PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928861

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928861

North America Pump Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

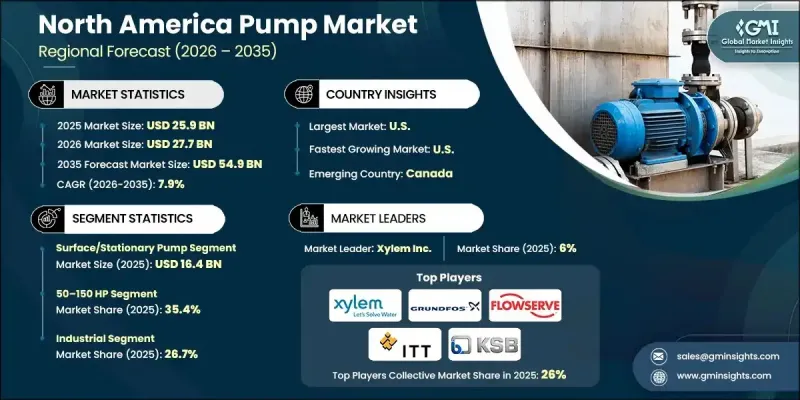

North America Pump Market was valued at USD 25.9 billion in 2025 and is estimated to grow at a CAGR of 7.9% to reach USD 54.9 billion by 2035.

Market growth is supported by the rising need to service aging pump systems across industrial and municipal facilities. Many existing pump installations are operating beyond their optimal lifecycle, leading to efficiency losses, unplanned failures, and increased operating expenses. As a result, asset owners are prioritizing scheduled servicing, condition-based maintenance, and refurbishment programs to sustain performance and reduce costly interruptions. Pump services play a critical role in maintaining stable flow, pressure control, and process continuity across essential operations. Service providers are increasingly supporting long-term equipment reliability through component upgrades and system optimization. The growing focus on preventive maintenance rather than reactive repairs continues to support steady demand. In addition, improvements in inspection tools and monitoring technologies allow more accurate identification of wear and performance issues. These factors collectively reinforce the importance of pump servicing as a core operational requirement across North America.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $25.9 Billion |

| Forecast Value | $54.9 Billion |

| CAGR | 7.9% |

The surface and stationary pumps category generated USD 16.4 billion in 2025 and is expected to grow at a CAGR of 6.4% between 2026 and 2035. This segment remains essential due to its extensive use in fixed-location fluid handling operations across multiple industries. Continuous-duty requirements make routine servicing, repairs, and efficiency improvements critical to avoid downtime and maintain process consistency.

The 50-150 horsepower segment held a 35.4% share in 2025 and is projected to grow at a CAGR of 6.8% through 2035. Pumps within this power range are widely used for demanding operational loads while maintaining manageable energy consumption. Their continuous use results in steady demand for maintenance services, performance tuning, and component replacement to control operating costs and ensure reliability.

United States Pump Market accounted for USD 22.3 billion in 2025. Market leadership is supported by strong demand across utility systems, energy operations, and industrial facilities, where ongoing pump servicing is essential to address aging assets and maintain operational efficiency.

Key companies active in the North America Pump Market include DXP Enterprises, CHAMCO, OTP Industrial Solutions, Industrial Pump Repair, Godwin, Westpower Group, MSI, Vaughan's Industrial Repair, Pump Tech, Industrial Service Solutions, Rotech Pumps, Rapid Pump and Meter Services, Industrial Pump Sales and Service, PSI Repair Services, and Gainesville Industrial Electric. Companies in the Global North America Pump Market are strengthening their competitive position by expanding service portfolios and focusing on long-term customer relationships. Many providers are investing in skilled technicians, advanced diagnostic tools, and predictive maintenance capabilities to deliver faster and more reliable service. Geographic expansion and localized service centers help reduce response times and improve customer satisfaction. Strategic partnerships with industrial operators and utility providers support recurring service contracts. Firms are also emphasizing refurbishment and retrofit solutions to help clients extend equipment life while controlling capital spending, reinforcing their foothold in a highly service-driven market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 North America

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 By power range

- 2.2.4 Material/construction

- 2.2.5 End use sector

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Infrastructure modernization & federal funding

- 3.2.1.2 Expansion of industrial & mining operations

- 3.2.1.3 Stringent environmental & PFAS regulations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High operational & energy costs

- 3.2.2.2 Supply chain volatility for specialized alloys

- 3.2.3 Opportunities

- 3.2.3.1 IoT integration & "smart" pumping

- 3.2.3.2 Growth of the pump rental model

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter';s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By country

- 4.2.1.1 U.S.

- 4.2.1.2 Canada

- 4.2.1 By country

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022 - 2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Submersible pumps

- 5.3 Surface/stationary pumps

Chapter 6 Market Estimates and Forecast, By Power Range, 2022 - 2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Less than 10 HP

- 6.3 10-50 HP

- 6.4 50-150 HP

- 6.5 Above 150 HP

Chapter 7 Market Estimates and Forecast, By Material/Construction, 2022 - 2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Body and chassis parts manufacturing

- 7.3 Powertrain components

- 7.4 Interior and exterior components

- 7.5 Battery and EV components

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By End Use Sector, 2022 - 2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Mining

- 8.3 Construction

- 8.4 Municipal water & wastewater

- 8.5 Industrial

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Country, 2022 - 2035 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 U.S.

- 9.3 Canada

Chapter 10 Company Profiles

- 10.1 Atlas Copco

- 10.2 Baker Hughes

- 10.3 Crane North America pump & Systems

- 10.4 Ebara America Corporation

- 10.5 Flowserve Corporation

- 10.6 Franklin Electric Co., Inc.

- 10.7 Gorman-Rupp Company

- 10.8 Grundfos Holding A/S

- 10.9 ITT Inc.

- 10.10 KSB SE & Co. KGaA

- 10.11 Pentair plc

- 10.12 Sulzer Ltd.

- 10.13 Tsurumi America, Inc.

- 10.14 Weir Group PLC

- 10.15 Wilo USA LLC

- 10.16 Xylem Inc.

- 10.17 Zoeller Pump Company