PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913480

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913480

Medical Suction Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

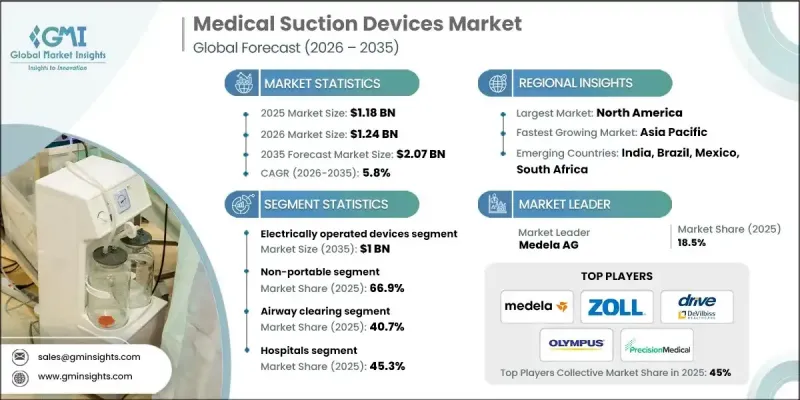

The Global Medical Suction Devices Market was valued at USD 1.18 billion in 2025 and is estimated to grow at a CAGR of 5.8% to reach USD 2.07 billion by 2035.

The upward trend is supported by the rising burden of long-term respiratory conditions, the expanding volume of medical interventions that rely on suction technology, and the growing acceptance of home-based healthcare solutions. As respiratory disorders become more common, effective airway clearance has become essential to reduce complications and support patient recovery. Medical suction systems are also widely relied upon to maintain visibility and cleanliness during medical procedures by removing fluids and secretions across diverse clinical settings. The increasing global volume of surgical and diagnostic procedures continues to reinforce demand for these devices. In addition, the shift toward less invasive medical techniques has increased the need for precise and controlled fluid management, driving the adoption of advanced suction solutions that support accuracy, safety, and consistent clinical outcomes.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.18 Billion |

| Forecast Value | $2.07 Billion |

| CAGR | 5.8% |

The electrically powered medical suction devices segment generated USD 573.6 million in 2025. These devices are favored for their dependable performance, adjustable suction control, and ability to support continuous operation. Their design enables consistent functionality, portability options, and automated safety features, making them widely used across healthcare environments.

The non-portable suction systems segment accounted for 66.9% share in 2025. These stationary units are primarily used in hospitals and advanced care facilities where high-capacity and uninterrupted suction is required. Their robust design supports critical medical procedures and long-term patient management by delivering reliable and sustained performance.

U.S. Medical Suction Devices Market recorded USD 443.3 million in 2025. The rising incidence of chronic respiratory conditions continues to drive demand for airway management solutions across emergency, acute, and extended care settings.

Key companies operating in the Global Medical Suction Devices Market include Medtronic, Laerdal Medical, Allied Healthcare Products, Inc., Olympus Corporation, Drive DeVilbiss Healthcare, ATMOS MedizinTechnik GmbH & Co. KG, ZOLL Medical Corporation, Precision Medical, Inc., Amsino International, Inc., Integra Biosciences AG, Medicop, Inc., and Welch Vacuum. Companies in the Global Medical Suction Devices Market are strengthening their market position through innovation, product diversification, and strategic expansion. Many manufacturers are investing in advanced device designs that improve reliability, ease of use, and patient safety. Emphasis is being placed on developing compact, energy-efficient, and user-friendly systems suited for both clinical and home-care environments. Firms are also expanding their geographic footprint through partnerships and distribution agreements to improve market access.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Type trends

- 2.2.3 Portability trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of chronic respiratory disorders

- 3.2.1.2 Rising number of procedures that require suction devices.

- 3.2.1.3 Increasing preference for home healthcare

- 3.2.1.4 Increase in awareness regarding portable medical suction devices in emerging economies.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Dearth of skilled professionals

- 3.2.2.2 Limited reimbursement for suction devices

- 3.2.3 Market opportunities

- 3.2.3.1 Ongoing technology improvements

- 3.2.3.2 Expansion of public healthcare infrastructure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Pricing analysis, 2024

- 3.8 Future market trends

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Electrically operated devices

- 5.3 Manually operated devices

- 5.4 Venturi

Chapter 6 Market Estimates and Forecast, By Portability, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Non portable

- 6.3 Portable

Chapter 7 Market Estimates and Forecast, By Application, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Airway clearing

- 7.3 Surgical

- 7.4 Gastric

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 clinics

- 8.4 Others

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Allied Healthcare Products, Inc.

- 10.2 Precision Medical, Inc.

- 10.3 Drive Medical

- 10.4 Integra Biosciences AG

- 10.5 Medicop, Inc.

- 10.6 ATMOS MedizinTechnik GmbH & Co. KG

- 10.7 ZOLL Medical Corporation

- 10.8 Welch Vacuum

- 10.9 Laerdal Medical

- 10.10 Amsino International, Inc.

- 10.11 Olympus Corporation

- 10.12 Medtronic