PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913478

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913478

Europe Ophthalmic Lenses Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

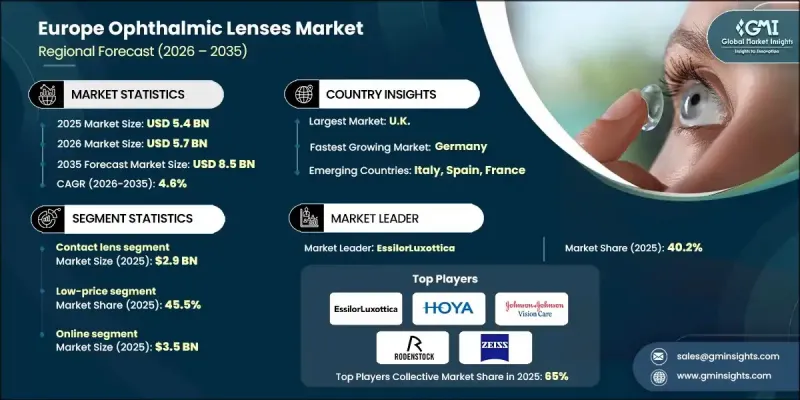

Europe Ophthalmic Lenses Market was valued at USD 5.4 billion in 2025 and is estimated to grow at a CAGR of 4.6% to reach USD 8.5 billion by 2035.

Growing attention towards preventive eye care and expanding public health messaging across the region continues to increase the need for corrective lenses. Awareness initiatives that emphasize routine vision checks are encouraging more individuals to seek professional eye care, which supports the rising consumption of ophthalmic lenses. The blending of style with advanced optical functionality is also reshaping product development, as eyewear now carries both aesthetic and performance value. Another important factor influencing market expansion is the broader shift toward environmentally conscious products, leading manufacturers to introduce sustainable lens options that reduce waste and appeal to eco-focused consumers. Digital care services are helping in market growth, as remote access to eye care has widened product availability across Europe. Additionally, the demand for blue light-reducing lenses continues to rise as screen exposure increases throughout the region.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $5.4 Billion |

| Forecast Value | $8.5 Billion |

| CAGR | 4.6% |

The contact lens segment generated USD 2.9 billion in 2025. Rising cases of vision impairments such as myopia and astigmatism are pushing demand within the CPE ophthalmic lenses space, and manufacturers are expanding their ranges of daily disposable options to meet consumer preferences for convenience and comfort.

The low-price segment held a 45.4% share in 2025. Its dominance is linked to strong accessibility, affordability, and its appeal to consumers managing limited discretionary spending or prioritizing essential healthcare purchases. A widespread increase in vision-related issues is also reinforcing the demand for cost-effective ophthalmic solutions across Europe.

U.K. Ophthalmic Lenses Market generated USD 1.1 billion in 2025. National commitments to broad vision-care access continue to reinforce early diagnosis and drive adoption of corrective eyewear. Extensive eye-testing activity and supportive insurance programs have improved affordability and significantly increased the use of ophthalmic lenses throughout the country.

Key companies active in the Europe Ophthalmic Lenses Market include Carl Zeiss Vision, Indo Optical, Fielmann AG, Rodenstock GmbH, BBGR Optical, EssilorLuxottica, JINS, Safilo Group, Silhouette International, Charmant Group, Shamir Optical Industry Ltd., Marchon Eyewear (VSP Global), De Rigo Vision, HOYA Corporation, and Seiko Optical Products. Companies competing in the Europe Ophthalmic Lenses Market are deploying a mix of strategic growth initiatives to reinforce their market position. Many are expanding their product lines with advanced lens technologies, including lightweight materials and enhanced visual-comfort features, to appeal to a broader user base. Investments in sustainable manufacturing, recyclable materials, and eco-friendly packaging are becoming essential to attract environmentally conscious consumers. Several manufacturers are strengthening distribution networks through retail partnerships, digital sales channels, and regional expansion to improve availability and customer reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Country

- 2.2.2 Product type

- 2.2.3 Type

- 2.2.4 Material

- 2.2.5 Shape

- 2.2.6 Price

- 2.2.7 End user

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Aging population

- 3.2.1.2 Rising prevalence of vision problems

- 3.2.1.3 Increasing awareness of eye health

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Regulatory complexity and compliance burden

- 3.2.2.2 Price sensitivity and market saturation

- 3.2.3 Opportunities

- 3.2.3.1 Technological advancements

- 3.2.3.2 Sustainability & eco-friendly materials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By country

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Risk assessment and mitigation

- 3.9 Gap analysis

- 3.10 Trade statistics (HS code- 90015000, 900140)

- 3.10.1 Major importing countries

- 3.10.2 Major exporting countries

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

- 3.13 Consumer behaviour analysis

- 3.13.1 Purchasing patterns

- 3.13.2 Preference analysis

- 3.13.3 Regional variations in consumer behaviour

- 3.13.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By country

- 4.2.1.1 Germany

- 4.2.1.2 UK

- 4.2.1.3 France

- 4.2.1.4 Italy

- 4.2.1.5 Spain

- 4.2.1.6 Rest of Europe

- 4.2.1 By country

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2022 - 2035, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Spectacles

- 5.2.1 Single vision

- 5.2.2 Multifocal

- 5.2.3 Bifocal

- 5.2.4 Progressive

- 5.2.5 Reading glasses

- 5.2.6 Safety glasses

- 5.2.7 Others (Blue light glasses, etc.)

- 5.3 Contact lens

- 5.3.1 Soft contact lens

- 5.3.2 Rigid contact lens

- 5.3.3 Others (Toric contact lens)

- 5.4 IOL

Chapter 6 Market Estimates & Forecast, By Type, 2022-2035, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Prescription

- 6.3 Non-prescription

Chapter 7 Market Estimates & Forecast, By Material, 2022-2035, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Plastic

- 7.3 Polycarbonate

- 7.4 Glass

- 7.5 Hydrogel

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Shape, 2022- 2035, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Shape

- 8.3 Oval & aviator

- 8.4 Rectangular

- 8.5 Round

- 8.6 Square

- 8.7 Others (oversized, shield, etc.)

Chapter 9 Market Estimates & Forecast, By Price, 2022-2035, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Low

- 9.3 Medium

- 9.4 High

Chapter 10 Market Estimates & Forecast, By End Use, 2022-2035, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Male

- 10.3 Female

- 10.4 Unisex

- 10.5 Kids

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2022-2035, (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Online

- 11.2.1 E-commerce

- 11.2.2 Company site

- 11.3 Offline

- 11.3.1 Specialty stores

- 11.3.2 Mega retail stores

- 11.3.3 Others (optical camps, ophthalmic centers, etc.)

Chapter 12 Market Estimates & Forecast, By Country, 2022-2035, (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 Germany

- 12.3 UK

- 12.4 France

- 12.5 Italy

- 12.6 Spain

- 12.7 Rest of Europe

Chapter 13 Company Profiles

- 13.1 BBGR Optical

- 13.2 Carl Zeiss Vision

- 13.3 Charmant Group

- 13.4 De Rigo Vision

- 13.5 EssilorLuxottica

- 13.6 Fielmann AG

- 13.7 HOYA Corporation

- 13.8 Indo Optical

- 13.9 JINS

- 13.10 Marchon Eyewear (VSP Global)

- 13.11 Rodenstock GmbH

- 13.12 Safilo Group

- 13.13 Seiko Optical Products

- 13.14 Shamir Optical Industry Ltd.

- 13.15 Silhouette International