PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928883

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928883

Low Smoke Halogen Free Flame Retardant Polypropylene (PP) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

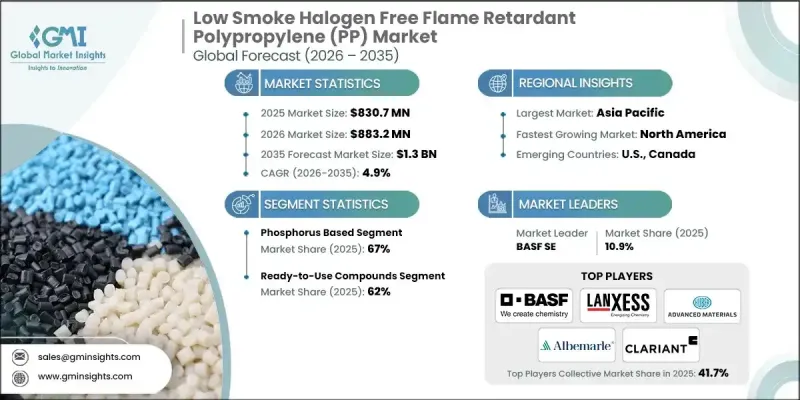

The Global Low Smoke Halogen Free Flame Retardant Polypropylene (PP) Market was valued at USD 830.7 million in 2025 and is estimated to grow at a CAGR of 4.9% to reach USD 1.3 billion by 2035.

Market growth is supported by the increasing replacement of halogenated flame retardants with safer material solutions that limit smoke generation and toxic gas release during combustion. These polypropylene formulations are engineered to avoid bromine- and chlorine-based additives, enabling compliance with widely recognized international safety and toxicity benchmarks used across electrical systems, vehicles, electronics, and infrastructure installations. Regulatory frameworks across global markets continue to reinforce adoption, as material standards emphasize reduced smoke density, lower toxicity, and improved fire performance. The tightening of environmental and safety regulations has positioned halogen-free polypropylene as a preferred option for manufacturers seeking long-term regulatory alignment. The market is also benefiting from expanding use in electrification-driven applications, where material reliability during thermal stress is critical. Ongoing innovation in flame-retardant chemistry is allowing manufacturers to balance fire resistance with mechanical strength, flow behavior, and long-term stability, making these materials suitable for demanding and safety-sensitive end uses.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $830.7 Million |

| Forecast Value | $1.3 Billion |

| CAGR | 4.9% |

The phosphorus-based solutions segment accounted for 67% share in 2025. These systems are widely adopted due to their ability to deliver effective flame resistance while maintaining acceptable processing and mechanical performance. Advancements in synergistic formulations have expanded design flexibility, enabling improved smoke suppression and lower toxicity without compromising durability.

The ready-to-use compounds segment held 62% share in 2025. These materials are favored for their consistent quality, validated compliance with safety standards, and technical support that simplifies qualification processes. Manufacturers benefit from reduced development time and predictable performance across multiple thicknesses and application requirements.

North America Low Smoke Halogen Free Flame Retardant Polypropylene (PP) Market accounted for 16% share in 2025. Regional growth is supported by rising adoption in electrified transportation, energy storage systems, and safety-driven construction applications. Regulatory alignment and a strong emphasis on fire safety standards continue to reinforce market expansion across the United States and Canada.

Key companies active in the Global Low Smoke Halogen Free Flame Retardant Polypropylene (PP) Market include BASF, Lanxess, Albemarle Corporation, DuPont, Clariant International, RTP Company, Israel Chemicals, FRX Polymers, Huber Engineered Materials, DSM, Nabaltec, Thor Group, Washington Penn Plastic, Delamin, PolyOne Corporation, and Chemtura Corporation. Companies operating in the Global Low Smoke Halogen Free Flame Retardant Polypropylene (PP) Market are strengthening their market position through continuous formulation innovation that improves fire performance while preserving mechanical integrity. Many players are expanding ready-to-use compound portfolios to reduce customer qualification timelines and improve consistency. Strategic collaboration with OEMs and component manufacturers supports early material adoption in new platforms. Investments in regulatory expertise and compliance testing help suppliers align with evolving safety standards.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Flame retardant type

- 2.2.2 Form

- 2.2.3 Application

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Low Smoke Halogen Free Flame Retardant Polypropylene (PP) Market, By Flame Retardant Type, 2022-2035(USD Million, Kilo Tons)

- 5.1 Key trends

- 5.2 Phosphorus-based flame retardants

- 5.3 Nitrogen-based flame retardants

- 5.4 Others

Chapter 6 Low Smoke Halogen Free Flame Retardant Polypropylene (PP) Market, By Form, 2022-2035(USD Million, Kilo Tons)

- 6.1 Key trends

- 6.2 Ready-to-use compounds

- 6.3 Masterbatches (concentrates)

- 6.4 Additive powders & pellets

Chapter 7 Low Smoke Halogen Free Flame Retardant Polypropylene (PP) Market, By Application, 2022-2035(USD Million, Kilo Tons)

- 7.1 Key trends

- 7.2 Wire & cable

- 7.3 Electrical & electronics

- 7.4 Automotive & transportation

- 7.5 Railway & mass transit

- 7.6 Aerospace

- 7.7 Building & construction

- 7.8 Industrial applications

- 7.9 Marine applications

- 7.10 Consumer products

- 7.11 Others

Chapter 8 Market Size and Forecast, By Region, 2022-2035(USD Million, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 Albemarle Corporation

- 9.2 Israel Chemicals

- 9.3 Chemtura Corporation

- 9.4 Clariant International

- 9.5 Huber Engineered Materials

- 9.6 BASF

- 9.7 Thor Group

- 9.8 Lanxess

- 9.9 DSM

- 9.10 FRX Polymers

- 9.11 Nabaltec

- 9.12 Delamin

- 9.13 DuPont

- 9.14 Washington Penn Plastic

- 9.15 RTP Company

- 9.16 PolyOne Corporation