PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913481

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913481

Baby and Toddlers Carriers and Accessories Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

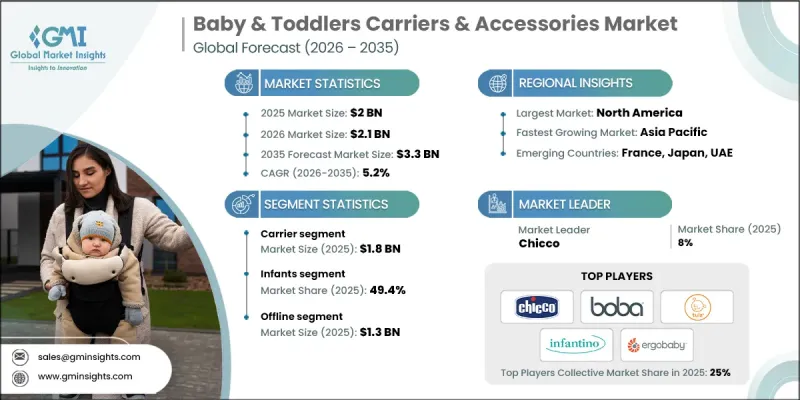

The Global Baby & Toddlers Carriers & Accessories Market was valued at USD 2 billion in 2025 and is estimated to grow at a CAGR of 5.2% to reach USD 3.3 billion by 2035.

Market growth is shaped by changing family dynamics, particularly the rise in dual-income households and continued urbanization. Modern parents increasingly seek products that support active lifestyles while allowing them to manage childcare alongside professional and personal responsibilities. Baby carriers offer a practical solution by enabling hands-free mobility while maintaining close physical connection with children. In dense urban environments, carriers are often favored over traditional strollers due to their ease of use on crowded streets, public transport systems, and in compact living spaces. The emphasis on portability and efficiency has influenced product innovation, leading brands to design carriers that balance comfort, safety, and visual appeal. Today's parents expect products that integrate seamlessly into daily routines while reflecting modern aesthetics and functionality, which has encouraged manufacturers to expand their portfolios with versatile, ergonomic, and visually refined carrier solutions.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2 Billion |

| Forecast Value | $3.3 Billion |

| CAGR | 5.2% |

The carriers segment reached USD 1.8 billion in 2025. These products are designed to be worn by caregivers, allowing infants and toddlers to be carried securely while keeping hands free. Available in a variety of designs, carriers support different developmental stages, comfort needs, and carrying preferences. Parents rely on them to promote closeness, support proper posture for both caregiver and child, and maintain comfort during everyday activities.

The infant category accounted for 49.4% share in 2025. Early childhood is marked by rapid physical and cognitive development, particularly between five months and two years of age. As infants gain better head, neck, and core control, caregivers increasingly transition to structured carriers that provide support while allowing children to observe and engage with their surroundings. During this pre-mobility phase, carriers play a key role in maintaining caregiver bonding while supporting a child's growing curiosity and sensory interaction with the environment.

United States Baby & Toddlers Carriers & Accessories Market held 78.6% share, generating USD 500 million in 2025. Strong purchasing power, high awareness of safety and ergonomic standards, and a well-established culture of child-focused consumer spending support sustained demand. Parents in the U.S. show strong preference for carriers that combine comfort, design appeal, versatility, and compliance with health guidelines. Broad product availability through both physical retail channels and online platforms further strengthens market growth and consumer choice.

Key companies active in the Global Baby & Toddlers Carriers & Accessories Market include Ergobaby, Baby K'tan, Infantino, Chicco, Boba, Tushbaby, LennyLamb, Baby Tula, Kinderkraft, Wildbird, Fidella, Be Lenka, Kol Kol Baby Carrier, MaMidea, and Mabe. Companies in the Global Baby & Toddlers Carriers & Accessories Market are reinforcing their market position through continuous product innovation, brand differentiation, and expanded distribution strategies. Many players focus on ergonomic research to improve comfort and safety for both caregivers and children. Design-led development that blends functionality with modern styling is being used to attract fashion-conscious parents. Brands are also strengthening digital presence through direct-to-consumer platforms and targeted marketing campaigns. Strategic partnerships with retailers and parenting communities help expand reach and build trust.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Material

- 2.2.4 Age

- 2.2.5 Carry positions

- 2.2.6 Price

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in working parents & urban lifestyles

- 3.2.1.2 Parental awareness of babywearing benefits

- 3.2.1.3 Focus on ergonomics & comfort

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Safety and compliance concerns

- 3.2.2.2 Quality control and counterfeit products

- 3.2.3 Opportunities

- 3.2.3.1 Accessory innovation

- 3.2.3.2 Tech-integrated products

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022 - 2035 (USD Billion)

- 5.1 Key trends

- 5.2 Carrier

- 5.2.1 Soft structured

- 5.2.2 Wrap carriers

- 5.2.3 Sling carriers

- 5.2.4 Backpack carriers

- 5.2.5 Others (Mei-tai carriers etc.)

- 5.3 Accessories

- 5.3.1 Hood

- 5.3.2 Back support

- 5.3.3 Drool pads

- 5.3.4 Shoulder strap protectors

- 5.3.5 Others (storage pouch etc.)

Chapter 6 Market Estimates and Forecast, By Material, 2022 - 2035 (USD Billion)

- 6.1 Key trends

- 6.2 Cotton

- 6.3 Nylon

- 6.4 Linen

- 6.5 Polyester

- 6.6 Others (faux fur, neoprene etc.)

Chapter 7 Market Estimates and Forecast, By Age, 2022 - 2035 (USD Billion)

- 7.1 Key trends

- 7.2 Newborns (0m-5m)

- 7.3 Infants (5m-2y)

- 7.4 Toddler (2y-4y)

Chapter 8 Market Estimates and Forecast, By Carry Positions, 2022 - 2035 (USD Billion)

- 8.1 Key trends

- 8.2 Front facing

- 8.3 Back facing

- 8.4 Hip

Chapter 9 Market Estimates and Forecast, By Price, 2022 - 2035 (USD Billion)

- 9.1 Key trends

- 9.2 Low

- 9.3 Medium

- 9.4 High

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Billion)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce

- 10.2.2 Company owned website

- 10.3 Offline

- 10.3.1 Supermarket/hypermarket

- 10.3.2 Specialty stores

- 10.3.3 Others (individual stores, etc.)

Chapter 11 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Baby K'tan

- 12.2 Baby Tula

- 12.3 Be Lenka

- 12.4 Boba

- 12.5 Chicco

- 12.6 Ergobaby

- 12.7 Fidella

- 12.8 Infantino

- 12.9 Kinderkraft

- 12.10 Kol Kol Baby Carrier

- 12.11 LennyLamb

- 12.12 Mabe

- 12.13 MaMidea

- 12.14 Tushbaby

- 12.15 Wildbird