PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928862

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928862

Menstrual Pain Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

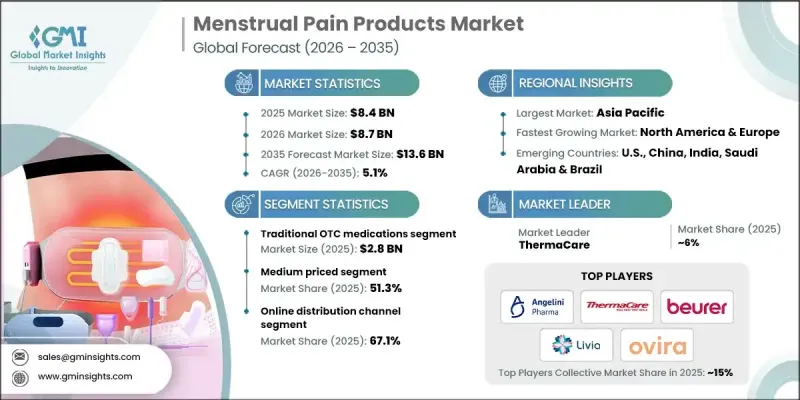

The Global Menstrual Pain Products Market was valued at USD 8.4 billion in 2025 and is estimated to grow at a CAGR of 5.1% to reach USD 13.6 billion by 2035.

Growth is strongly supported by a higher number of women reporting menstrual discomfort worldwide and by broader conversations around menstrual well-being that have reduced stigma and improved health literacy. Women are increasingly confident in managing their menstrual needs and are actively choosing solutions that align with comfort, safety, and long-term wellness goals. Concerns related to the long-term effects of drug-based pain relief have also shifted consumer interest toward alternative approaches that emphasize natural, non-invasive, and personalized care. At the same time, sustainability considerations are influencing purchasing decisions, as environmentally responsible and organic options gain greater acceptance. Together, these behavioral, medical, and environmental factors continue to reshape demand patterns and support consistent market growth across both developed and emerging economies.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $8.4 Billion |

| Forecast Value | $13.6 Billion |

| CAGR | 5.1% |

The traditional over-the-counter solutions segment generated USD 2.8 billion in 2025 and is forecast to grow at a CAGR of 5.5% from 2026 to 2035. These products continue to be widely used due to strong consumer confidence, rapid pain relief, broad retail availability, and the long-standing presence of trusted brands across pharmacy and mass-market channels.

The online sales segment accounted for 67.1% share in 2025. Digital platforms have transformed product access by offering convenience, broader assortments, competitive pricing, and recurring delivery options. The growth of direct-to-consumer models and personalized purchasing experiences has further strengthened the dominance of online distribution.

U.S. Menstrual Pain Products Market reached USD 1.5 billion in 2025 and is projected to grow at a CAGR of 6.2% from 2026 to 2035. High awareness of menstrual health conditions, strong purchasing power, and advanced healthcare infrastructure continue to encourage the adoption of innovative and non-drug pain management solutions.

Key companies active in the Global Menstrual Pain Products Market include Ovira, Angelini Pharma, ThermaCare, Nua, Chiaro Technology, Sumitomo Pharma America, Sirona Hygiene, Beurer, Welme, SteadySense, Cora, Matri, Livia by iPulse Medical, Meyer Organics, Thermaissance, and Bridges CHC. Companies operating in the Global Menstrual Pain Products Market are focusing on innovation, brand differentiation, and consumer engagement to strengthen their market position. Many players are investing in product development to deliver discreet, wearable, and technology-enabled solutions that improve comfort and usability. Strategic partnerships, especially with digital platforms and wellness communities, help brands expand visibility and reach targeted audiences. Firms are also emphasizing sustainability through responsible sourcing, eco-conscious packaging, and transparent manufacturing practices.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Usage

- 2.2.4 Price

- 2.2.5 Age group

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising dysmenorrhea prevalence & health awareness

- 3.2.1.2 Shift toward non-pharmaceutical & natural solutions

- 3.2.1.3 Increasing inclination towards adoption of organic and eco-friendly menstrual products

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Social challenges associated with menstruation and its products in developing countries

- 3.2.2.2 Adverse effects of menstrual products on the environment

- 3.2.3 Opportunities

- 3.2.3.1 Natural, herbal & eco-friendly products

- 3.2.3.2 Personalized & digital health integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter';s analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2022 - 2035, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 OTC pharmaceuticals

- 5.2.1 NSAIDs

- 5.2.2 Analgesics

- 5.2.3 Antispasmodics

- 5.3 Topical pain relief

- 5.3.1 Menthol-based creams and gels

- 5.3.2 Lidocaine creams

- 5.3.3 Capsaicin patches

- 5.3.4 CBD-infused balms and roll-ons

- 5.4 Heat therapy products

- 5.4.1 Disposable heat patches

- 5.4.2 Microwaveable heat packs

- 5.4.3 Electric heating pads

- 5.4.4 Wearable heat belts

- 5.5 Wearable pain relief devices

- 5.5.1 TENS units

- 5.5.2 Smart belts with heat/vibration

- 5.5.3 App-connected devices

- 5.6 Herbal & natural remedies

- 5.6.1 Herbal teas

- 5.6.2 Essential oil roll-ons

- 5.6.3 Supplements

- 5.7 Combination & multi-modal solutions

Chapter 6 Market Estimates & Forecast, By Usage, 2022 - 2035, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Preventive use

- 6.3 Acute pain relief

- 6.4 Chronic pain management

- 6.5 On-the-go relief

Chapter 7 Market Estimates & Forecast, By Price, 2022 - 2035, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Age Group, 2022 - 2035, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Adult women

- 8.3 Teen girls

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce

- 9.2.2 Company website

- 9.3 Offline

- 9.3.1 Mega retail stores

- 9.3.2 Health & wellness stores

- 9.3.3 Subscription services

- 9.3.4 Pharmacies and drugstores

- 9.3.5 Others

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Indonesia

- 10.4.7 Malaysia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Angelini Pharma

- 11.2 Beurer

- 11.3 Bridges CHC

- 11.4 Chiaro Technology

- 11.5 Cora

- 11.6 Livia by iPulse Medical

- 11.7 Matri

- 11.8 Meyer Organics

- 11.9 Nua

- 11.10 Ovira

- 11.11 Sirona Hygiene

- 11.12 SteadySense

- 11.13 Sumitomo Pharma America

- 11.14 ThermaCare

- 11.15 Thermaissance

- 11.16 Welme