300 GHz

Chapter 7 Market Estimates and Forecast, By End Use, 2022 - 2035 (USD Million)

- 7.1 Key trends

- 7.2 Telecommunication

- 7.3 Healthcare

- 7.4 Industrial

- 7.5 Automotive

- 7.6 Transportation

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Global Key Players

- 9.1.1 Qualcomm

- 9.1.2 Huawei

- 9.1.3 Ericsson

- 9.1.4 Keysight Technologies Inc.

- 9.1.5 Broadcom

- 9.2 Regional key players

- 9.2.1 North America

- 9.2.1.1 Analog Devices, Inc.

- 9.2.1.2 Bridgewave Communications Inc.

- 9.2.1.3 L3Harris Technologies Inc.

- 9.2.1.4 Millimeter Wave Products Inc.

- 9.2.2 Asia Pacific

- 9.2.2.1 Siklu Communication Ltd.

- 9.2.2.2 NEC Corporation

- 9.2.2.3 Eravant (SAGE Millimeter Inc.)

- 9.2.3 Europe

- 9.2.3.1 Farran Technology Ltd.

- 9.2.3.2 Infineon

- 9.2.3.3 Kyocera Corporation

- 9.2.3.4 Smiths Interconnect Group Limited

- 9.2.1 North America

- 9.3 Niche Players/Disruptors

- 9.3.1 Cambium Networks

- 9.3.2 Ducommun Incorporated

- 9.3.3 E-band Communications LLC

- 9.3.4 Aviat Networks