PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928873

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928873

Livestock Monitoring Robot Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

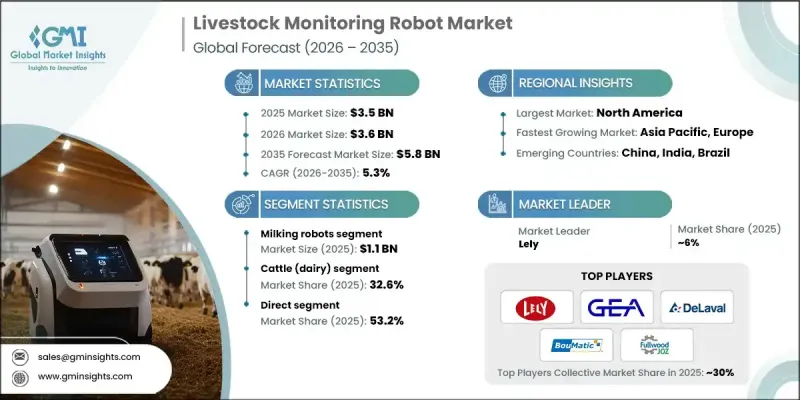

The Global Livestock Monitoring Robot Market was valued at USD 3.5 billion in 2025 and is estimated to grow at a CAGR of 5.3% to reach USD 5.8 billion by 2035.

The market growth is driven by rising global population levels and increasing disposable income across developing economies, which together are pushing demand for meat, milk, eggs, and other animal-based protein beyond current supply levels. Livestock producers face mounting pressure to scale operations while maintaining sustainability, efficiency, and acceptable animal welfare standards. Conventional farming practices are no longer sufficient, as they depend heavily on manual labor and aging processes that limit productivity. Producers are increasingly turning toward advanced robotic solutions to remain competitive and meet consumer expectations. Livestock monitoring robots offer a path toward higher efficiency, improved output quality, and better welfare management by integrating automation and data-driven insights into daily farm operations. These systems are transforming livestock production by supporting consistent monitoring, reducing labor dependency, and enabling smarter production planning, making them an essential tool for modern animal farming.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $3.5 Billion |

| Forecast Value | $5.8 Billion |

| CAGR | 5.3% |

The milking robot category generated USD 1.1 billion in 2025 and is forecast to grow at a CAGR of 5.7% between 2026 and 2035. This segment leads the overall market because dairy operations require frequent, labor-intensive milking routines. Automated milking solutions reduce workforce dependence, support higher milk output, and promote calmer milking conditions that benefit animal health. These systems also capture valuable operational and health-related data, allowing producers to improve herd management through informed decision-making.

The dairy cattle segment accounted for 32.6% share in 2025 and is expected to register a CAGR of 5.6% through 2035. Strong global consumption of dairy products drives this dominance, as dairy farms rely on continuous oversight of feeding, health, and production cycles. Robotic monitoring tools help safeguard milk quality, minimize disease risks, and streamline routine tasks, enabling farm operators to focus on efficiency improvements and long-term growth strategies.

United States Livestock Monitoring Robot Market reached USD 1 billion in 2025 and is projected to grow at a CAGR of 6.7% from 2026 to 2035. Market leadership is supported by large-scale livestock operations, rapid adoption of advanced agricultural technologies, and persistent labor constraints. Supportive agricultural policies, combined with strong demand for precision and welfare-focused farming systems, continue to encourage investment in intelligent robotic platforms across the country.

Key companies active in the Global Livestock Monitoring Robot Market include DeLaval, Lely, GEA Group, BouMatic, Dairymaster, Fullwood JOZ, Waikato Milking Systems, Trioliet B.V., Cormall A/S, Milkomax, AMS Galaxy USA, System Happel GmbH, HETWIN Automation Systems GmbH, Swine Robotics, Inc., and AT-Collections B.V. Companies operating in the Global Livestock Monitoring Robot Market are strengthening their market position through continuous technology innovation, product customization, and strategic collaborations. Many players are investing heavily in research and development to integrate advanced analytics, automation, and system reliability into their solutions. Firms are also expanding their global distribution networks and offering tailored solutions to meet region-specific farming needs. Partnerships with agricultural cooperatives and service providers help improve market access and customer trust.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Market estimates & forecasts parameters

- 1.4 Forecast Model

- 1.4.1 Key trends for market estimates

- 1.4.2 Quantified market impact analysis

- 1.4.2.1 Mathematical impact of growth parameters on forecast

- 1.4.3 Scenario analysis framework

- 1.5 Primary research and validation

- 1.5.1 Some of the primary sources (but not limited to)

- 1.6 Data mining sources

- 1.6.1 Paid Sources

- 1.7 Primary research and validation

- 1.7.1 Primary sources

- 1.8 Research Trail & confidence scoring

- 1.8.1 Research trail components

- 1.8.2 Scoring components

- 1.9 Research transparency addendum

- 1.9.1 Source attribution framework

- 1.9.2 Quality assurance metrics

- 1.9.3 Our commitment to trust

- 1.10 Market Definitions

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Livestock type

- 2.2.4 Farm type

- 2.2.5 End user

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for animal protein

- 3.2.1.2 Precision livestock farming adoption

- 3.2.1.3 IoT & AI advancements

- 3.2.2 Pitfalls & Challenges

- 3.2.2.1 High initial investment

- 3.2.2.2 Infrastructure requirement

- 3.2.3 Opportunities

- 3.2.3.1 AI-powered predictive health monitoring

- 3.2.3.2 Integrated farm management platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 North America

- 3.7.1.1 US: Consumer Product Safety Commission (CPSC) 16 Code of Federal Regulations (CFR) part 1512

- 3.7.1.2 Canada: International Organization for Standardization (ISO) 4210

- 3.7.2 Europe

- 3.7.2.1 Germany: Deutsches Institut fur Normung (DIN) European Norm (EN) ISO 4210

- 3.7.2.2 UK: European Norm (EN) ISO 4210 / United Kingdom Conformity Assessed (UKCA)

- 3.7.2.3 France: European Norm (EN) ISO 4210

- 3.7.3 Asia Pacific

- 3.7.3.1 China: Guobiao (GB) 3565

- 3.7.3.2 India: Indian Standard (IS) 10613

- 3.7.3.3 Japan: Japanese Industrial Standard (JIS) D 9110

- 3.7.4 Latin America

- 3.7.4.1 Brazil: Associacao Brasileira de Normas Tecnicas (ABNT) Norma Brasileira (NBR) ISO 4210

- 3.7.4.2 Mexico: International Organization for Standardization (ISO) 4210

- 3.7.5 Middle East & Africa

- 3.7.5.1 South Africa: South African National Standard (SANS) 311

- 3.7.5.2 Saudi Arabia: Saudi Standards, Metrology and Quality Organization (SASO) Gulf Standardization Organization (GSO) ISO 4210

- 3.7.1 North America

- 3.8 Trade statistics (HS code- 8479.50.00)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter';s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2022 - 2035, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Milking robots

- 5.3 Feeding robots

- 5.4 Health monitoring robots

- 5.5 Cleaning robots

- 5.6 Others (herding, multi-functional)

Chapter 6 Market Estimates & Forecast, By Livestock Type, 2022 - 2035, (USD Billion) (Thousand units)

- 6.1 Key trends

- 6.2 Cattle (Dairy)

- 6.3 Cattle (beef)

- 6.4 Swine

- 6.5 Poultry

- 6.6 Sheep & Goats

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Farm Type, 2022 - 2035, (USD Billion) (Thousand units)

- 7.1 Key trends

- 7.2 Dairy farms

- 7.3 Poultry farms

- 7.4 Swine farms

- 7.5 Others (e.g., equine, mixed-use farms)

Chapter 8 Market Estimates & Forecast, By End Use, 2022 - 2035, (USD Billion) (Thousand units)

- 8.1 Key trends

- 8.2 Commercial farms

- 8.3 Research institutions / academic use

- 8.4 Other users (NGOs, etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 AMS Galaxy USA

- 11.2 AT-Collections B.V.

- 11.3 BouMatic

- 11.4 Cormall A/S

- 11.5 Dairymaster

- 11.6 DeLaval

- 11.7 Fullwood JOZ

- 11.8 GEA Group

- 11.9 HETWIN Automation Systems GmbH

- 11.10 Lely

- 11.11 Milkomax

- 11.12 Swine Robotics, Inc.

- 11.13 System Happel GmbH

- 11.14 Trioliet B.V.

- 11.15 Waikato Milking Systems