PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913477

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913477

Storage Tank Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

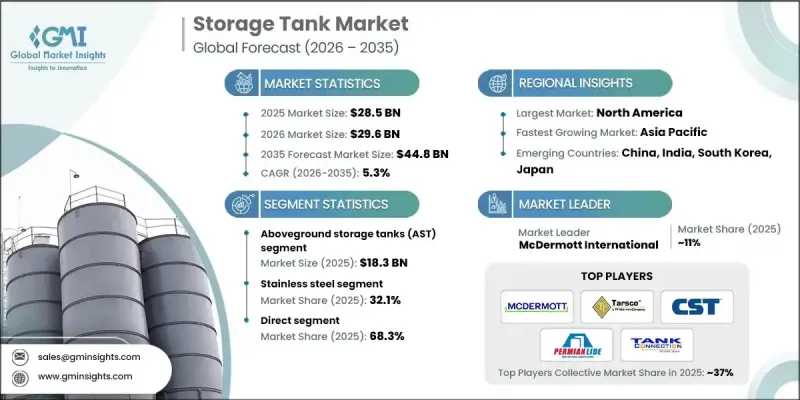

The Global Storage Tank Market was valued at USD 28.5 billion in 2025 and is estimated to grow at a CAGR of 5.3% to reach USD 44.8 billion by 2035.

Market expansion is supported by ongoing development of energy and processing infrastructure worldwide. Rising activity across resource extraction, processing, and downstream operations continues to create sustained demand for large-scale storage solutions designed for safe containment and operational continuity. Industrial operators are prioritizing long-lasting and corrosion-resistant tank systems to ensure asset reliability and regulatory compliance. Storage tanks play a critical role in inventory control, uninterrupted supply management, and overall process optimization. Increasing energy consumption and capacity additions across refining and processing facilities are generating consistent procurement activity. The construction of advanced industrial complexes is also supporting demand for engineered tanks suitable for challenging operating conditions. Alongside energy-related development, greater attention to infrastructure resilience and long-term asset performance is influencing purchasing decisions across multiple end-use sectors. As industrialization progresses and environmental compliance standards evolve, the need for efficient, durable, and scalable storage systems continues to rise, positioning the storage tank market for steady long-term growth.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $28.5 Billion |

| Forecast Value | $44.8 Billion |

| CAGR | 5.3% |

Growth in wastewater treatment and recycling infrastructure is also supporting market expansion. Treatment and processing facilities require large-capacity tanks to manage fluids and treatment inputs efficiently. Long-term operational performance is encouraging investment in materials that offer strong resistance to environmental degradation. Effective storage solutions support consistent processing outcomes and help facilities align with environmental standards, while expanded recycling initiatives are increasing the need for safe containment of reclaimed resources.

The aboveground storage tanks generated USD 18.3 billion in 2025 and is expected to grow at a CAGR of 5.4% between 2026 and 2035. This segment continues to attract demand due to simplified installation processes, accessibility for inspection, and ease of ongoing maintenance. These systems are widely adopted across industrial, municipal, and commercial environments, with material selection focused on long-term durability and environmental resistance.

The direct distribution channel held a 68.3% share in 2025 and is forecast to grow at a CAGR of 5.4% through 2035. Direct engagement with manufacturers enables tailored system design, efficient delivery schedules, and access to technical expertise. This purchasing model allows customers to align tank specifications closely with operational and regulatory requirements.

U.S. Storage Tank Market accounted for USD 6.9 billion in 2025. Growth is supported by continued investment across processing, infrastructure, and treatment facilities. Demand remains strong for advanced storage systems designed for industrial liquids and regulated applications, reinforcing steady market expansion through 2035.

Major companies active in the Global Storage Tank Market include CST Industries, Worthington Industries, Caldwell Tanks, McDermott International, Tank Connection, ZCL Composites, Superior Tank Co., Pfaudler Group, Synalloy Corporation, Fox Tank Company, Tarsco, Snyder Industries, PermianLide, Motherwell Bridge Industries, and Highland Tank & Manufacturing Company. Companies in the Storage Tank Market are strengthening their competitive position through capacity expansion, product customization, and material innovation. Manufacturers are investing in advanced fabrication technologies to improve durability, corrosion resistance, and lifecycle performance. Strategic partnerships with industrial clients support long-term supply agreements and repeat business. Geographic expansion and localized manufacturing are being used to reduce delivery timelines and enhance customer responsiveness. Firms are also focusing on compliance-driven designs to meet evolving safety and environmental standards. Enhanced aftersales support, including maintenance and inspection services, is improving customer retention.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Installation type

- 2.2.4 Material

- 2.2.5 End Use industry

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of oil and gas and petrochemical infrastructure projects

- 3.2.1.2 Growth of wastewater treatment and recycling facilities

- 3.2.1.3 Rising demand for water storage due to urbanization and population growth

- 3.2.2 Pitfalls & Challenges

- 3.2.2.1 High capital cost of large-capacity and customized storage tanks

- 3.2.2.2 Corrosion and material degradation over long service periods

- 3.2.3 Opportunities

- 3.2.3.1 Rising demand for modular and prefabricated storage tank solutions

- 3.2.3.2 Growing use of advanced coatings and composite materials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS Code - 7309)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2022 - 2035, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Hazardous Storage Tanks

- 5.3 Non-Hazardous Storage Tanks

Chapter 6 Market Estimates & Forecast, By Installation Type, 2022 - 2035, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Aboveground storage tanks (AST)

- 6.3 Underground storage tanks (UST)

Chapter 7 Market Estimates & Forecast, By Material, 2022 - 2035, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Stainless Steel

- 7.3 Polyethylene

- 7.4 Fiberglass

- 7.5 Concrete

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2022 - 2035, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Oil & Gas Industry

- 8.3 Chemical Industry

- 8.4 Water and Wastewater Treatment

- 8.5 Food and Beverage Industry

- 8.6 Pharmaceutical Industry

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Caldwell Tanks

- 11.2 CST Industries

- 11.3 Fox Tank Company

- 11.4 Highland Tank & Manufacturing Company

- 11.5 McDermott International

- 11.6 Motherwell Bridge Industries

- 11.7 PermianLide

- 11.8 Pfaudler Group

- 11.9 Snyder Industries

- 11.10 Superior Tank Co.

- 11.11 Synalloy Corporation

- 11.12 Tank Connection

- 11.13 Tarsco

- 11.14 Worthington Industries

- 11.15 ZCL Composites