PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928878

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928878

Collagen Casings Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

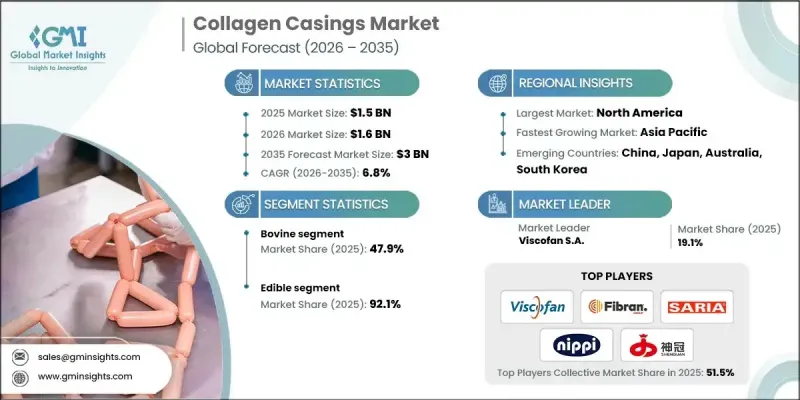

The Global Collagen Casings Market was valued at USD 1.5 billion in 2025 and is estimated to grow at a CAGR of 6.8% to reach USD 3 billion by 2035.

Collagen casings are edible, protein-rich sausage casings made from bovine or porcine collagen, offering a natural and sustainable alternative to traditional casings derived from animal intestines. They are primarily produced from bovine hides and are widely used in sausage manufacturing because they provide uniformity, convenience, and compatibility with high-speed automated machinery, which significantly boosts operational efficiency for meat processors. The steady rise in global meat consumption is fueling demand for collagen casings, as they provide scalable and cost-effective solutions compared to natural alternatives. According to the Food and Agriculture Organization, global meat production reached nearly 364 million metric tons in 2023, with expectations of continuous growth, particularly in emerging markets. Collagen casings are favored because they maintain consistent diameters, withstand production forces, and reduce contamination risks while meeting stringent food safety regulations.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.5 Billion |

| Forecast Value | $3 Billion |

| CAGR | 6.8% |

The bovine collagen segment held a 47.9% share in 2025 and is expected to grow at a CAGR of 6.6% through 2035. Its strength, stability, and seamless integration into automated production lines make it a preferred choice for major sausage processors. Availability from the beef industry ensures cost-effective sourcing and reliable performance.

The edible collagen casings segment held 92.1% share in 2025. Fresh, cooked, and smoked edible casings are widely used in high-volume sausage production. Their ability to remain on the product during consumption, uniform sizing, and compatibility with automated stuffing systems make them the go-to option for meat processors of all scales worldwide.

North America Collagen Casings Market captured USD 446.2 million in 2025 and is projected grow at a CAGR of 6.6% from 2026 to 2035. Rising consumer demand for natural, clean-label, and allergen-free foods is driving the adoption of collagen casings in processed meat, ready-to-eat meals, and snacks. Companies are increasingly focusing on sustainable sourcing and environmentally friendly manufacturing processes to meet consumer expectations regarding health, transparency, and product quality.

Key players in the Global Collagen Casings Market include FABIOS S.A., Belkozin, Nippi Inc., PS Seasoning, Fibran Group, Viscofan S.A., Shenguan Holdings (Group) Limited, Viskoteepak, Foodchem International Corporation, and SARIA SE & Co. KG. Market participants are strengthening their position by investing in R&D to develop high-performance, consistent, and clean-label casings. Collaborations with meat processors and food manufacturers allow them to customize solutions for automated production lines. Geographic expansion into emerging markets with growing meat consumption enhances market penetration. Companies also focus on sustainable sourcing and eco-friendly manufacturing processes to meet regulatory standards and consumer demand. Offering technical support, training, and innovation in casing design further solidifies brand loyalty and increases competitive advantage.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Source

- 2.2.3 Product

- 2.2.4 Caliber

- 2.2.5 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global meat consumption & processing

- 3.2.1.2 Advantages over natural casings

- 3.2.1.3 Sustainability & circular economy trends

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Raw material price volatility

- 3.2.2.2 Competition from alternative casings

- 3.2.3 Market opportunities

- 3.2.3.1 Tannery waste valorization

- 3.2.3.2 Premium certification markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By source

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Source, 2022-2035 (USD Billion) (Million Metres)

- 5.1 Key trends

- 5.2 Bovine

- 5.3 Porcine

- 5.4 Poultry

- 5.5 Marine

- 5.6 Ovine & caprine

Chapter 6 Market Estimates and Forecast, By Product, 2022-2035 (USD Billion) (Million Meters)

- 6.1 Key trends

- 6.2 Edible

- 6.3 Non-edible

Chapter 7 Market Estimates and Forecast, By Caliber, 2022-2035 (USD Billion) (Million Meters)

- 7.1 Key trends

- 7.2 Small diameter (14-32 mm)

- 7.3 Medium diameter (33-50 mm)

- 7.4 Large diameter (>50 mm)

Chapter 8 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Million Meters)

- 8.1 Key trends

- 8.2 Fresh sausages

- 8.3 Cooked sausages

- 8.4 Dry-cured sausages

- 8.5 Smoked sausages

- 8.6 Meat-based snacks

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Million Meters)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Belkozin

- 10.2 FABIOS S.A.

- 10.3 Fibran Group

- 10.4 Foodchem International Corporation

- 10.5 Nippi Inc.

- 10.6 PS Seasoning

- 10.7 SARIA SE & Co. KG

- 10.8 Shenguan Holdings (Group) Limited

- 10.9 Viscofan S.A.

- 10.10 Viskoteepak